10 Wide Moat Stocks To Buy Now

Like it protected castles from plunderers in olden times, a moat protects a company from competitors in the business world. A company’s moat can be thought of as its competitive advantages, namely its advantages over competitors.

This moat can be narrow or it can be wide. A narrow moat is a smaller competitive advantage over peers, while a wide moat can mean the company has a significant advantage over peers, which likely protects its results through multiple economic cycles.

Narrow and wide moats have minimum life expectancies of 10+ and 20+ years, respectively, which are anticipated to benefit the company.

We often see that companies with wide moats are better able to continue growing earnings and as a result, grow their dividends for many years. These companies also usually have strong margins in relation to their peers, as their moats protect their profits and market share.

Companies with wide moats can offer investors more peace of mind as they are generally more stable blue-chip stocks.

Below are ten wide moat dividend stocks that can be found in the VanEck Morningstar Wide Moat ETF (MOAT), which have respectable expected annual returns over the next five years.

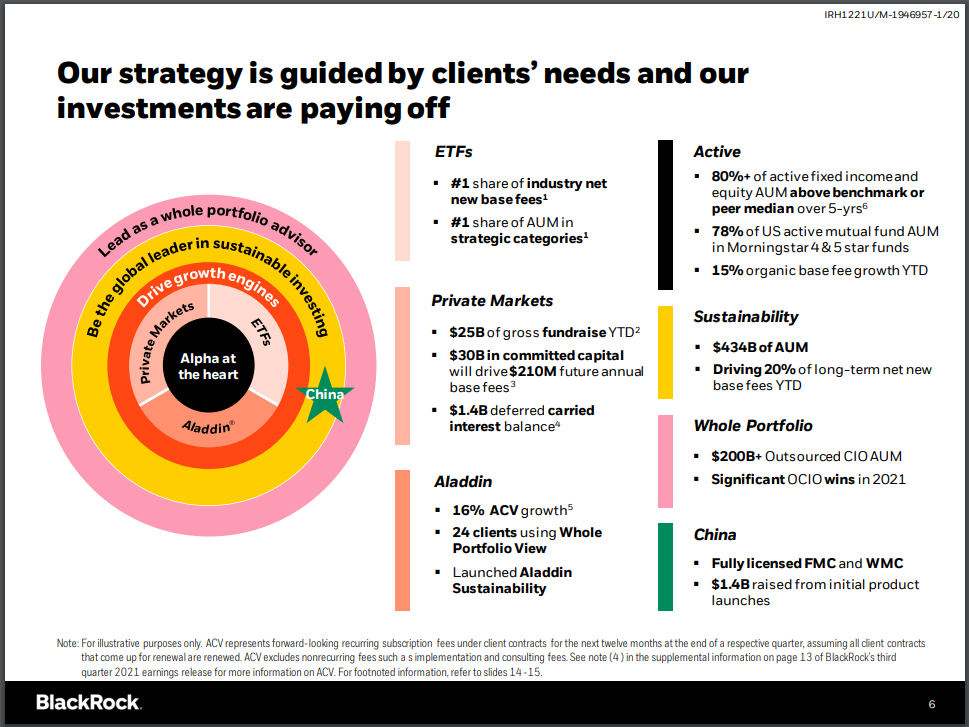

Wide Moat Stock #10: Blackrock (BLK)

- Expected annual returns: 6.5%

BlackRock, founded in 1988, is a large investment and asset management firm. Today the firm boasts over $8 trillion of assets under management (“AUM”). BlackRock provides investment management, risk management, and advisory services worldwide for institutional and retail clients.

Its products include single and multi-asset class portfolios, equities, fixed income, alternative investments, and money market instruments. About 79% of BlackRock’s revenue is obtained from investment advisory, administration fees, and securities lending, with the remainder coming from performance fees, distribution fees, and technology services revenue.

Source: Investor Presentation

Revenue decreased by 15% in the third quarter of 2022 to $4.31 billion, primarily due to the impact of lower markets and dollar appreciation on average AUM and lower performance fees. Operating income fell 21% to $1.53 billion, net income decreased by 16% to $1.41 billion, and adjusted EPS fell 16% to $9.55.

