3 Reasons Why Amazon Bears Are Wrong

Amazon (AMZN) is a widely discussed stock, with both the Amazon bulls and bears usually taking sanguine positions. Personally, I think that an investment in Amazon carries above-average risk. However, the upside potential in the stock can more than compensate for those risks over the long term.

Let's take a look at three particularly relevant arguments among Amazon bears and try to explain why those arguments are ultimately no reason to stay away from the stock.

1. Valuation Is Unreasonable

When looking at Amazon through ratios such as price to earnings, it's easy to make the case that the stock is egregiously overvalued. The trailing price to earnings ratio stands at a stratospheric 91 times earnings as of the time of this writing.

On the other hand, current earnings numbers are not truly reflecting the company's underlying earnings power. Amazon is aggressively investing in all kinds of growth projects, and this naturally takes a big toll on both current earnings and free cash flows.

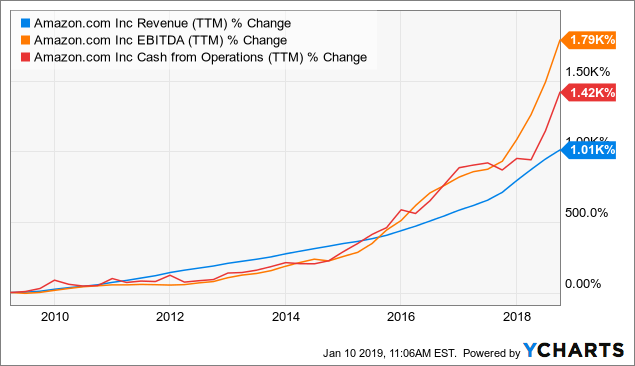

However, operational profitability metrics show that the company is thriving and profits are growing at a faster rate than revenue over the long term. The chart below shows the evolution of revenue, cash flow from operations, and EBITDA over the past decade.

AMZN Revenue (TTM) data by YCharts

Amazon stock has never traded at cheap valuations, but a high growth business doesn't need to be purchased for a cheap price in order to produce attractive returns.

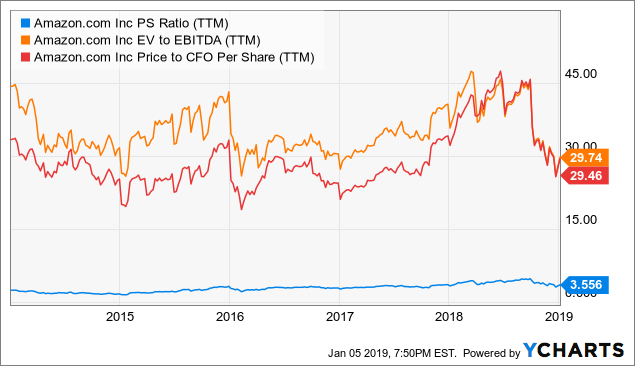

Current valuation levels are in line with historical standards for Amazon over the past five years when looking at price to sales, enterprise value to EBITDA, and price to operating cash flows.

AMZN PS Ratio (TTM) data by YCharts

It is important to note that Amazon has produced massive returns from those valuation levels. Even after falling by more than 20% from its highs of last year, Amazon has gained 32.4% annually in the past five years, nearly double the 16.78% produced on average by companies in the specialty retail category, based on data from Morningstar.

If Amazon can sustain rapid revenue growth and increasing margins going forward, this will provide a double boost to earnings, since earnings will increase due to both larger sales and a bigger percentage of sales retained as profits. This would mean that current earnings are not telling the whole story regarding future earnings potential, making valuation far more attractive than it seems to be at first sight.

As long as Amazon continues generating vigorous growth and increasing profitability levels, then current valuation should be no impediment for the stock to continue rewarding investors with attractive returns.

The PowerFactors system is a quantitative investing system available to members in my research service, "The Data Driven Investor." This system basically ranks companies in a particular universe according to quantitative return drivers such as financial quality, valuation, fundamental momentum, and relative strength.

