3 Soon-To-Be Dividend Kings

Many investors pivot to the Dividend Aristocrats when looking to generate an income stream. After all, it’s easy to understand why; these companies have upped their payouts for a minimum of 25 consecutive years, which displays their reliable nature.

While that’s impressive, there’s even a step above the Dividend Aristocrats.

Let me introduce you to Dividend Kings, those that have shown an unparalleled commitment to shareholders through 50+ years of increased dividend payouts.

Interestingly enough, several stocks are gearing up to burst into the elite club, including Archer Daniels Midland (ADM) , Sherwin-Williams (SHW) , and Aflac (AFL).

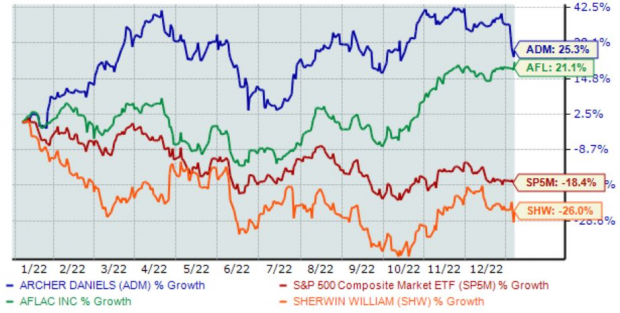

Below is a chart illustrating the performance of all three stocks over the last year, with the S&P 500 blended in as a benchmark.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Archer Daniels Midland

Archer Daniels Midland is a leading producer of food and beverage ingredients and goods made from various agricultural products. ADM currently sports a Zacks Rank #2 (Buy).

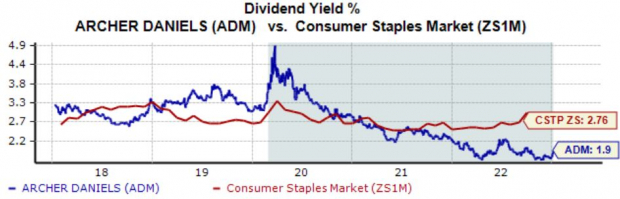

ADM’s annual dividend currently yields 1.9%, below its Zacks Consumer Staples sector average. Still, the company’s 4% five-year annualized dividend growth rate helps to pick up the slack.

(Click on image to enlarge)

Image Source: Zacks Investment Research

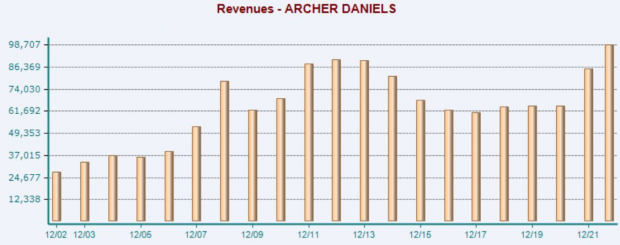

In addition, it’s hard to ignore ADM’s quarterly performance; the company has exceeded the Zacks Consensus EPS Estimate by double-digit percentages in four consecutive quarters.

In its latest release, Archer Daniels Midland registered a sizable 31% EPS beat and reported revenue nearly 8% above expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

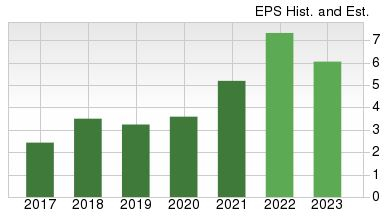

The company has a favorable growth profile for its current fiscal year (FY22), with earnings forecasted to climb 44% Y/Y. Still, the growth cools down in FY23, with estimates indicating a 15% Y/Y pullback in earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Sherwin-Williams

Sherwin-Williams manufactures and sells paints, coatings, and other related products. As it stands, the company carries a favorable Zacks Rank #2 (Buy).

SHW’s annual dividend currently yields a respectable 1.1%, just a few ticks below its Zacks Construction sector average. Impressively, the company’s payout has grown by a double-digit 20% over the last five years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

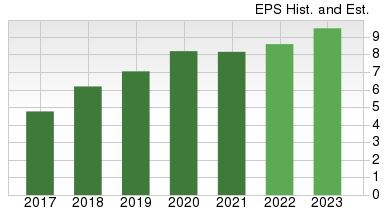

Growth is more than apparent, with the Zacks Consensus EPS Estimate of $8.71 for FY22 indicating an improvement of nearly 7% Y/Y. And in FY23, the company’s bottom line is forecasted to expand a further 19%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Aflac

Aflac is an American insurance company and a massive supplier of supplemental insurance within the U.S. Currently, AFL carries a Zacks Rank #3 (Hold).

Aflac rewards its shareholders via its annual dividend that currently yields 2.2%, modestly below its Zacks Finance sector average.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, valuation multiples aren’t stretched, further reinforced by its Style Score of a “B” for Value. Currently, AFL shares trade at a 13.6X forward earnings multiple, modestly above the five-year median and nearly in line with its Zacks sector average.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Investors enjoy few things more than consistent, reliable dividends. After all, getting paid is an incredible feeling.

And when looking to build an income stream, many turn to the Dividend Aristocrats, companies that have successfully upped their payouts for a minimum of 25+ consecutive years.

However, a step above is the elite Dividend Kings group, those who have done it for 50+ years, putting their shareholder-friendly nature on full display.

All three stocks above – Archer Daniels Midland (ADM Quick QuoteADM - Free Report) , Sherwin-Williams (SHW Quick QuoteSHW - Free Report) , and Aflac (AFL Quick QuoteAFL - Free Report) – are knocking on the door of the elite club.

More By This Author:

2 Dividend Aristocrat Stocks To Buy And Never Sell

2 Top-Rated Steel Stocks to Buy Now

BOOT Or PPRUY: Which Is The Better Value Stock Right Now?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more