The main competitive advantage for BlackRock is its size, which is powerful when combined with a leading brand in the investment management industry. Many of its products, such as the iShares line of ETFs, are very popular for their low fees.

Click here to download our most recent Sure Analysis report on Blackrock (preview of page 1 of 3 shown below):

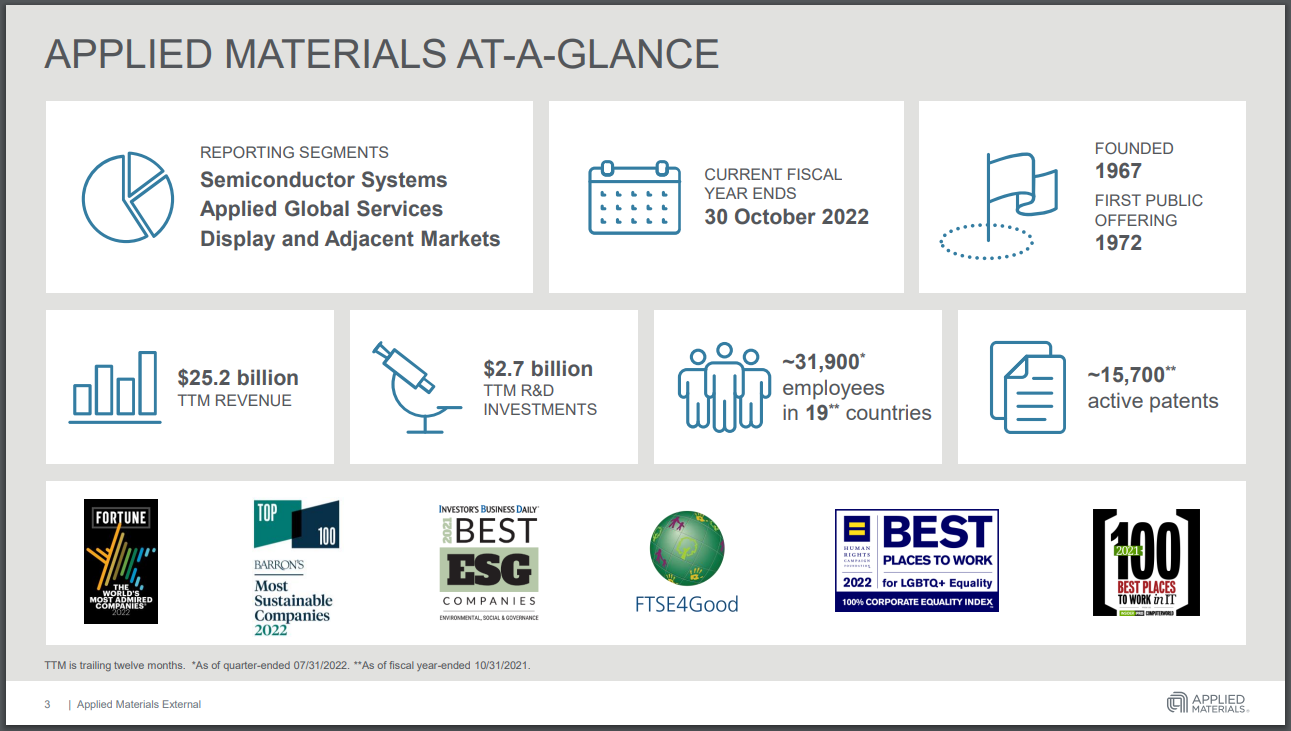

Wide Moat Stock #9: Applied Materials (AMAT)

- Expected annual returns: 9.8%

Applied Materials began in a small office unit in 1967; since then, it has undergone some major, transformative changes. Those changes have afforded it some spectacular growth rates; today, it has a market capitalization of $85 billion and more than $25 billion in annual revenue. Applied Materials has become a major player in the semiconductor market, making up most of its revenue.