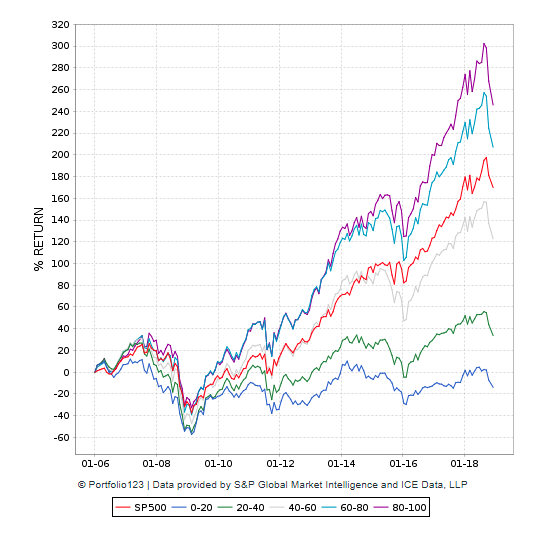

The system has produced solid performance over the long term. The chart below shows backtested performance numbers for companies in 5 different PowerFactors buckets over the years.

Companies with higher rankings tend to produce superior returns and vice versa. Besides, stocks with relatively high PowerFactors rankings tend to materially outperform the market.

Data from S&P Global via Portfolio123

Amazon is in the top segment, with a PowerFactors ranking of 85 as of the time of this writing. This does not guarantee that the stock will necessarily do well in the future, of course. However, it shows that, even if valuation ratios are elevated, the numbers still look quite solid for Amazon when considering other quantitative factors such as financial performance and momentum.

Amazon trades at expensive valuation levels because the market is expecting a lot from the company. But that does not mean that the stock is overvalued if Amazon can continue surpassing those expectations.

2. The Winner's Curse

Becoming too big can be quite problematic for a company, and there is plenty of statistical evidence showing that large corporations tend to underperform the market more often than not.

From an article by Rob Arnot and Lillian Wu:

For investors, top dog status—the No. 1 company, by market capitalization, in each sector or market—is dismayingly unattractive. We find a statistically significant tendency for top companies in each sector to underperform both the overall sector and the stock market as a whole.

It is relatively easy to grow at fast rates when a company has a small revenue base and plenty of room for market share gains in the future. But growth tends to naturally slow down as a company gains size over time.

This can be particularly important for businesses in sectors prone to disruptive innovation. When a company is an innovative leader in a particular segment, it can enjoy superior growth as long as the innovative advantage remains in place. But competitors many times replicate those innovations, which erodes the competitive advantage and ultimately has a negative impact on growth.

However, that doesn't seem to be the case when it comes to Amazon. The company has rock-solid competitive strengths and plenty of room for expansion over the years ahead.

Brand power is a key source of competitive differentiation in the consumer discretionary space, and Amazon comes second to none in terms of brand value. According to Brand Finance, Amazon is in fact the most valuable brand in the world, with an estimated brand value of $150 billion.

The business model gets stronger as the company gains size over time. Buyers and sellers attract each other to a leading platform such as Amazon in e-commerce. In addition, the company leverages its massive size to obtain economies of scale and competitive pricing in cloud computing infrastructure.

Vertical integration provides an additional layer of competitive strength for Amazon, since the company is broadening its own private level offerings and consolidating its fulfillment network. Amazon's logistics network would be almost prohibitively expensive to replicate by the competition.

Amazon is expected to make $232.3 billion in revenue during 2018, still only 45% the size of Wal-Mart (WMT) and its $514.3 billion in expected sales. Amazon still has substantial room for expansion in the retail business, and that does not even consider the company's tremendous potential in cloud computing, digital content, online advertising, and hardware.

Revenue during the third quarter of 2018 increased 29%, to $56.6 billion. Excluding the impact from year-over-year changes in foreign exchange rates throughout the quarter, net sales increased 30% year over year.

Amazon has reached a massive scale, and this allows the company to distribute fixed costs on a huge and growing amount of units, which reduces fixed costs per unit. Besides, segments such as Amazon Web Services, online advertising, and third-party sales in e-commerce naturally allow for increasing profitability.

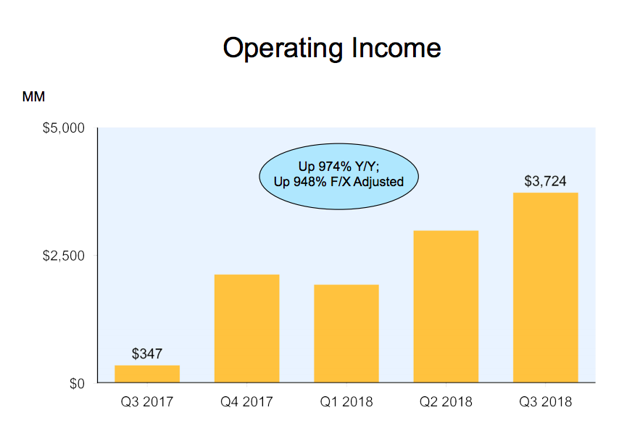

Because of these factors, profit margins are expanding, and operating income grew from $347 million in the third quarter of 2017 to $3,724 million in the third quarter of 2018.

