Share Buybacks: 5 Companies Scooping Up Shares

Image Source: Unsplash

Stock buybacks, or share repurchase programs, are commonly executed by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock. In its simplest form, buybacks represent companies essentially re-investing in themselves.

As of late, several companies – NVR (NVR), Meta Platforms (META), Altria Group (MO), United Rentals (URI), and Paychex (PAYX) – have unveiled new repurchase programs. Let’s take a closer look at each.

Meta Platforms

Up a remarkable 180% over the last year, better-than-expected quarterly results have driven the company’s stellar share performance. Meta authorized an additional $50 billion in share buybacks and unveiled its first-ever dividend following its latest print.

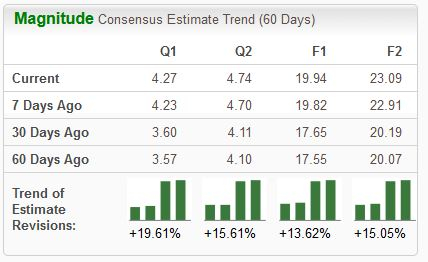

The stock is a current Zacks Rank #1 (Strong Buy), with earnings expectations higher across the board.

Image Source: Zacks Investment Research

The company’s growth profile remains solid, with expectations for its current year (FY24) suggesting 34% earnings growth on 18% higher sales. Improved profitability has been a significant tailwind for the tech giant, with Q4 costs and expenses falling 8% year-over-year.

NVR

NVR shares have been strong performers as well, adding roughly 45% in value and outperforming relative to the S&P 500 over the last year. The company recently unveiled a $750 million buyback.

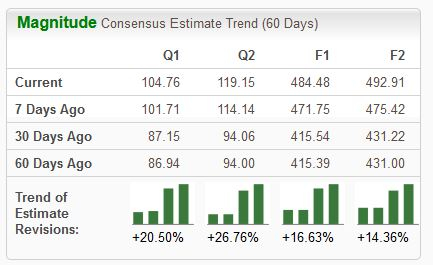

The stock is a current Zacks Rank #1 (Strong Buy), with analysts positively revising their expectations across the board.

Image Source: Zacks Investment Research

Altria Group

Altria has a leading portfolio of tobacco products for U.S. tobacco consumers. Following its latest quarterly release, the company announced a new $1 billion buyback program.

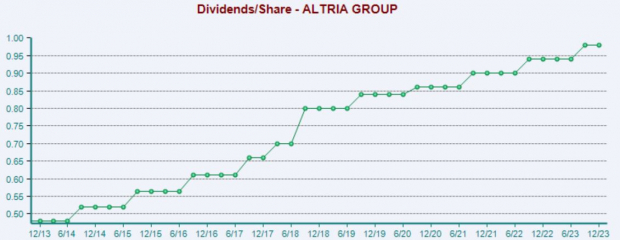

Income-focused investors could find MO shares attractive, currently yielding a sizable 9.6% annually. Dividend growth is also apparent, with the payout growing by 4% annually over the last five years.

Image Source: Zacks Investment Research

United Rentals

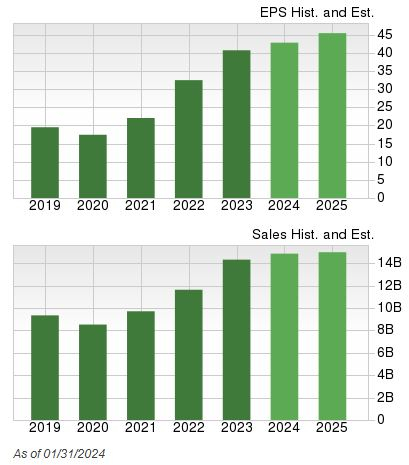

URI shares have been considerably hot over the last year, adding more than 45% in value and widely outperforming relative to the S&P 500. The company unveiled a $1.5 billion share repurchase program near the beginning of February.

The company’s growth is forecasted to remain steady, with consensus expectations for its current fiscal year (FY24) suggesting 5.5% earnings growth on 4.6% higher sales. Peeking ahead to FY25, consensus estimates allude to an additional 7% boost in earnings paired with a 3% sales boost.

Image Source: Zacks Investment Research

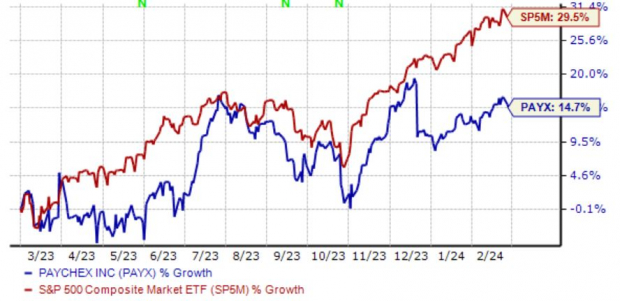

Paychex

Paychex is a recognized leader in the payroll, human resource, and benefits outsourcing industry. PAYX announced a $400 million buyback near the end of January. Shares have been quite volatile over the last year, up 14% and underperforming relative to the S&P 500’s nearly 30% gain.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies amplify shareholder value is through implementing share buybacks. They can provide a nice confidence boost for investors, indicating that the company is utilizing excess cash and can help put in a floor for shares.

And recently, all companies above – NVR, Meta Platforms, Altria Group, United Rentals, and Paychex – unveiled additional or fresh buyback programs.

More By This Author:

Bull Of The Day - CoinbaseThings To Note Before The TJX Companies Q4 Earnings

Bear Of The Day: Archer Daniels Midland

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more