Source: Investor Presentation

Applied Materials reported third-quarter earnings on August 18th, 2022, and results beat analysts’ expectations on both the top and bottom lines. Adjusted earnings-per-share equaled $1.94, which was 15 cents ahead of estimates. Revenue grew 5.2% to $6.52 billion and beat expectations by $250 million.

Applied Materials’ long history of solving complex engineering problems and its entrenched customers is a benefit to the company. The company has created high customer switching costs with its excellent products, which we think is a long-term competitive advantage in a very competitive field. It is also seeing high rates of growth in its subscription business, which is well over half of its revenue now.

Click here to download our most recent Sure Analysis report on Applied Materials (preview of page 1 of 3 shown below):

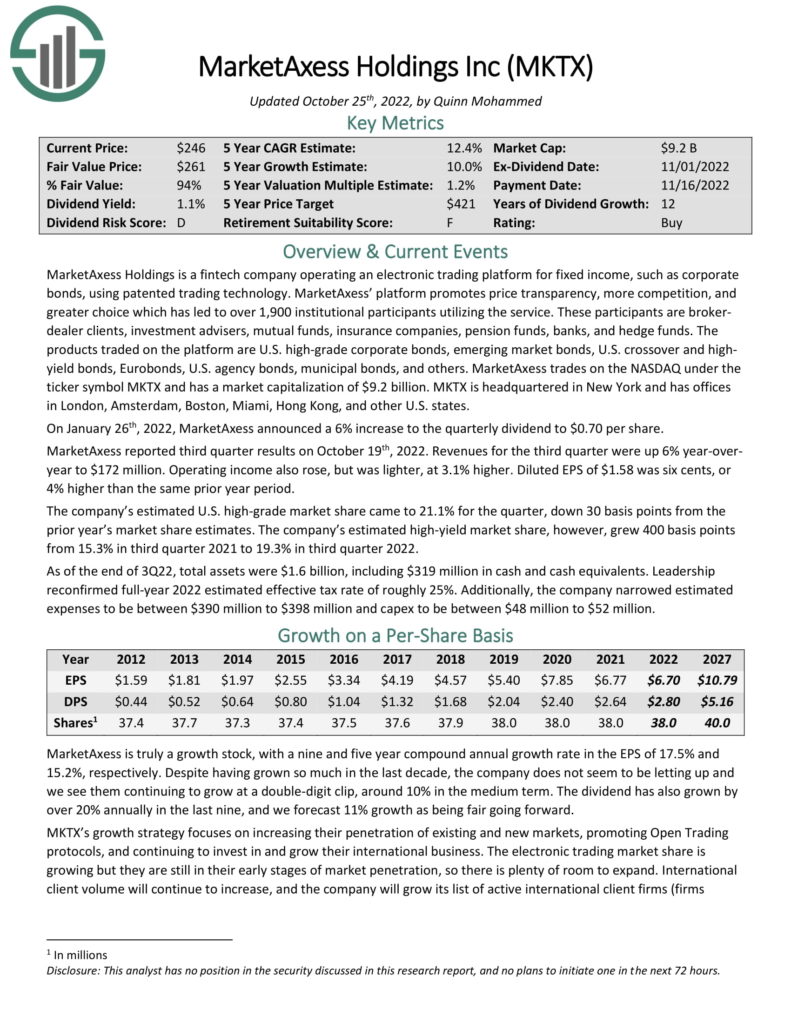

Wide Moat Stock #8: MarketAxess Holdings Inc. (MKTX)

- Expected annual returns: 10.6%

MarketAxess Holdings is a fintech company operating an electronic trading platform for fixed income, such as corporate bonds, using patented trading technology. Over 1,900 institutional participants utilize the company’s service. These participants are broker-dealer clients, investment advisers, mutual funds, insurance companies, pension funds, banks, and hedge funds.

The products traded on the platform are U.S. high-grade corporate bonds, emerging market bonds, U.S. crossover, and high-yield bonds, Eurobonds, U.S. agency bonds, municipal bonds, and others.

MarketAxess reported third-quarter results on October 19th, 2022, and saw revenue increase 6% year-over-year to $172 million. Operating income also rose but was lighter, at 3.1% higher. Diluted EPS of $1.58 was six cents, or 4% higher than the same prior year period.

