3 Top-Ranked Stocks Investors Can Buy Now

Image: Bigstock

The incredible strength of the market this year has massively exceeded expectations. Going into 2023, most analysts had projected a recession and another painful year for stocks, and yet the market has climbed a wall of worry and the economy has remained resilient.

When markets get tricky, the best way to stay grounded is to utilize a proven process. The Zacks Rank is an extremely effective way to find stocks with a high likelihood of appreciating in price over the near-term, dramatically improving investors’ odds of success.

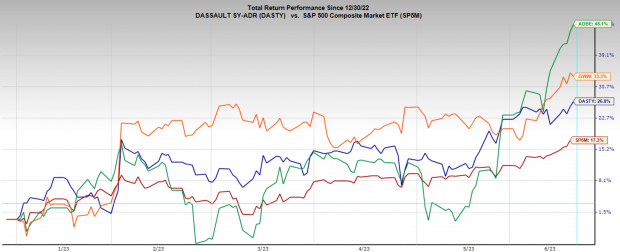

W.W. Grainger (GWW - Free Report), Dassault Systemes (DASTY - Free Report), and Adobe (ADBE - Free Report) all have high Zacks Ranks, indicating upward trending earnings revisions. Additionally, they show strong momentum, reasonable historical valuations, and extremely robust business models. By picking stocks with multiple bullish factors, we can dramatically improve the odds of buying winning stocks.

Image Source: Zacks Investment Research

Dassault Systemes

Dassault Systemes is a renowned global leader in 3D design, engineering, and collaborative software solutions. The company, founded in 1981 and headquartered in France, offers a comprehensive portfolio of innovative products and services that cater to various industries, including aerospace, automotive, manufacturing, and life sciences.

Dassault Systemes' flagship software, CATIA, is widely recognized as a leading design and modeling tool, while its other offerings, such as SOLIDWORKS and SIMULIA, provide advanced simulation and virtual testing capabilities.

With a strong focus on digital transformation and sustainable innovation, Dassault Systemes empowers businesses to enhance their product development processes, improve efficiency, and drive meaningful customer experiences.

Through its cutting-edge technologies and industry expertise, DASTY continues to shape the future of design and engineering, enabling companies to stay at the forefront of their respective sectors.

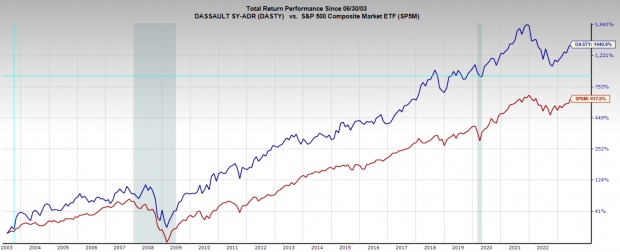

DASTY stock has had an impressive performance over the last twenty years, compounding at an annual rate of 14.5% and returning a total of 1,440%. Over that period, DASTY has consistently grown sales and revenue at an impressive pace.

Image Source: Zacks Investment Research

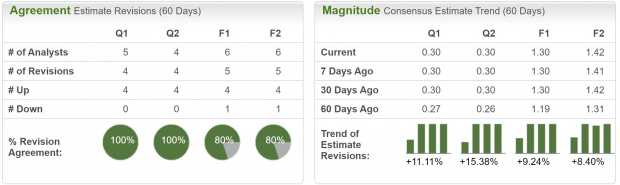

Analysts have almost unanimously upgraded DASTY earnings estimates across timeframes. Next quarter earnings have been revised higher by 15.4%, and FY23 earnings estimates have been boosted by 9.2% over the last two months.

Current quarter earnings estimates have been revised 11% higher, and are expected to grow 7% year-over-year while current quarter sales are expected to climb 8.8% year-over-year.

Image Source: Zacks Investment Research

Dassault Systemes applications are the leader in PLM (Product Lifecycle Management) and Engineering software. It is estimated that it owns the largest share in the market at 17%, and it increased that share by 8.3% over the last year. DASTY has over 300,000 customers in more than 140 countries.

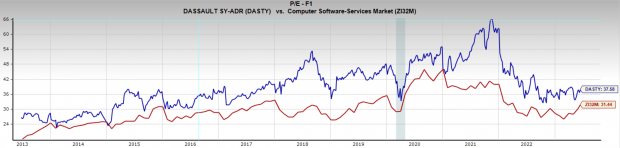

DASTY has recently been seen trading at a one-year forward earnings multiple of 37.6x, which is above the industry average of 31.5x and in line with its 10-year median.

Image Source: Zacks Investment Research

W.W. Grainger

W.W. Grainger is a business-to-business distributor of maintenance, repair and operating products and services. GWW customers represent a wide array of industries including government, manufacturing, transportation, commercial, and contractors.

