4 Positive Messages From The May ISM Report

Image: Bigstock

The major indexes were swooning on Friday as the market reacted to the May jobs report and Elon Musk’s comments on the state of the economy. Tesla’s boss told employees via an email that he has a “super bad feeling” about the economy and that he intends to lay off 10% of Tesla's workforce.

In a situation where everyone is straining themselves for the first signs of a drop-off in demand, any negative comment can cause quite a commotion. And this is coming from somebody known for speaking his mind regardless of the consequences for himself or the rest of humanity.

My take on the employment situation was in Thursday's article, but in a nutshell, let me just say that the it is nowhere near as bad as it’s being made out to be. While nobody can say for certain that there won’t be a recession, or that the Fed will succeed in engineering a “soft landing,” we definitely don’t seem to be anywhere near that eventuality yet.

The ISM report gave us a broader picture of the overall economy, so it makes sense to look at it in some detail. And that’s where you find some optimism. Four positive messages from this report were:

On Economic Activity: The overall Purchase Managers Index (PMI) for May was 56.1%, indicating that economic activity in the U.S. continues to expand. The PMI was over 60% through most of 2021, dropping under that level in December. This shouldn’t be viewed so negatively because prior to 2021, the PMI has been above 60% only briefly and only a couple of times in the last 10 years.

And 2021 was an exceptional year as companies struggled with pent-up demand from millions who were adjusting with a new mode of operation. This year was expected to be less sensational. Besides, any reading above 50% is an expansion in the economy and that’s what we continue to see. So maybe we shouldn’t read too much into the PMI deceleration, at least not yet.

On Demand: The report explicitly stated that respondents continue to see increasing demand, with five optimistic voices for every cautious one. Demand should also be read from the perspective of new orders and backlog, both of which expanded from April. 11 of the 18 manufacturing industries reported expansion in new orders, six reported no change, and only one reported a decline.

The backlog of orders increased 2.7%. Price increases, another indicator of demand, also continued but at a slightly slower pace than April. It was mainly driven by oil and fuel, packaging supplies (including corrugate), food ingredients, commodity materials (copper, steel, and aluminum), and petroleum-based products and petrochemicals. Prices increased in 17 of the 18 industries.

On Inventories: Customer inventories are a very good indicator of demand. When customer inventories are high, it’s obvious that there’s lower sell-through, leading to greater accumulation of inventory. So when customer inventories are depleted or growing slowly from a low base, it’s an indication that there’s much more demand out there. Customers are selling all that they are being supplied, so they are unable to build inventory.

The report stated that “Customers' Inventories Index registered 32.7 percent in May, 4.4 percentage points lower than the 37.1 percent reported for April,” and “Customers' inventories are too low for the 68th consecutive month.” 14 of the 18 industries reported too low inventories.

This is a positive for production: it indicates that we are far from a recession. Even if demand falls back suddenly, there won’t be an immediate negative impact because stocks are so depleted at the moment.

On Capex Lead Times: Companies make capital investments when they see a notably higher level of demand that they aren’t able to satisfy with existing infrastructure. However, since underutilization increases cost, they will avoid building if they don’t expect the strength to continue. Lead times on this spending increase when their suppliers have so many orders to fulfill that it takes them longer to service this demand.

The report stated that “lead time for Capital Expenditures in May was 178 days, an increase of five days compared to April and an all-time high” (the data is being tracked since 1987). Obviously, companies are rushing to add infrastructure because they expect demand to remain strong in the foreseeable future.

Given the positive indications, you can make use of the dip to buy growth stocks such as the following Zacks Rank #1 (Strong Buy) stocks.

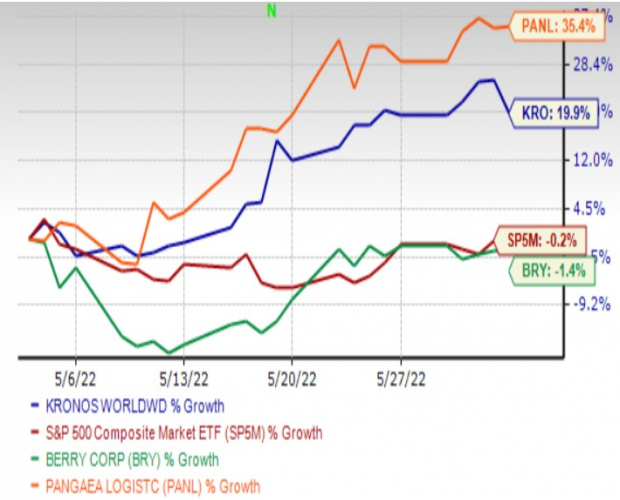

Kronos Worldwide, Inc. (KRO - Free Report)

Kronos belongs to the Chemical – Diversified industry, which is in the top 25% of Zacks-classified industries. It has a Growth Score of B. In the last 30 days, its 2022 estimate has increased 60.9% while the 2023 estimate has increased 61.0%. Kronos’ revenue is currently expected to grow 16.1% this year and 3.8% in the next. Its earnings are expected to grow a respective 110.2% and 6.3%.

Berry Corporation (BRY - Free Report)

Berry Corp., a member of the Zacks-classified Oil and Gas - Integrated - United States industry (top 9%), also has Growth Score of B. Berry’s estimates have been rising steadily. In the last 30 days, the Zacks Consensus Estimate for 2022 increased 69.9% while the 2023 estimate increased 89.8%.

Berry’s revenue and earnings are expected to grow 34.7% and 1,368%, respectively in 2022. Next year, they are expected to increase a respective 29.8% and 11.7%.

Pangaea Logistics Solutions (PANL - Free Report)

Pangea Logistics belongs to the Zacks-classified Transportation – Shipping industry (top 13%). It has a Growth Score of A. In the last 30 days, analysts have raised their 2022 estimates on Pangea by an average 32.5% and the 2023 estimates by an average 45.2%. They currently see Pangea’s revenue growing 5.3% and earnings 18.4% in 2022. The following year, revenues are expected to grow 3.0% and earnings 27.3%.

One-Year Price Performance

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more