The company’s estimated U.S. high-grade market share came to 21.1% for the quarter, down 30 basis points from the prior year’s market share estimates. However, the company’s estimated high-yield market share grew 400 basis points from 15.3% in the third quarter of 2021 to 19.3% in the third quarter of 2022.

MKTX’s competitive advantage is its position as the leading electronic trading network for the institutional market in U.S. credit products. It comprises nearly two thousand active institutional investors and dealer firms.

Click here to download our most recent Sure Analysis report on MarketAxess Holdings Inc. (preview of page 1 of 3 shown below):

Wide Moat Stock #7: Microsoft (MSFT)

- Expected annual returns: 10.8%

Microsoft Corporation, founded in 1975, develops, manufactures, and sells software and hardware to businesses and consumers. Its products include operating systems, business software, software development tools, video games and gaming hardware, and cloud services. Microsoft is one of the largest companies in the world, with a market capitalization is $1.7 trillion.

Microsoft has a pending acquisition of Activision Blizzard (ATVI), a video game development and content leader, for $68.7 billion. The deal was announced on January 18th, 2022, and is expected to close in the fiscal year 2023 and is subject to review.

In late October, Microsoft reported financial results for the first quarter of fiscal 2023. The company grew its revenue by 11% year-over-year. Sales of Azure, Microsoft’s high-growth cloud platform, grew 35%. However, adjusted earnings-per-share decreased by -13%, from $2.71 to $2.35, mostly due to a strong dollar, which reduced earnings from international markets, as well as production shutdowns in China and weak trends in the PC market.

Microsoft has a wide moat in the operating system & Office business units and a strong market position in cloud computing. It is unlikely that the company will lose market share with its older, established products, whereas cloud computing is such a high-growth industry that there is enough room for growth for multiple companies. Microsoft has a renowned brand and a global presence, which provides competitive advantages.

Click here to download our most recent Sure Analysis report on Microsoft (preview of page 1 of 3 shown below):

Wide Moat Stock #6: KLA Corp. (KLAC)

- Expected annual returns: 11.4%

KLA Corporation is a supplier to the semiconductor industry. The company supplies process control and yield management systems for semiconductor producers such as TSMC, Samsung, and Micron. KLA was created in 1997 through a merger between KLA Instruments and Tencor Instruments and has grown through a range of acquisitions since then.

KLA Corporation reported first-quarter earnings results on October 26th, and revenues of $2.72 billion was a 31% year-over-year increase. This beat analyst expectations by $120 million. KLA’s solid revenue performance can be explained by the fact that many semiconductor companies have increased their investments into manufacturing capacity thanks to ongoing healthy chip demand.

KLA is a key supplier to the largest semiconductor companies and, therefore, a relevant part of this large industry that is extremely important to our modern way of life. KLA is the market leader in the process control sector. Its scale and size give it advantages over competitors when it comes to receiving big contracts, and through better economies of scale, KLA also has the ability to achieve higher margins than smaller peers.

Click here to download our most recent Sure Analysis report on KLA Corp. (preview of page 1 of 3 shown below):