W.W. Grainger’s products include material-handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, and metalworking tools.

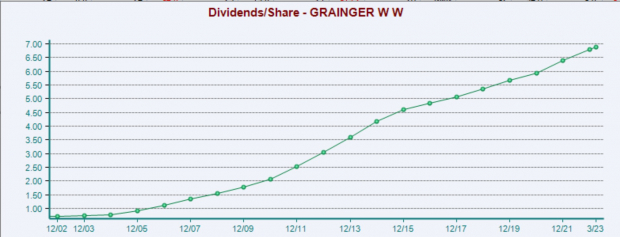

W.W. Grainger has raised dividends for 51 consecutive years, and the stock offers a dividend yield of approximately 1.1%.

Image Source: Zacks Investment Research

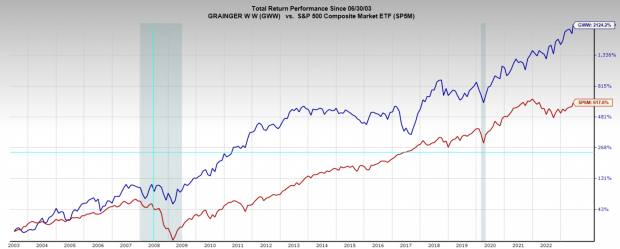

Over the last 20 years, GWW stock has performed as strongly as any investor can hope. Over that period, the stock has appreciated 1900%, which is an extremely impressive 16% annualized. Even more impressive is that this return was achieved with fewer deep drawdowns than the broad market.

W.W. Grainger is a great example of a lesser known stock quietly making its investors rich over many decades.

Image Source: Zacks Investment Research

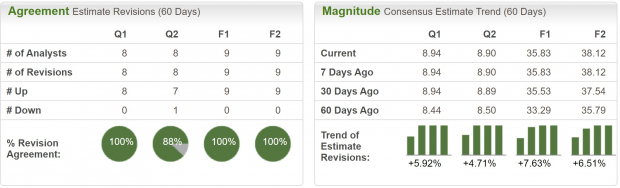

GWW boasts a Zacks Rank #2 (Buy), reflecting upward trending earnings revisions. Analysts have near unanimously upgraded earnings estimates across timeframes, with current quarter estimates being upgraded by 6% and FY23 earnings getting boosted by 7.6% over the last two months.

Image Source: Zacks Investment Research

GWW has recently been seen trading at a one-year forward earnings multiple of 20.8x, which is below the industry average 21.2x and a touch above its 10-year median of 20x.

Image Source: Zacks Investment Research

Adobe

Adobe is one of the largest software companies in the world collecting licensing fees from customers, which form the bulk of its revenue. ADBE also offers technical support and education, which accounts for the balance.

On Thursday, after the market closed, Adobe announced its Q2 earnings results and beat both earnings and sales estimates, with sales setting a record quarter. Management also highlighted Adobe’s burgeoning generative AI products, which are quickly being integrated into its software platform.

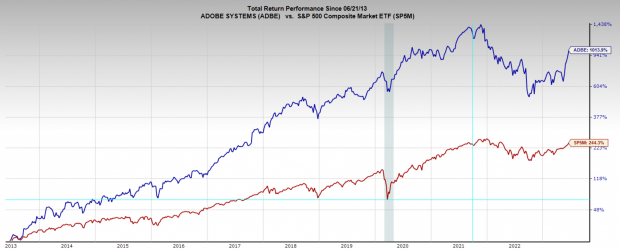

Adobe stock has been a ten-bagger over the last ten years, compounding at an incredible 27% annually. The stock has also benefited from the strong resurgence of tech and growth stocks and has returned 48% year-to-date.

Image Source: Zacks Investment Research

Adobe earns a Zacks Rank #2 (Buy), reflecting its upward trending earnings revisions. Earnings have been upgraded slightly over the past two months, with current quarter earnings projected to grow 13.5% year-over-year and FY23 earnings to grow 12.6% year-over-year.

At a one-year forward earnings multiple of 40x, ADBE is above the industry average of 35x and below its 10-year median of 45x.

Image Source: Zacks Investment Research

Bottom Line

When picking stocks, the odds of investing in winners can be improved when you align multiple positive factors. With the Zacks Rank identifying stocks with strong near-term expectations based on earnings trends, investors can then dive deeper into company fundamentals. This way they can pick companies with appealing long-term performance and compelling business models, such as those listed above.

More By This Author:

Caterpillar Hikes Quarterly Dividend Payout By 8%Microsoft Roars To New High: ETFs To Tap The Strength

Adobe Systems Q2 Earnings And Revenues Top Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more