2026 Can Be The IPO Supercycle With SpaceX, OpenAI, And Anthropic Poised To Take Over Public Markets

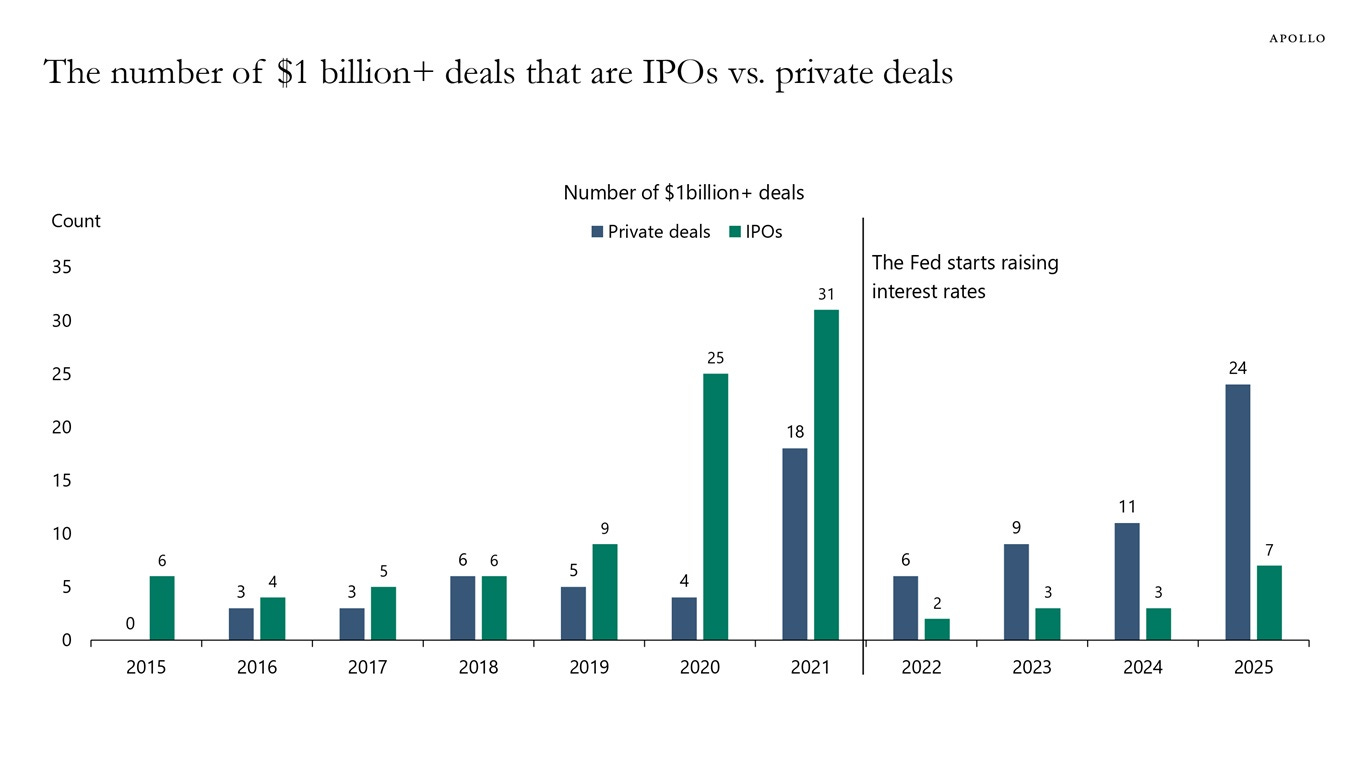

The Federal Reserve's aggressive rate hikes beginning in 2022 significantly curtailed public offerings, redirecting billion-dollar-plus transactions toward private markets. Private equity and venture capital offered greater flexibility in an environment of elevated borrowing costs and heightened valuation scrutiny, resulting in a sharp increase in large private deals that far outpaced IPOs.

This shift represented a broader regime change: higher interest rates compressed EV/EBITDA multiples in public markets. Many companies postponed public listings to evade quarterly earnings scrutiny and steeper discounting of future cash flows.

As of December 2025, the Fed's rate-cut cycle has improved financial conditions, enhancing liquidity and investor risk appetite. Major investment banks, including Morgan Stanley and Goldman Sachs, anticipate a sustained global IPO recovery, with U.S. markets expected to drive significant activity into 2026. 🇺🇸

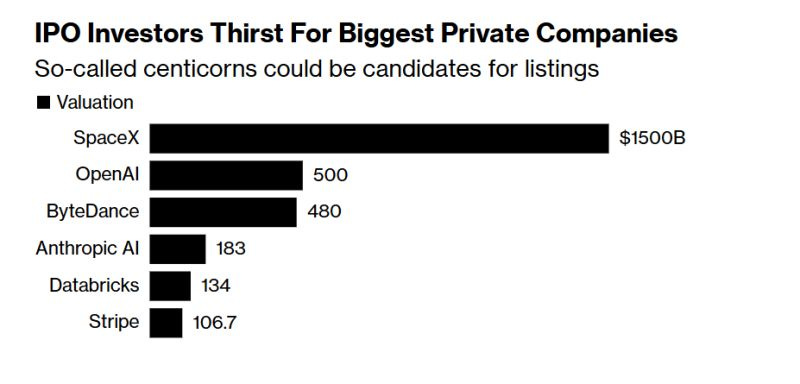

Three leading private companies could catalyze this rebound:

- SpaceX: Reports indicate preparations for a potential late-2026 IPO, with recent insider transactions implying a valuation of approximately $800 billion and aspirational targets up to $1.5 trillion. The company maintained dominance in global launches throughout 2025, while Starlink continues to deliver substantial cash flows—positioning

- OpenAI: Following a secondary share sale implying a $500 billion valuation and an annualized revenue run rate approaching $20 billion, the company is conducting preliminary IPO groundwork, potentially targeting a late-2026 or 2027 listing with valuations discussed up to $1 trillion.

- Anthropic: The developer of Claude has retained Wilson Sonsini for IPO preparation, eyeing a 2026 debut amid negotiations for funding rounds that could exceed a $300 billion valuation.

Should these listings occur in proximity, the aggregate addition of $2–3 trillion in market capitalization would markedly influence the S&P 500 and Nasdaq, marking a pivotal moment underpinned by substantial revenues—distinct from prior speculative cycles.

Private investors have provided extensive capital to these enterprises, yet constraints are emerging. Public markets offer the necessary scale to support ongoing profitability pursuits and large-scale capital expenditures, including AI infrastructure and advanced space programs.

Significant risks persist, including regulatory challenges in AI governance and space operations, potential market volatility following elections, and concerns over elevated valuations.

More By This Author:

Fed Ends Quantitative Tightening (QT) - What Happened Last Time?