2 Red-Hot Stocks Suited For Momentum Investors

Image Source: Unsplash

When stocks are cruising near all-time or 52-week highs, it reflects considerable bullishness with trends where buyers are in control. Stocks making new highs tend to make even higher highs, particularly when analysts' positive earnings estimate revisions are present.

That’s been precisely the case for Philip Morris (PM - Free Report) and Sterling Infrastructure (STRL - Free Report), both of which presently sport a favorable Zacks Rank and are trading near 52-week highs with notable momentum. Let’s take a closer look at what’s been driving the bullish behavior.

Sterling Makes Big Splash

Notably, Sterling Infrastructure made headlines this week following its announcement of an acquisition of Texas-based CEC Facilities Group, LLC (CEC), a leading specialty electrical and mechanical contractor. CEC will join Sterling’s E-Infrastructure Solutions segment, a move aimed at bolstering its Data Center capabilities amid the current AI frenzy.

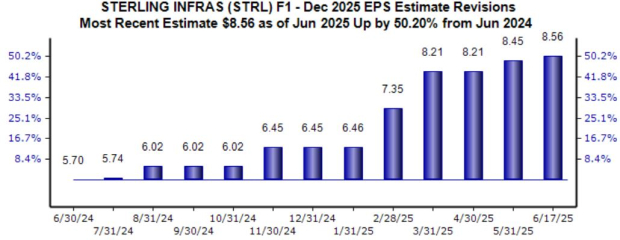

The stock headed into the acquisition news in an already strong position, currently sporting a Zacks Rank #2 (Buy). Earnings estimate revisions for its current fiscal year are very bullish, with the $8.56 Zacks Consensus EPS estimate up 50% over the last year and suggesting 40% YoY growth.

Image Source: Zacks Investment Research

PM Keeps Paying Investors

Philip Morris shares have benefited nicely in 2025, with quarterly results regularly beating expectations. Demand has remained strong for the tobacco titan, with product innovations, namely its smoke-free business (SFB), remaining key for its future.

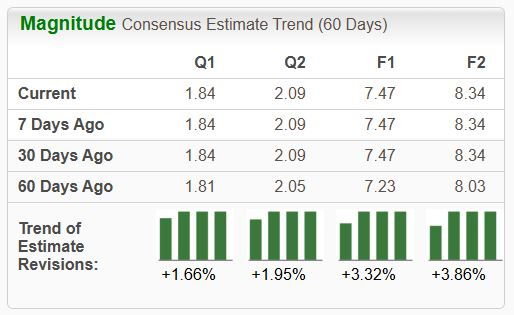

EPS expectations are climbing higher across the board over recent months.

Image Source: Zacks Investment Research

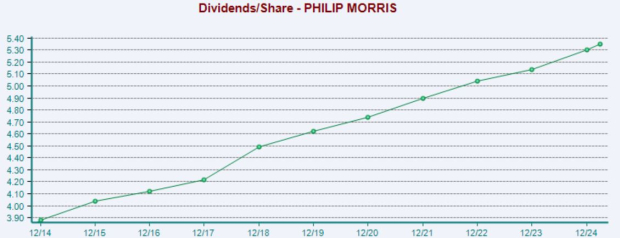

The company has consistently upped its payouts over its history, currently sporting a 2.8% five-year annualized dividend growth rate and also being a Dividend King.

Below is a chart illustrating the company’s dividends paid on an annual basis. Please note that the final value is calculated on a trailing twelve-month basis, as the company’s FY25 is still ongoing.

Image Source: Zacks Investment Research

Bottom Line

Stocks making new highs tend to make even higher highs, particularly when positive earnings estimate revisions hit the tape.

That’s precisely what both stocks above – Philip Morris and Sterling Infrastructure – have enjoyed, with each sporting a favorable Zacks Rank and seeing their shares trade near 52-week highs.

More By This Author:

What Drives Stock Outperformance?

Coca-Cola Vs. PepsiCo: What's The Better Buy?

AI Infrastructure Boom: 2 Companies Poised To Benefit

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more