3 Top-Ranked Stocks Pushing 52-Week Highs

Image: Bigstock

We’ve sailed through choppy market waters in 2022 following a hawkish pivot from the Federal Reserve, geopolitical issues, and lingering COVID-19 disruptions. However, there are still stocks pushing 52-week highs. And a few have seen their near-term earnings outlook turn visibly bright. Stocks making new highs tend to make even higher highs, especially when positive earnings estimate revisions roll in from analysts.

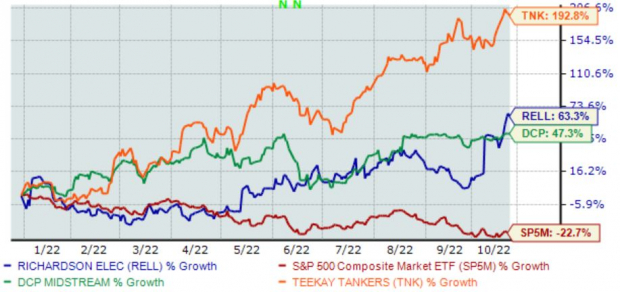

Three stocks fit the criteria – Richardson Electronics (RELL - Free Report), DCP Midstream Partners, LP (DCP - Free Report), and Teekay Tankers Ltd. (TNK - Free Report). Below is a chart illustrating the performance of all three stocks in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, buyers have been out in full force, driving shares upwards. Let’s take a deeper dive into each one.

DCP Midstream Partners, LP

DCP Midstream Partners, LP, is a midstream master limited partnership with a diversified portfolio of assets engaged in gathering, compressing, treating, processing, transporting, storing, and selling natural gas. DCP sports a Zacks Rank #1 (Strong Buy), with shares recently trading just below fresh 52-week highs at $39.39.

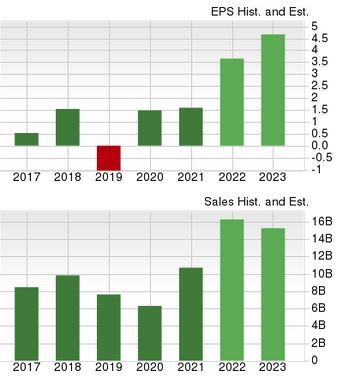

It’s hard to ignore DCP’s growth estimates; the Zacks Consensus EPS Estimate of $3.65 for FY22 suggests year-over-year earnings growth of 130%. And in FY23, estimates call for a further 28% uptick in earnings.

DCP’s revenue is forecasted to grow 52% year-over-year in FY22, but the top-line growth is projected to stall in FY23, with estimates suggesting a year-over-year decline of 6.2%.

Image Source: Zacks Investment Research

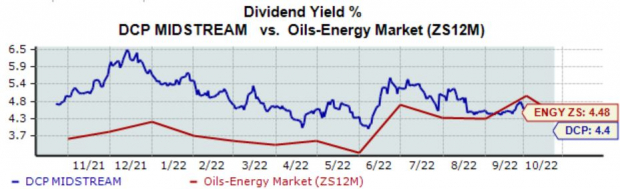

For those that like dividends, DCP has that covered; the company’s annual dividend yields a solid 4.4%, nearly in line with that of its Zacks Oils and Energy sector average. DCP pays out 42% of its earnings.

Image Source: Zacks Investment Research

Richardson Electronics

Richardson Electronics is a global provider of Engineered Solutions serving the RF, wireless and power, conversion, electron device, security, and display systems markets.

RELL boasts a Zacks Rank #1 (Strong Buy), with shares recently making a fresh 52-week high of $22.47. Analysts have upped their earnings outlook across multiple timeframes over the last few months.

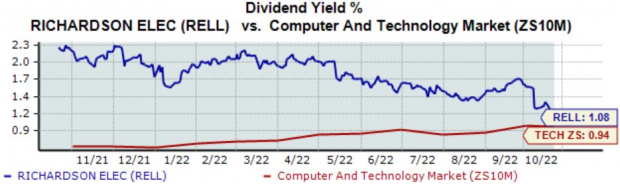

Image Source: Zacks Investment Research

Richardson Electronics rewards its shareholders via its annual dividend, yielding 1.1%, a tick above its Zacks Computer and Technology sector average. RELL’s payout ratio sits sustainably at 19% of earnings.

Image Source: Zacks Investment Research

For the cherry on top, revenue and earnings are healthy; earnings are forecasted to climb 28% in the company’s current fiscal year (FY23) and a further 31% in FY24. Revenue estimates suggest year-over-year growth of 16% and 11% in FY23 and FY24, respectively.

Teekay Tankers

Teekay Tankers Ltd. was formed by Teekay Corporation to provide international marine transportation of crude oil.

TNK shares touched a fresh 52-week high of $33.33 on Oct. 18, and they ended Friday, Oct. 21 at $32.59. Analysts have upped their earnings outlook across multiple timeframes over the last several months, helping land the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Teekay Tankers carries a loaded growth profile; earnings are forecasted to soar a triple-digit 170% in its current fiscal year (FY22) and a further 62% in FY23. The projected earnings growth comes on top of forecasted revenue growth of 110% and 6.2% in FY22 and FY23, respectively.

Further, the company has had little issue exceeding earnings estimates as of late, surpassing the Zacks Consensus EPS Estimate by an average of 46% over its last four quarters.

Bottom Line

While the price action of many stocks has been uninspiring in 2022, all three stocks above have entirely shaken off the market’s woes. And all three carry a Zacks Rank #1 (Strong Buy), telling us their near-term earnings outlook has improved.

For those seeking stocks with strong price action paired with a strengthening earnings outlook, all three – Richardson Electronics (RELL - Free Report), DCP Midstream Partners, LP (DCP - Free Report), and Teekay Tankers Ltd. (TNK - Free Report) – fit the criteria.

More By This Author:

Airline Stock Roundup: Q3 Earnings Beat At American Airlines, Alaska Air & United Airlines, Spirit Airlines In Focus

Can Earnings Boost Microsoft Stock?

Chipotle Mexican Grill Q3 Preview: Double-Digit Earnings Growth In Store?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more