2 Dividend Aristocrat Stocks To Buy And Never Sell

A dividend aristocrat is a stock that is a member of the S&P500 that has raised dividend payments for at least 25 consecutive years. This filter alone is an effective way to identify companies with lasting brands, durable cash flow, and effective management.

They make products or provide services you use every day without even thinking about it and their returns are the opposite of high-flying speculative technology stocks. Dividend Aristocrats are steady and maybe a bit boring. But that can be a good thing, especially during periods of volatility.

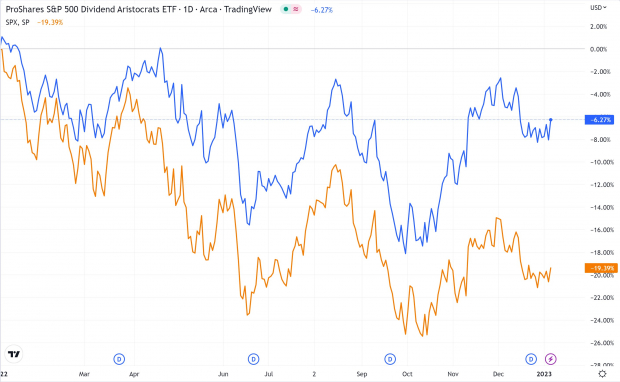

2022 was a big year for dividend stocks and the (NOBL) ETF, which is a fund holding the 64 dividend aristocrats outperformed the broad market.

Some of the best performing stocks of 2022 were among these dividend growth companies, which presents us with a slight problem. I want to invest in some of these companies, but many were bid up significantly in 2022 amid a flight to safety. My goal is to find companies that are on this list, but are also reasonably valued, score well on the Zacks Rank, and will do well if the economy goes into a recession.

(Click on image to enlarge)

Image Source: Tradingview

Procter and Gamble (PG)

Procter and Gamble is a consumer staples company with a broad portfolio of brands including Gillette razors, Bounty paper towels, Pampers diapers, and Tide laundry detergent to name just a few. Procter and Gamble has a total of 65 brands that cover many daily necessities, which is one reason why we are looking at PG.

Even in the case of a recession, these everyday products will likely be some of the very last things families remove from their budgets, if they cut them at all.

PG is a 185-year-old company that has raised its dividend for 66 consecutive years. In 2022 Procter and Gamble did $80 billion in revenue, $21 billion in EBITDA, and currently has a dividend yield of 2.4%. The stock trades with a P/E ratio of 26x. While this is a lofty valuation compared to the sector, it is just above Procter and Gamble’s long-term median P/E of 23x.

Image Source: Zacks Investment Research

2022 was a rather challenging year for PG stock. Along with the broad market, the stock price experienced a major correction, down 26% at the worst point. Procter and Gamble eventually made a strong recovery, finishing the year down marginally. Fortunately for us, I believe this correction shook many weak holders. Even more compelling is the technical setup as is seen in the nearby chart. Over the last month a clear bull flag has formed, and a breakout above $155 should push the stock towards its all-time high. Trading below $150 invalidates this trade setup.

(Click on image to enlarge)

Image Source: Tradingview

Lastly, PG sports a Zacks Rank #2 (Buy), illustrating that its earnings outlook has improved, which is no easy task at the moment. Something else to note is that 2023 Year over Year estimates for sales growth is estimated at -0.78%, while earnings growth for the same period is +0.34%. This is no simple feat for a business but is typical for these dividend growth companies. This is possible only because brands like PG can raise prices of their products without affecting demand. This is a huge testament to their resilience as a company.

Cardinal Health (CAH)

Cardinal Health is probably one of those companies you’ve never heard of but has a big impact on your life. CAH specializes in the distribution of healthcare products and serves over 100,000 locations including more than 75% of hospitals in the US. Cardinal Health is also one of the highest revenue generating companies in the US with $180 billion in sales in 2022.

In the case of a recession, it is unlikely that CAH will suffer in a significant way. Healthcare expenses are inelastic, and Cardinal Health is a major piece of infrastructure for the healthcare industry. Whether people have disposable income or not should not affect Cardinal Health’s business model.

CAH earns a Zacks Rank #2 (Buy) given its upward earnings revisions and does very well in the Style Scores as well, earning an A in Value and Momentum, and a B for Growth. Fundamentally, I believe Cardinal Health is very fairly valued as well. Looking at the Price to Free Cash Flow ratio, CAH trades at just a 7.5x multiple, below its long-term median of 11x. For a mature business like this Price to FCF multiple under 10x is very appealing.

Cardinal Health also sports a 2.6% dividend yield, which it has increased for the last 35 consecutive years.

Conclusion

Dividend income investing is not nearly as sexy as technology investing, or venture capital, but the results speak for themselves. While 2022 was especially good for these types of companies you can go much further back to see that this is not an anomaly. Focusing on businesses that have been around for a long time, are conservative with their financials, and regularly return cash to shareholders is a winning strategy in the long run. With consistent cash flow, and entrenched brands it is hard to go wrong adding dividend growth stocks to a well-diversified portfolio.

More By This Author:

2 Top-Rated Steel Stocks to Buy NowBOOT Or PPRUY: Which Is The Better Value Stock Right Now?

Things To Know Before Constellation Brands' Q3 Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more