Source: Amazon

In a nutshell, Amazon has plenty of potential for revenue growth going forward, and profits are outgrowing revenue over time. This should provide a double boost to earnings growth in the years ahead.

3. Regulators Will Crush Amazon

Amazon is the undisputed leader in e-commerce, and one of the leading players in the world across different retail product categories. The company is also the top player in cloud computing infrastructure, and it's rapidly expanding into marketing, delivery and logistics, payment services, entertainment, and hardware, to name a few important areas where Amazon is extending its tentacles.

Amazon has produced a lot of damage to many small businesses over the years, competitors have been undercut and even taken out of businesses, and the company squeezes suppliers with a relentless drive. For these reasons, Amazon has received plenty of criticism from both sides of the political spectrum, ranging from Bernie Sanders to Donald Trump.

This is an important risk factor to monitor in the years ahead, but Amazon has one big advantage when it comes to avoiding regulatory risk: Unlike the old monopolies of the industrial era, Amazon uses its competitive strength to reduce prices and provide the best possible service to consumers. The first thing that Amazon did after closing the acquisition of Whole Foods was implementing a series of price cuts in different products.

Amazon's dominance is actually benefitting consumers, not hurting them, and this is a game changer from a regulatory perspective, especially because consumers fully acknowledge this strategy, and they are quite happy with Amazon.

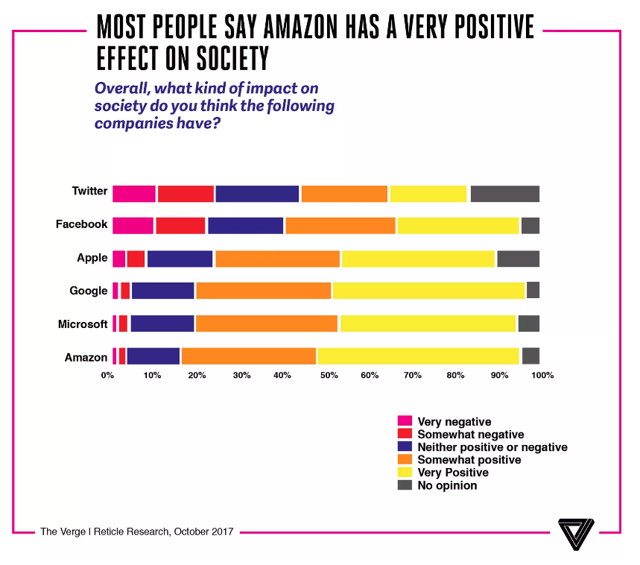

Amazon has been the top-rated internet retailer in the American Customer Satisfaction survey in every year since 2000. According to data from a survey by The Verge, Amazon is the most trusted and well-liked brand among big tech companies, and most consumers believe that Amazon has a very positive or somewhat positive effect in society.

Source: The Verge

Regulatory risk can never be completely eliminated, but politicians and regulators looking to stop Amazon could face strong opposition from consumers, and this is a key advantage for Amazon.

The Bottom Line

Amazon is one of the best businesses in the world, but that does not mean that a position in the company is free from risk. On the contrary, investing in Amazon carries above-average risk levels in comparison to the broad market.

When investors are looking for safety, they tend to gravitate towards stable and predictable companies with moderate valuation levels. Amazon is almost the opposite of such description, so the stock could face lots of selling pressure in a challenging market environment.

Amazon is all about growth and innovation, the company is aggressively investing in all kinds of projects, and this makes of Amazon an investment proposition with above-average risk levels.

But an old saying in the market is that "bull markets climb a wall of worry." The time to buy Amazon is when investors have plenty of doubts about the company. If everyone is on the long side, then the easy money has already been made, and waiting for lower prices is a better idea when sentiment is too optimistic.

One thing looks quite certain, though. Amazon is a world-class business generating vigorous growth and with outstanding potential over the long term. As long as the fundamentals remain intact, any short-term retracement in Amazon stock looks like a buying opportunity for long-term investors.

Disclosure: I am/we are long AMZN. I wrote this article myself, and it expresses my own opinions.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not ...

more

Arguments well put. I'm with you on $AMZN.