3 Top-Ranked Large-Caps To Buy For Growth

Large-cap stocks are frequently targeted among investors. They typically have greater stability and a proven track record, two reasons why they're beloved.

They also frequently pay dividends, providing another advantage for those seeking exposure. Large caps typically aren't as explosive as small-cap stocks, being tailored toward more conservative investors.

Still, many large-caps carry favorable growth expectations, including Target (TGT), Cardinal Health (CAH), and Arista Networks (ANET).

All three carry a favorable Zacks Rank, reflecting upward earnings estimate revisions among analysts. Let’s take a closer look at each.

Arista Networks

Arista Networks shares have benefited nicely from the AI frenzy. The company provides network switches to hyperscalers that speed up communication between computer servers.

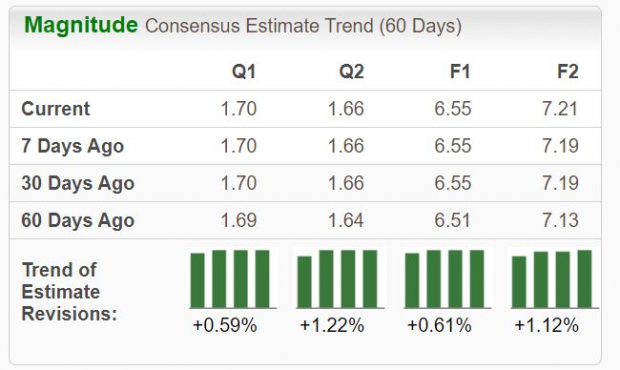

The stock is a Zacks Rank #2 (Buy), with expectations inching higher across all timeframes.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company boasts an impressive growth profile, with consensus estimates for its current fiscal year suggesting 43% earnings growth on 33% higher sales. Growth looks to continue in FY24, as estimates allude to an additional 10% boost in earnings paired with an 11% revenue climb.

Target

Target has evolved from just being a pure brick-and-mortar retailer to an omni-channel entity. The stock sports a Zacks Rank #2 (Buy), with earnings estimates moving higher nearly across the board.

The company’s profitability picture is expected to improve in a big way in its current fiscal year, with consensus estimates alluding to 40% earnings growth. Shares pay a solid dividend as well, currently yielding a market-beating 3.1%.

Target has also increasingly rewarded its shareholders, currently boasting a sizable 15% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Cardinal Health

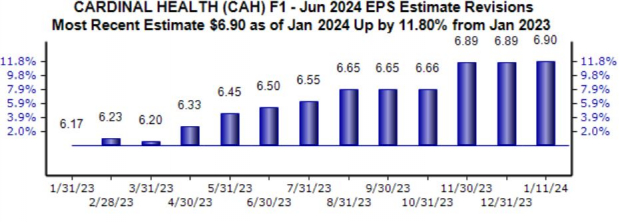

Cardinal Health is a nationwide drug distributor and provider of services to pharmacies, healthcare providers, and manufacturers. The stock is a Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year particularly strong, up 12% over the last year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Consensus expectations for its current year presently suggest 20% earnings growth on 10% higher sales, with FY25 estimates alluding to an additional 12% boost in earnings paired with an 8% revenue climb.

The company has been a strong earnings performer as of late, exceeding both earnings and revenue expectations in each of its last five releases.

Bottom Line

Large caps are found in nearly every portfolio, as their stable nature and successful track records are impossible to ignore.

And for those seeking large-cap exposure, all three stocks above – Target, Cardinal Health, and Arista Networks – could be great considerations, all boasting improved earnings outlooks.

More By This Author:

5 Stocks To Watch From The Thriving Securities And Exchanges Industry

Should Investors Buy BlackRock Or Goldman Sachs Stock This Earnings Season?

Don't Overlook These Top Value Stocks In January It's Time To Buy