3 Tech Stocks To Watch As Q3 Earnings Approach: CSGP, IBM, VRT

Image Source: Unsplash

Led by International Business Machines (IBM - Free Report), several trending tech stocks are set to report their third quarter results on Tuesday, October 22.

Here’s a brief earnings preview for IBM and a look at two IT services stocks to watch as their Q3 reports approach.

IBM’s Q3 Expectations

Expanding outside of its renowned computer hardware offerings, IBM’s growth as a provider of cloud and data platforms has started to captivate investors' attention with its stock sitting on +40% gains this year.

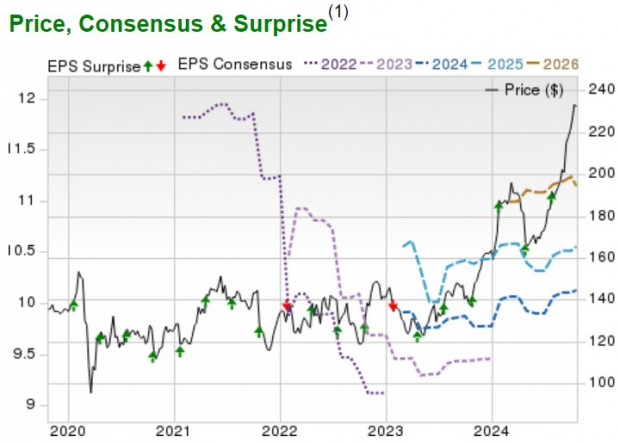

Currently landing a Zacks Rank #3 (Hold), IBM’s Q3 EPS is expected to be up 3% to $2.27 on sales of $15.14 billion, a 2% increase from the comparative quarter. Notably, IBM has surpassed the Zacks EPS Consensus for six consecutive quarters posting an average earnings surprise of 6.08% in its last four quarterly reports.

Image Source: Zacks Investment Research

IT Service Leaders – CoStar Group & Vertiv

Sporting a Zacks Rank #2 (Buy), CoStar Group (CSGP - Free Report) and Vertiv (VRT - Free Report) are two IT service leaders to watch. To that point, it’s noteworthy that their Zacks Computers-IT Services Industry is currently in the top 21% of over 250 Zacks industries.

Down -11% year to date, CoStar’s stock may be a buy-the-dip candidate as a provider of online real estate marketplaces, and data analytics in the United States. Meanwhile, Vertiv’s blazing price performance could continue with VRT soaring over +100% in 2024 with its IT services extending to digital infrastructure and continuity solutions.

Most captivating is that CoStar and Vertiv have consistently exceeded the Zacks EPS Consensus posting an average earnings surprise of 34.12% and 12.92% in their last four quarterly reports respectively.

Takeaway

IBM, CoStar, and Vertiv are three of the most intriguing tech stocks to watch in this week’s earnings lineup. These tech stocks could be in store for a post-earnings rally if they can continue their impressive streaks of exceeding bottom line expectations and reach sales estimates while offering positive guidance.

More By This Author:

3 REITs Likely To Turn Out Winners This Earnings Season

Is Costco Stock A Buy, Hold Or Sell Post-September Sales Results?

Netflix Earnings Review: Still Winning The Streaming Wars?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more