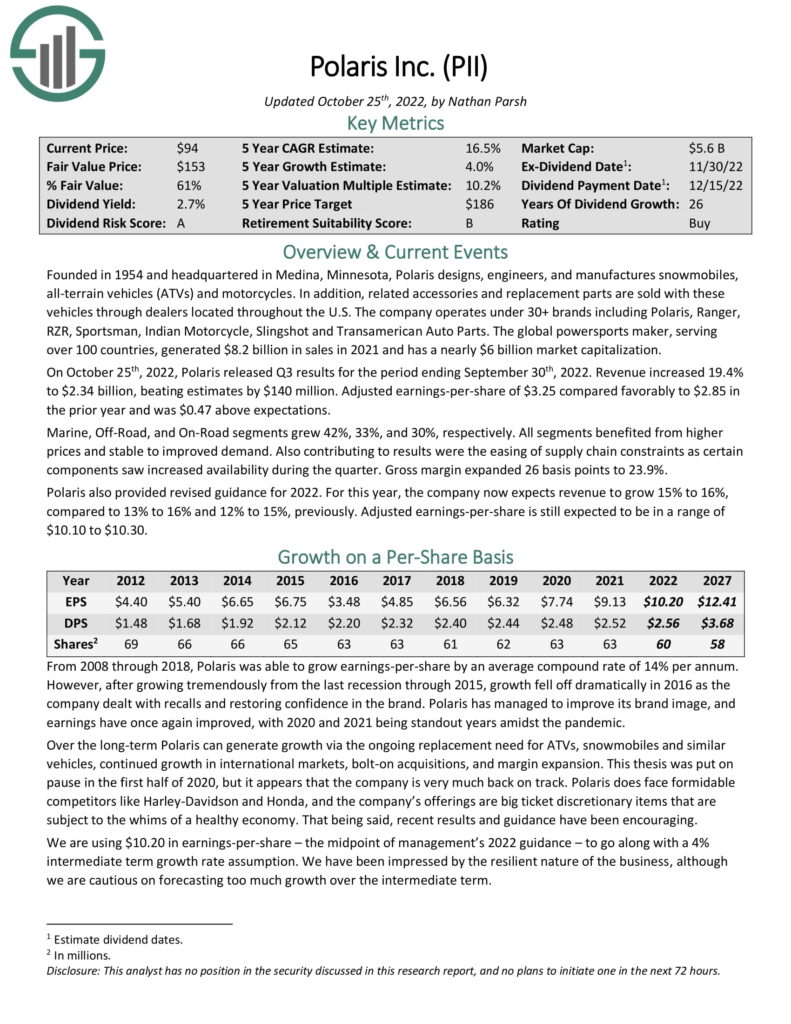

Wide Moat Stock #5: Polaris (PII)

- Expected annual returns: 12.6%

Polaris designs, engineers, and manufactures snowmobiles, all-terrain vehicles (ATVs), and motorcycles. In addition, related accessories and replacement parts are sold with these vehicles through dealers located throughout the U.S.

The company operates under 30+ brands, including Polaris, Ranger, RZR, Sportsman, Indian Motorcycle, Slingshot, and Transamerican Auto Parts.

On October 25th, 2022, Polaris released Q3 results. Revenue increased 19.4% to $2.34 billion, beating estimates by $140 million. Adjusted earnings-per-share of $3.25 compared favorably to $2.85 in the prior year and was $0.47 above expectations.

Polaris enjoys a competitive advantage through its brand names, low-cost production, and long history in its various industries, allowing the company to be the leader in ATVs and number two in snowmobiles and domestic motorcycles.

Click here to download our most recent Sure Analysis report on Polaris (preview of page 1 of 3 shown below):

