AI Infrastructure Boom: 2 Companies Poised To Benefit

Photo by Steve Johnson on Unsplash

Artificial intelligence (AI) remains among the hottest market topics, with investors continuing to seek ways to obtain exposure. The theme has undoubtedly been the strongest we’ve seen in years, with many stocks benefiting from the frenzy.

And for those seeking exposure, particularly concerning the data center angle, several stocks, including Vertiv (VRT - Free Report) and Eaton (ETN - Free Report) – provide just that.

For those with an appetite for AI exposure through the data center angle, let’s take a closer look at each.

Vertiv Raises Guidance

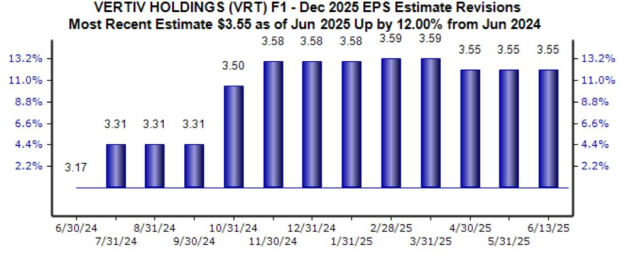

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services. Analysts have dialed their EPS expectations higher over the past year thanks to bullish commentary, with the current $3.55 Zacks Consensus EPS estimate suggesting 25% YoY growth.

Image Source: Zacks Investment Research

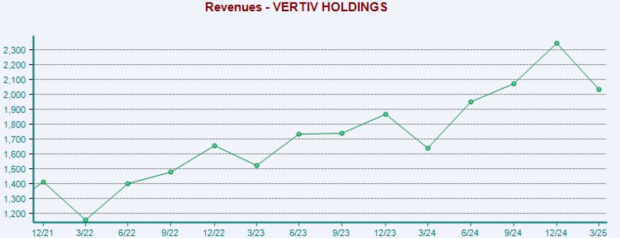

Revenue estimates are bullish as well thanks to the red-hot demand, with Vertiv expected to see 18% YoY sales growth in its current fiscal year. The strong demand over recent periods has allowed VRT to report double-digit percentage sales growth in each of its past four quarters.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

The company continues to land more and more business, with its Q1 orders showing 13% YoY growth and 21% sequential growth. Vertiv upped its current year sales guidance following the release and maintained other previous guidance, clearing a critical hurdle.

Eaton Breaks Records

Eaton is an intelligent power management company that provides products for the data center, utility, industrial, commercial, machine building, residential, aerospace, and mobility markets.

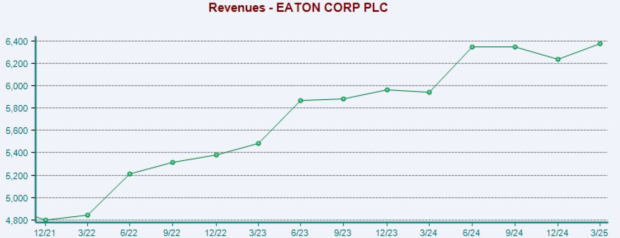

The company’s latest set of results provided a big wave of positivity, with the company posting record Q1 adjusted EPS of $2.72 (up 13% YoY), record Q1 sales of $6.4 billion (up 7% YoY), and record segment margins of 23.9% (80 bp increase YoY).

The company’s top line has shown solid, consistent growth, as shown below.

Image Source: Zacks Investment Research

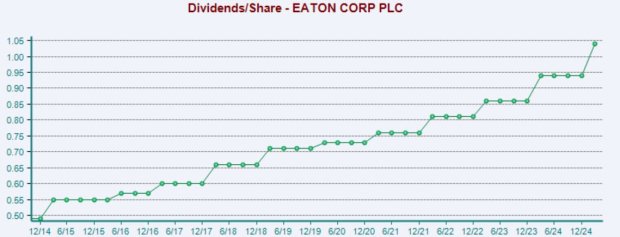

ETN shares also reflect a great opportunity for those with an appetite for income, sporting a 7% five-year annualized dividend growth rate. Impressively, the company has paid a dividend on its shares every year since 1923. Below is a chart illustrating its dividends paid on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

The AI trade continues to grip investors, with many seeking exposure. It’s easy to understand why there’s such excitement surrounding the topic, as the technology is expected to boost productivity and provide meaningful operational efficiencies for businesses for years to come.

And for those interested in the AI frenzy, both stocks above – Vertiv and Eaton – deserve consideration, thanks to their involvement within data centers.

More By This Author:

Seeking Quantum Computing Exposure? 2 Stocks Worth A LookIPO Mania: A Closer Look At Circle And CoreWeave

Tesla Vs. Rivian: What's Currently The Better Buy?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more