Don't Overlook These Top Value Stocks In January It's Time To Buy

Image Source: Unsplash

Investors searching for value will want to pay attention to a few top-rated Zacks stocks that are standing out among the finance and medical sectors.

With “A” Zacks Style Scores grades for Value here are three stocks with fundamental valuations that shouldn't be overlooked at the moment.

Arch Capital Group (ACGL) : Insurance giant Arch Capital sports a Zacks Rank #2 (Buy) and is a formidable investment prospect in terms of growth and value.

Offering a variety of underwritings for insurance, reinsurance, and mortgage insurance globally, Arch Capital's strong underwriting performance and improved investment returns have fueled the company of late.

Notably, Arch Capital shares have risen a very respectable +23% over the last year to top the S&P 500”s +21% and the Zacks Insurance-Property and Casualty Markets” +10%.

Arch Capital may be poised to continue outperforming the broader market as the insurance behemoth is expected to round out its fiscal 2023 with EPS up a lofty 62% to $7.89 per share versus $4.87 a share in 2022. Although FY24 earnings are expected to dip -1%, Arch Capital’s stock trades at a lucrative 9.9X forward earnings multiple.

Image Source: Zacks Investment Research

Double-digit sales growth for FY23 and FY24 is also compelling regarding the company's future earnings potential and Arch Capital’s price-to-sales (P/S) ratio of 2.3X is closing in on the optimum level of less than 2X.

Image Source: Zacks Investment Research

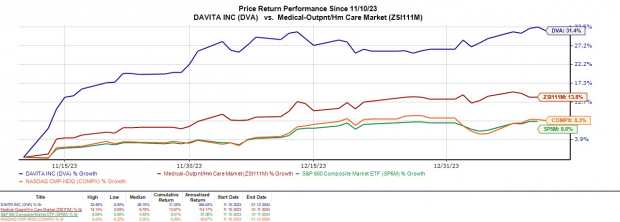

DaVita (DVA): As one of the nation's leading providers of dialysis services, DaVita’s stock remains attractive and has held a spot on the coveted Zacks Rank #1 (Strong Buy) list since early November. Since receiving its strong buy rating, DaVita’s stock has soared +31% in the last two months and is now up +37% for the year.

Image Source: Zacks Investment Research

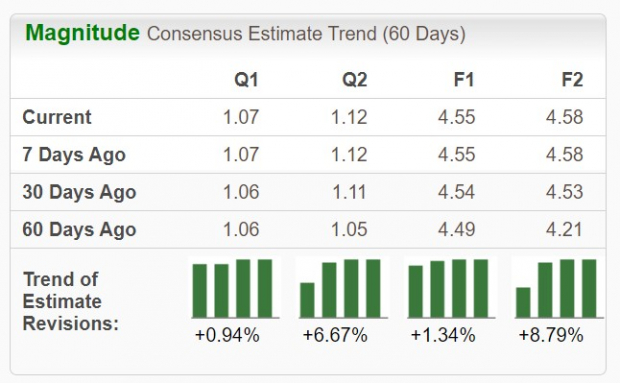

DaVita has attributed its continued success to a strong focus on near-term operating discipline and investment in the company’s future growth. To that point, DaVita has surpassed earnings expectations in each of its last four quarterly reports posting an average earnings surprise of 36.55%.

Image Source: Zacks Investment Research

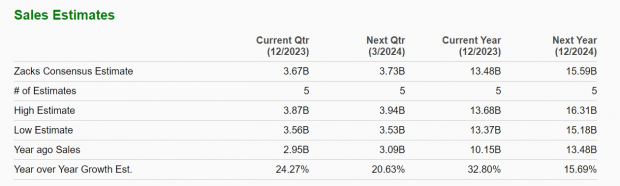

DaVita will be reporting its Q4 results in late February and is expected to round out FY23 with earnings up 22% to $8.07 a share. Fiscal 2024 EPS is expected to expand another 4% and DaVita trades at a reasonable 12.9X forward earnings multiple.

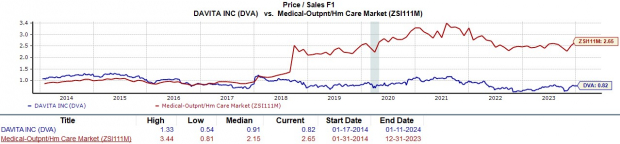

Plus, a P/S ratio of just 0.82X makes DaVita’s top-line growth look more appealing with sales projected to be up 3% for FY23 and rise another 2% this year to $12.31 billion.

Image Source: Zacks Investment Research

Heartland Financial USA (HTLF): Jumping back to the Zacks finance sector, we’ll round out the list with a promising regional bank that looks undervalued in Heartland Financial USA. Joining the illustrious Zacks Rank #1 (Strong Buy) list earlier in the month, Heartland operates through bank subsidiaries in the Midwest including Iowa, Wisconsin, and Illinois along with a presence in New Mexico.

Rising earnings estimates are starting to support the notion that Heathland’s 8.1X forward earning multiple is cheap which is at a slight discount to the Zacks Banks-Midwest Industry average of 10.1X and well below the S&P 500’s 20X.

Image Source: Zacks Investment Research

Heartland’s stock looks geared for a sharp rebound after falling -21% over the last year with annual earnings forecasted to dip -6% to end FY23 but stabilize and be virtually flat in FY24 at $4.58 a share. Furthermore, Heartland’s P/S ratio of 1.5X is attractive with total sales forecasted to dip -1% in FY23 but rebound and rise 2% in FY24 to $735.72 million.

Bolstering the value in Heartland’s stock is a very respectable 3.22% annual dividend yield which the company has increased eight times in the last five years for an annualized growth rate of 15.42% during this period.

Image Source: Zacks Investment Research

Bottom Line

At the moment these top-rated stocks are benefiting from strong business industries that are all in the top 30% of over 250 Zacks industries. This certainly makes their discounted valuations look more attractive as their outlooks are likely to strengthen as well.

More By This Author:

The Biggest Banks Reported Earnings Today: This One Is The Clear Leader3 Highly Ranked Stocks That Won't Break Your Piggybank

3 Top-Ranked Companies Seeing Stellar Sales Growth