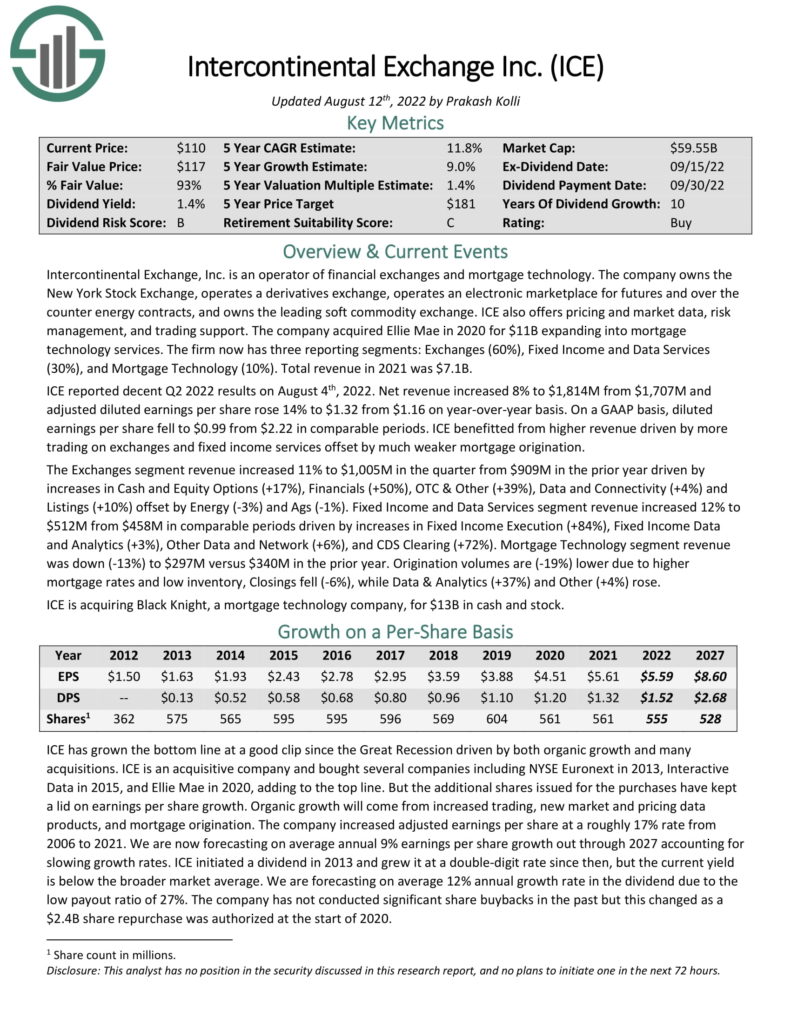

Wide Moat Stock #4: Intercontinental Exchange Inc (ICE)

- Expected annual returns: 12.9%

Intercontinental Exchange, Inc. is an operator of financial exchanges and mortgage technology. The company owns the New York Stock Exchange, a derivatives exchange, an electronic marketplace for futures and over-the-counter energy contracts, and the leading soft commodity exchange.

ICE offers pricing, market data, risk management, and trading support. The company acquired Ellie Mae in 2020 for $11B, expanding into mortgage technology services.

Intercontinental reported second-quarter results on August 4th, and net revenue increased 8% to $1.8 billion from $1.7 billion, and adjusted diluted earnings per share rose by 14% to $1.32 from $1.16 on a year-over-year basis. The company benefitted from higher revenue driven by more trading on exchanges and fixed-income services, offset by much weaker mortgage origination. ICE is also acquiring Black Knight, a mortgage technology company, for $13B in cash and stock. The acquisition is expected to close in the first half of 2023.

ICE’s competitive advantage is its scale in trading, the NYSE brand, proprietary exchange products, data in commodity futures and fixed-income data, and mortgage technology. The company can provide unique datasets from its exchanges that competitors cannot access.

Click here to download our most recent Sure Analysis report on Intercontinental Exchange Inc. (preview of page 1 of 3 shown below):

Wide Moat Stock #3: State Street Corp (STT)

- Expected annual returns: 13.3%

State Street Corporation is a Boston-based financial services company that traces its roots back to 1792. It is one of the largest asset management firms in the world, with $3.3 trillion of assets under management and $36 trillion of assets under custody and administration. The company has increased its dividend for 12 consecutive years.

In September of 2021, State Street announced the acquisition of Brown Brothers Harriman Investor Services for $3.5 billion, which would make State Street the number one asset servicing firm globally. Asset servicing provides back-end operations for many of the world’s most popular funds and ETFs. State Street’s main competitors include BlackRock, Bank of New York Mellon, and Vanguard.

On October 18th, State Street reported results for the third quarter, and fee revenues decreased -8% year-over-year due to headwinds from lower stock market levels and a stronger dollar. On the other hand, net interest income increased by 36% as a result of higher interest rates, and the bank generated high forex trading earnings and kept its total expenses essentially flat. Earnings-per-share fell only -7%, from $1.96 to $1.82.

State Street is a market leader in its asset management and asset servicing industry. It also benefits from its economies of scale, which pose a formidable barrier to new entrants.

