2 Highly Ranked Stocks To Buy After Massive Earnings Beats

Image Source: Unsplash

Currently belonging to the Zacks Rank #1 (Strong Buy) list, Alpha Metallurgical Resources (AMR) and LendingTree’s (TREE) stock look appealing after blasting their fourth-quarter earnings expectations this week.

Let’s briefly review Alpha Metallurgical Resources and LendingTree’s quarterly reports to see why now is a good time to buy these highly-ranked stocks.

AMR Q4 Earnings Review

Providing metallurgical products to the steel industry Alpha Metallurgical Resources is one of the most profitable miners and its earnings potential was on full display on Monday. The company posted Q4 earnings of $12.88 per share which crushed the Zacks Consensus of $8.78 a share by 47%.

This was despite Q4 EPS dipping from $13.37 in the comparative quarter. Still, Alpha Metallurgical Resources has topped earnings expectations in each of its last four quarterly reports posting an average earnings surprise of 24.78%.

Image Source: Zacks Investment Research

TREE Q4 Earnings Review

Reporting its Q4 results on Tuesday, LendingTree’s earnings of $0.28 a share reassuringly surpassed estimates of $0.14 a share by 100%. Despite Q4 EPS down from $0.38 a year ago, the consumer lending company has now surpassed earnings expectations for 13 consecutive quarters with an astonishing average earnings surprise of 202.32% in its last four quarterly reports.

Image Source: Zacks Investment Research

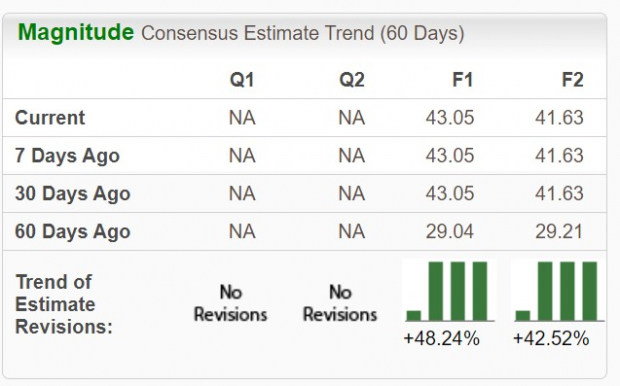

Earnings Estimate Revisions

Rising earnings estimates typically correllate with more short-term upside in a stock and EPS estimates should move higher for Alpha Metallurgical Resources and LendingTree following their massive earnings beats. Even better, over the last 60 days, Alpha Metallurgical Resources' fiscal 2024 and FY25 earnings estimates have already soared 48% and 42% respectively.

Image Source: Zacks Investment Research

Pivoting to LendingTree, FY24 earnings estimates are already up 3% in the last 60 days while FY25 EPS estimates have climbed 16%.

Image Source: Zacks Investment Research

Bottom Line

The earnings outlook for Alpha Metallurgical Resources and LendingTree continues to brighten and now looks like a good time to buy their stocks as they are two of the more appealing options among the basic materials sector and finance sector.

More By This Author:

Share Buybacks: 5 Companies Scooping Up Shares

Bull Of The Day - Coinbase

Things To Note Before The TJX Companies Q4 Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more