3 Intriguing Stocks To Buy For Value And Growth Potential

Image: Bigstock

Stocks that have exposure or dominance in markets that can be boosted by broader economic growth are very intriguing. Several top-rated Zacks stocks appear to fit the bill. Let’s take a look at three such stocks that are worthy of consideration at the moment.

ePlus (PLUS - Free Report)

Boasting a Zacks Rank #1 (Strong Buy), ePlus is very intriguing as a leading provider of technology solutions.

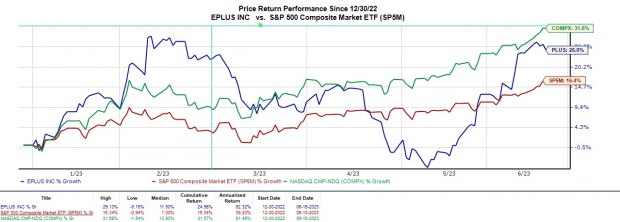

The strong performance of the Nasdaq this year has investors searching for tech stocks that could continue rising. This could be the case for ePlus stock, which is up 25% year-to-date to slightly trail the Nasdaq’s +31% but easily top the S&P 500’s +16%.

Image Source: Zacks Investment Research

The market environment is looking strong for ePlus, as its Business-Software Services Industry is in the top 19% of over 250 Zacks industries. The company looks poised to continue benefiting, with ePlus enabling organizations to optimize their IT infrastructure and supply chain processes.

The stock currently looks undervalued, as earnings are forecasted to dip -8% in its current fiscal 2024 at $4.61 per share. This is following a record year that saw EPS at $5.02 in the company’s FY23. Still, FY25 earnings are forecasted to rebound and rise 7% to $4.92 per share.

Piggybacking off of ePlus' value, its price-to-earnings valuation is very attractive considering the premium tech stocks can command. Recently seen trading at $55.81 a share and 12.1X forward earnings, ePlus appears to trade at a considerable discount to the industry average of 22.3X and nicely beneath the S&P 500’s 20.6X.

Image Source: Zacks Investment Research

Rush Enterprises (RUSHA - Free Report)

Retail auto dealer Rush Enterprises is starting to stand out with a Zacks Rank #2 (Buy). Rush operates the largest network of Peterbilt heavy-duty truck dealerships in North America and John Deere construction equipment dealerships in Texas and Michigan.

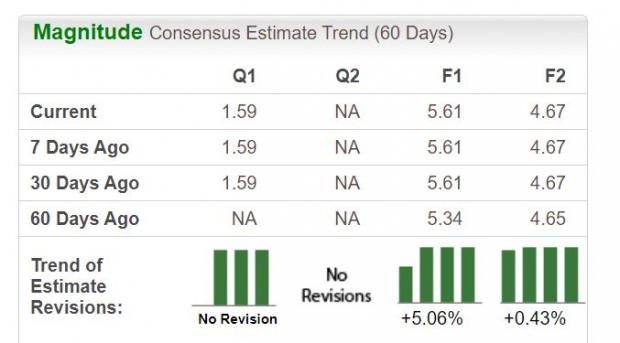

Following a record year for revenue and profitability, Rush's stock is up 14% in 2023. Additionally, its P/E valuation is enticing, with earnings estimates moving higher over the last 60 days. Fiscal 2023 earnings are now expected at $5.61 per share, with the stock recently seen trading at around $59.53 and just 10.7X forward earnings.

Image Source: Zacks Investment Research

While Rush has been trading modestly above its industry average of 7.2X forward earnings, the company is a leader in its space and often trades well below the benchmark’s 20.6X. Furthermore, Rush's stock has been recently trading 75% below its decade-long high of 41X and at a 25% discount to the median of 14.2X.

Image Source: Zacks Investment Research

Sterling Infrastructure (STRL - Free Report)

Also sporting a Zacks Rank #2 (Buy), Sterling Infrastructure's stock has been very intriguing since the company announced in February that it was awarded a landmark site development project for the Hyundai Engineering America New EV Battery Facility in Georgia.

In fact, the E-infrastructure, building and transportation solutions company has now seen its stock soar 59% this year to largely outperform the broader indexes. More astonishing, Sterling's stock is now up +447% over the last decade to vastly outperform the S&P 500’s +180% and even the Nasdaq’s +309%.

Image Source: Zacks Investment Research

Investors have been clinging to get in on Sterling’s recent growth, with fiscal 2023 earnings projected to rise 11% to $3.52 per share after what was a record year that saw EPS at $3.16 in 2022. Plus, fiscal 2024 earnings are expected to jump another 16% at $4.11 per share.

Even better, Sterling’s stock has still been trading reasonably at around $51.86 a share and 15X forward earnings. This is nicely beneath its industry average of 17.4X and the benchmark.

Image Source: Zacks Investment Research

Takeaway

These companies are attractively placed in their industries as leaders that can benefit from economic expansion. At the moment, ePlus, Rush Enterprises, and Sterling Infrastructure all have an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum. As inflation continues to ease, their strong performances could continue making them viable investments for 2023 and beyond.

More By This Author:

3 Top-Ranked Stocks Investors Can Buy Now

Caterpillar Hikes Quarterly Dividend Payout By 8%

Microsoft Roars To New High: ETFs To Tap The Strength

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more