Click here to download our most recent Sure Analysis report on State Street Corp. (preview of page 1 of 3 shown below):

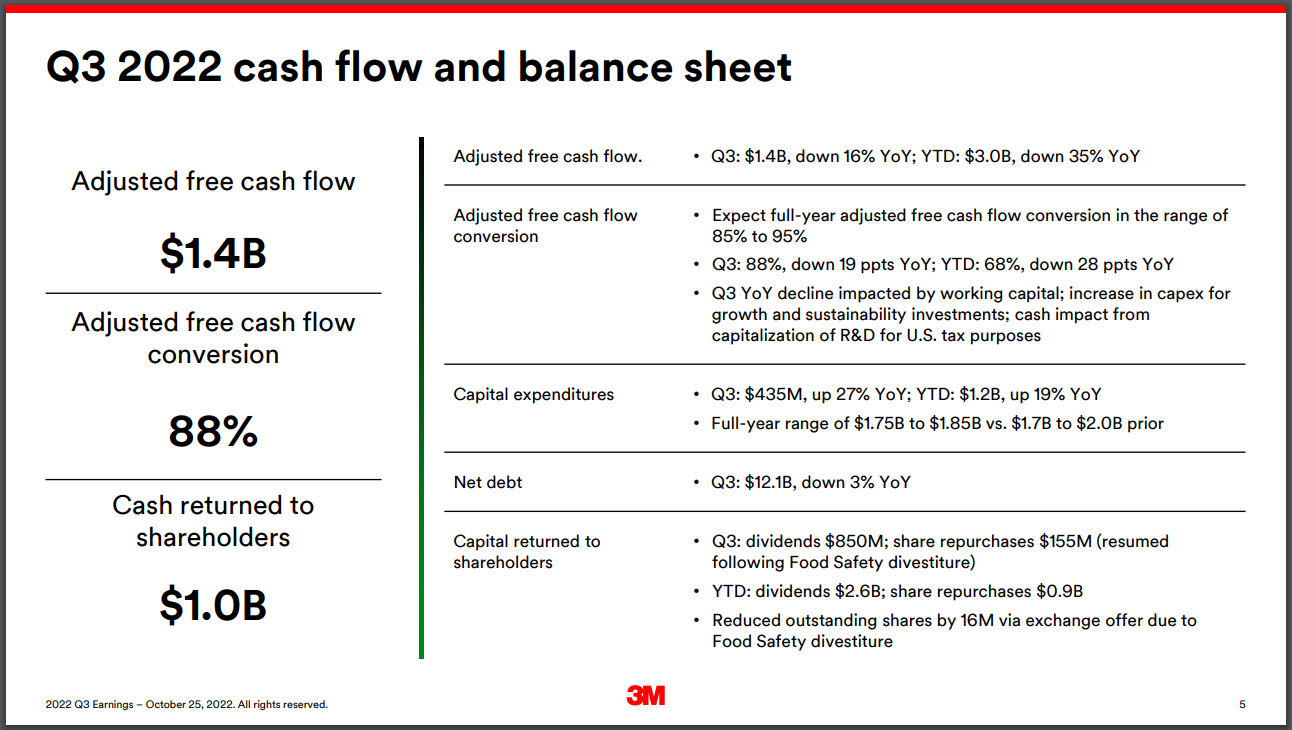

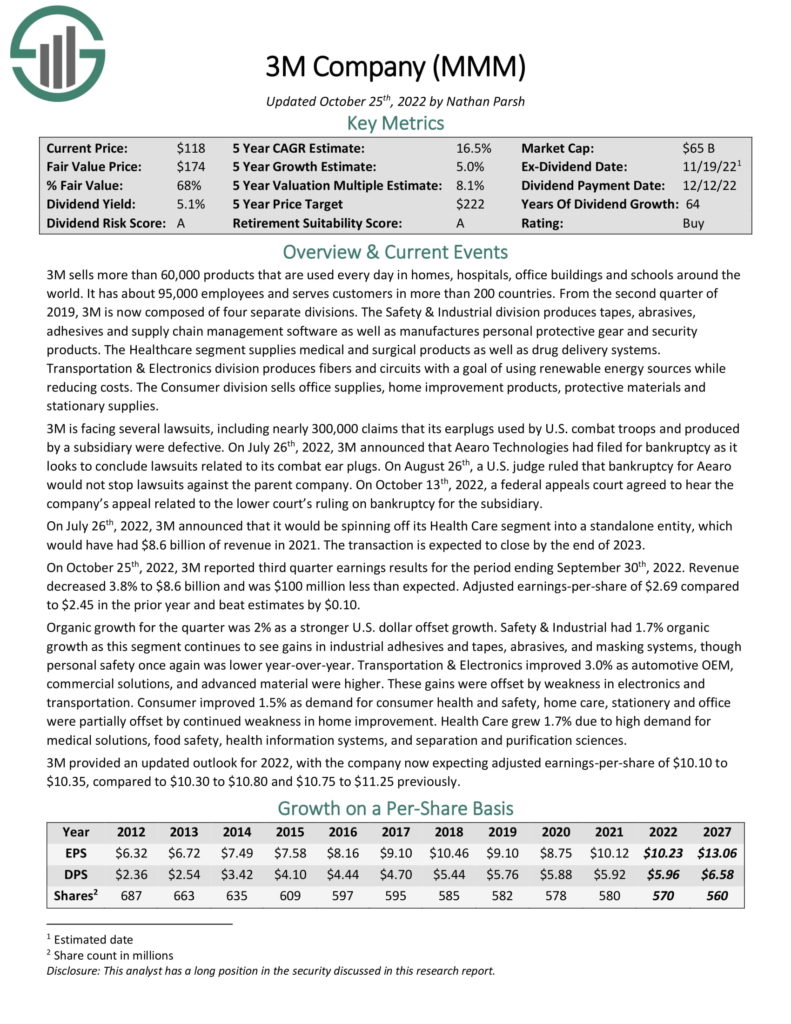

Wide Moat Stock #2: 3M Company (MMM)

- Expected annual returns: 14.1%

3M is an industrial manufacturer that sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries.

On July 26th, 2022, 3M announced that it would be spinning off its Health Care segment into a standalone entity, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

The new 3M will consist of the segments which generated $26.8 billion in sales in 2021, while the healthcare spin-off will retain the product portfolio, which generated $8.6 billion in sales in 2021.

Source: Investor Presentation

On October 25th, 2022, 3M reported third-quarter earnings results. Revenue decreased by 3.8% to $8.6 billion and was $100 million less than analyst expectations. Adjusted earnings-per-share of $2.69 compared to $2.45 in the prior year and beat estimates by $0.10.

3M’s innovation is one of the company’s greatest competitive advantages. The company targets R&D spending equivalent to 6% of sales (or roughly $2 billion annually) in order to create new products to meet consumer demand. This spending has proven to be very beneficial to the company as 30% of sales during the last fiscal year were from products that didn’t exist five years ago. 3M’s commitment to developing innovative products has led to a portfolio of more than 100,000 patents.

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

