3 Highly-Ranked Tech Stocks To Buy Now For Long-Term Upside

Image Source: Pixabay

Today’s episode of Full Court Finance at Zacks discusses the recent market rebound that has the S&P 500 and the Nasdaq back above some key technical levels, with the bulls possibly pushing for more critical gains soon. The episode then dives into three tech stocks—Uber (UBER - Free Report), AppLovin (APP - Free Report), and Pure Storage (PSTG - Free Report) —that are all currently Zacks Rank #1 (Strong Buys) that investors might want to buy now for long-term upside as they prepare to report quarterly earnings.

The bulls kept their foot on the gas through morning trading on Friday, sending the Nasdaq back above its 50-day moving average after it ripped through its 200-day earlier in the week. The S&P 500 is in a similar spot when it comes to these highly-tracked technical levels.

The bulls will, of course, have to hold the line at these levels and we could see some quick profit-taking after the rally. Nonetheless, Wall Street showed the bears that the battle is on for near-term control of the market.

The recent rally showcases once again how difficult it is to time the market and why investors might want to buy strong tech stocks now and possibly hold them for a long time.

The first Zacks Rank #1 (Strong Buy) stock up today is Uber Technologies, Inc. (UBER), ahead of its third quarter financial release on Tuesday, November 7.

Uber has soared over 90% in 2023 and it is back above its 50-day moving average as investors reward the company for growing its ride-hailing and delivery businesses while focusing on profits and its autonomous driving future.

Uber’s revenue is projected to jump over 17% in 2023 and another 18% in FY24 to $44 billion, as people clamor for convenience. Plus, its Monthly Active Platform Consumers are projected to climb by over 11% to 146.5 million in 2023, with trips expected to grow by 21%.

Uber is also projected to swing from an adjusted loss of -$4.65 a share last year to +$0.41 in FY23 and then soar to +$1.10 a share in FY24.

Image Source: Zacks Investment Research

Uber still trades about 24% below its average Zacks price target. Its PEG ratio, which factors in its longer-term bottom-line growth outlook, sits at 1.1 vs. tech’s 1.9. And Wall Street is very high on the stock, with 28 of the 34 brokerage recommendations Zacks has at “Strong Buys,” alongside four “Buys,” and two “Holds.”

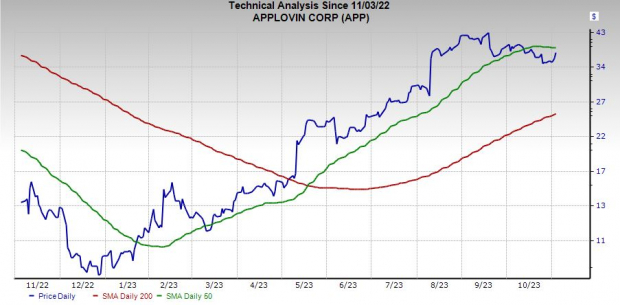

AppLovin Corporation (APP) is set to report its Q3 results on Wednesday, November 8. AppLovin is a digital application and marketing tool developer that offers long-term upside potential within a vital area of the economy, with people glued to their phones and tablets. APP has skyrocketed 270% YTD to blow away Nvidia and many other tech standouts as Wall Street and clients gravitate toward its new AI-enhanced offerings for the app economy.

AppLovin is projected to post roughly 10% sales growth this year and another 13% top-line expansion next year to climb from $2.82 billion in FY22 to $3.48 billion in FY24. Better yet, it is projected to post 339% adjusted earnings growth this year and another 74% next year.

Image Source: Zacks Investment Research

Despite its run, APP stock still trades about 65% below its record highs and 16% under its average Zacks price target. AppLovin is climbing right back toward its 50-day moving average. On the valuation front, APP trades at a 45% discount to its three-year median at 29.2X forward 12-month earnings.

Pure Storage (PSTG) is currently projected to release its quarterly results on November 29, though the company has yet to confirm a date. Pure Storage is an enterprise data storage and services company that aims to “uncomplicate data storage, forever” through its storage-as-a-service offerings. Pure Storage’s earnings outlook has steadily improved for the last several years as it grows its business and attracts more customers.

Pure Storage’s sales are projected to climb 8% this year and another 16% next year to reach $3.43 billion, based on Zacks consensus estimates. Pure Storage’s adjusted earnings are expected jump 9% and 19%, respectively. The data storage firm has also crushed our bottom-line estimates over the last four years, including some big beats in the last 12 months.

Image Source: Zacks Investment Research

Pure Storage shares have climbed 105% in the last three years to blow away the Zacks Tech sector’s 24%. PSTG stock has raced 56% higher during the last six months. The stock is currently trading between its 200-day and 50-day moving averages and 26% below its average Zacks price target. On top of that, Wall Street loves the stock right now, with 14 of the 17 brokerage recommendations Zacks has sitting at “Strong Buys.”

More By This Author:

Bear Of The Day: Texas Instruments Incorporated

Bull of the Day: Amazon.com, Inc.

Time To Finally Buy These 3 Beaten-Down Tech Stocks Before Earnings?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more