2 Top-Rated Stocks To Buy After Beating Earnings Expectations

As more names start to stand out this earnings season, LiveRamp Holdings (RAMP) and Nordson Corporation (NDSN) are two stocks investors will want to pay attention to.

Let’s review their quarterly reports and see why now may be a good time to buy these stocks.

RAMP Q4 Review

LiveRamp stock has a Zacks Rank #2 (Buy) with the company blasting its fiscal fourth-quarter earnings expectations on Wednesday.

The Zacks Technology Services Industry is in the top 48% of over 250 Zacks industries and LiveRamp is benefitting as a provider of data foundation, digital transformation, consumer engagement, and online marketing and analysis services.

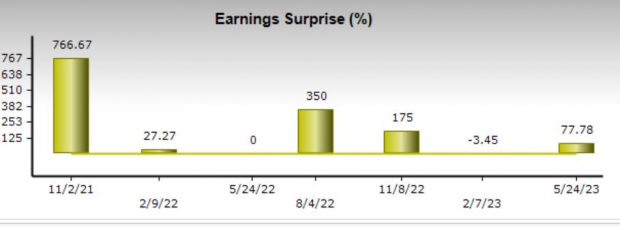

LiveRamp’s Q4 earnings of $0.32 per share came in 78% above EPS expectations of $0.18. More importantly, this soared from an adjusted loss of -$0.01 in the prior-year quarter. The earnings beat was very impressive despite LiveRamp slightly missing top-line estimates by -1%. However, Q4 sales of $148.63 million were still up 5% from a year ago.

(Click on image to enlarge)

Image Source: Zacks Investment Research

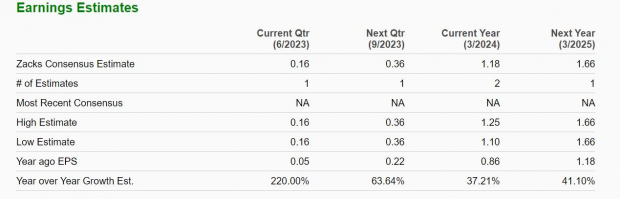

LiveRamp stated they are a more efficient company as they enter their current fiscal 2024 which is partly attributed to strategic partnerships with the likes of Alphabet (GOOGL), Snowflake (SNOW), and Twilio (TWLO). To that point, LiveRamp’s EPS growth is very intriguing at the moment.

LiveRamp’s fiscal 2024 earnings are forecasted to climb 37% at $1.18 per share compared to EPS of $0.86 in the company’s FY23. Even better, FY25 earnings are projected to soar another 41% at $1.66 per share. With shares of RAMP trading at $23, there certainly appears to be room for more upside as LiveRamp has soared past the profitability line after going public in 2018.

(Click on image to enlarge)

Image Source: Zacks Investment Research

NDSN Q2 Review

Also sporting a Zacks Rank #2 (Buy) Nordson was able to exceed its fiscal second-quarter top and bottom-line expectations earlier in the week on Monday.

Nordson’s Manufacturing-General Industrial Industry is also in Zacks top 13%. Attractively positioned within its industry, Nordson is one of the leading manufacturers and distributors of products and systems designed to dispense, apply and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

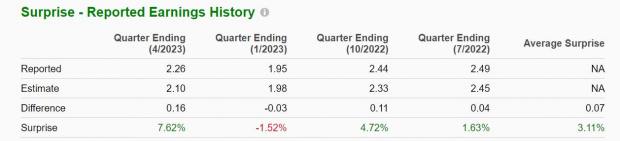

Earnings of $2.26 per share topped estimates by 7% despite dipping -7% from Q2 2022. Still, Q2 sales were up 2% YoY to $650.17 million and topped expectations by roughly 2% as well.

(Click on image to enlarge)

Image Source: Zacks Investment Research

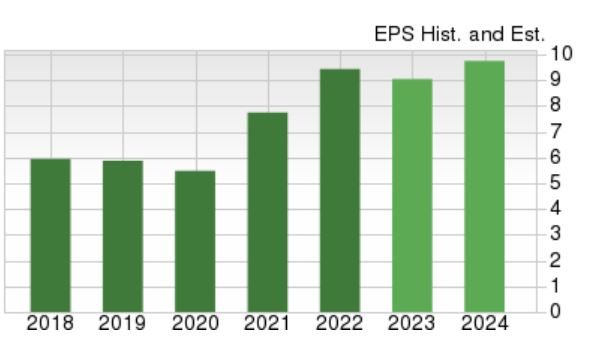

Shares of NDSN trade at $217 with Nordson’s bottom line remaining robust after a record year that saw EPS at $9.43 in 2022. Following a very tough-to-compete-against year, Fiscal 2023 earnings are now expected to slightly decline -4% at $9.07 per share but rebound and jump 8% in FY24 at $9.82 a share.

It is important to note that fiscal 2024 projections would represent 79% EPS growth over the last five years with 2020 earnings at $5.48 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

LiveRamp and Nordson’s earnings potential is very attractive, and their quarterly reports continued to reconfirm this. In addition to the possibility of more upside in their stocks this year, both companies have become viable long-term investments and now appears to be a good time to buy.

More By This Author:

Earnings Preview: Dell Technologies Q1 Earnings Expected To Decline

Nvdia EPS Takeaway: Valuation Is Not A Timing Tool

4 Stocks To Watch On Dividend Hikes As Market Volatility Continues

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more