Wide Moat Stock #1: Comcast Corp. (CMCSA)

- Expected annual returns: 15.5%

Comcast is a media, entertainment, and communications company. Its business units include Cable Communications (High-Speed Internet, Video, Business Services, Voice, Advertising, Wireless), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Entertainment), and Sky, a leading entertainment company in Europe that provides Video, High-speed internet, Voice, and Wireless Phone Services directly to consumers.

Comcast reported third-quarter 2022 results on October 27th, and revenue of $29.85 billion declined 1.5% year-over-year but surpassed estimates by $120 million. Adjusted earnings-per-share of $0.96 beat estimates by $0.06.

Comcast is one of the largest players in the entertainment industry. New market entrants would have to spend many billions of dollars to establish themselves as key cable players or entertainment networks. This solid position has enabled the company to increase its dividend for 14 consecutive years.

Click here to download our most recent Sure Analysis report on Comcast Corp. (preview of page 1 of 3 shown below):

Final Thoughts

Wide moat stocks have great competitive advantages with staying power. These advantages often allow the company to flourish through multiple economic cycles with growing earnings. As a result, these companies frequently sport strong dividend increase records.

More By This Author:

3 Dividend Stocks For Rising Interest Rates

The Dividend Capture Strategy: What Investors Need To Know

10 Undervalued Stocks Poised For Rotation

Disclosure: