10 Undervalued Stocks Poised For Rotation

Stock markets, and indeed any financial markets, go through periods of rotation. This is where money flows from one sector or asset class to another, as institutions believe one area will start to outperform another. We see this when recessions strike, for instance, when money flows to consumer staples stocks and away from technology.

There are many examples like this, and one way that we can take advantage of these cycles as investors is to buy names that are out of favor. That means their valuations will be lower than fair value; over time, that undervaluation can turn into outsized returns for investors.

There are many blue chip stocks trading for reasonable valuations.

We value stocks by examining their historical valuations over a period of years and determining if the factors that drove that historical valuation have changed. For instance, if a stock was valued quite highly due to exemplary growth, but that growth profile has deteriorated, we would likely assign a lower fair value than historical. The opposite is true, of course, but the point is that history is our guide.

In addition, we tend to err on the side of caution when it comes to assigning fair value, meaning that when we see a stock that is undervalued according to our model, it tends to be quite undervalued. This increases the odds of success and decreases the chances of being wrong. Buying overvalued stocks, by contrast, means the odds of a draw-down are much higher, reducing potential total returns.

With this in mind, we’ll take a look at 10 stocks below that screen well for these criteria. Their names, we think, are out of favor today and, therefore, undervalued and offer great total return potential to buyers.

Qualcomm, Inc. (QCOM)

Our first stock is Qualcomm, a technology company that designs and manufactures technology solutions, primarily for the mobile phone industry. Qualcomm has interests in 5G wireless service, artificial intelligence, automotive chip and software production, and a variety of related intellectual properties.

The company was founded in 1985, generates about $40 billion in annual revenue, and trades today with a market cap of $123 billion.

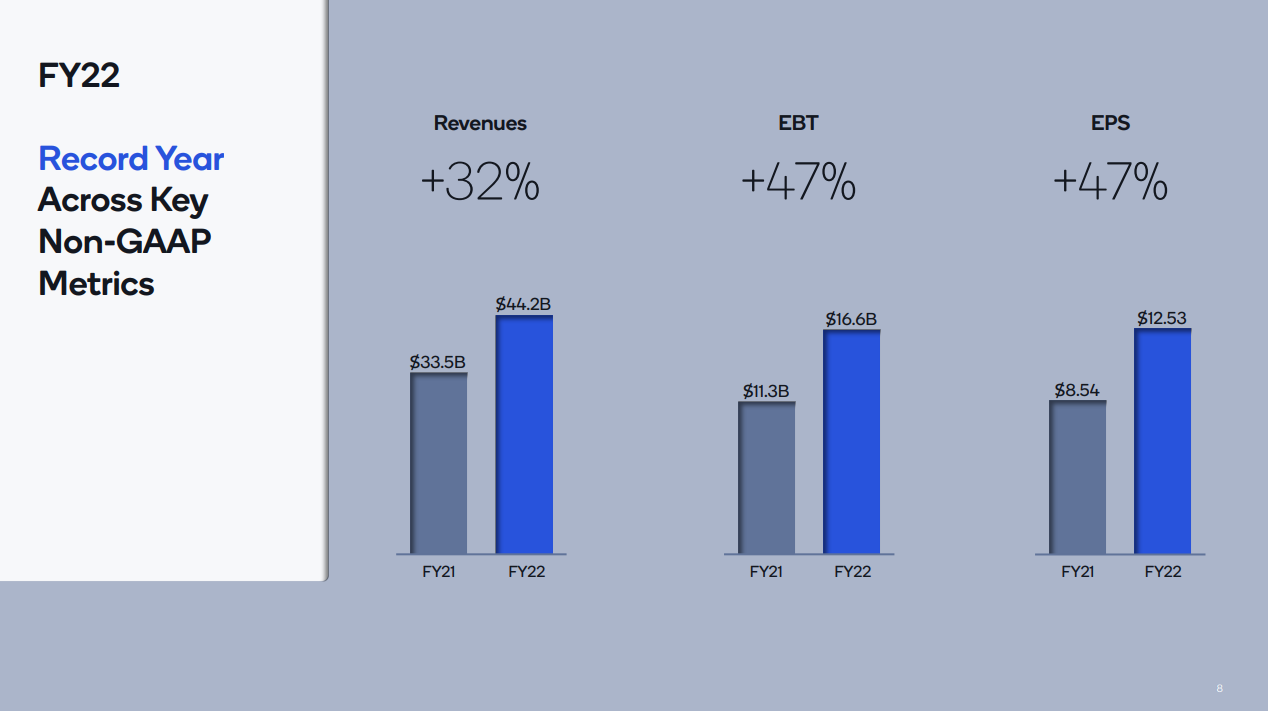

Source: Investor presentation

The company just finished up its fiscal 2022, and as we can see above, growth was outstanding. We think this is indicative of Qualcomm’s valuation being far too low today.

We see Qualcomm trading at just 56% of fair value today, given it is valued at just about 9 times earnings for this year. Semiconductor stocks, and technology stocks in general, have been out of favor for all of 2022, and Qualcomm’s valuation has declined enormously.

The good news is that it could drive a 12%+ tailwind to total annual returns from the valuation, as we see the case for reflation as quite strong.

The stock also yields 2.7% and has raised its payout for an impressive 20 consecutive years. Finally, we see 7% annual earnings-per-share growth as Qualcomm’s industry-leading position remains intact. All told, we expect Qualcomm’s very low valuation to help power total annual returns of nearly 22% going forward.

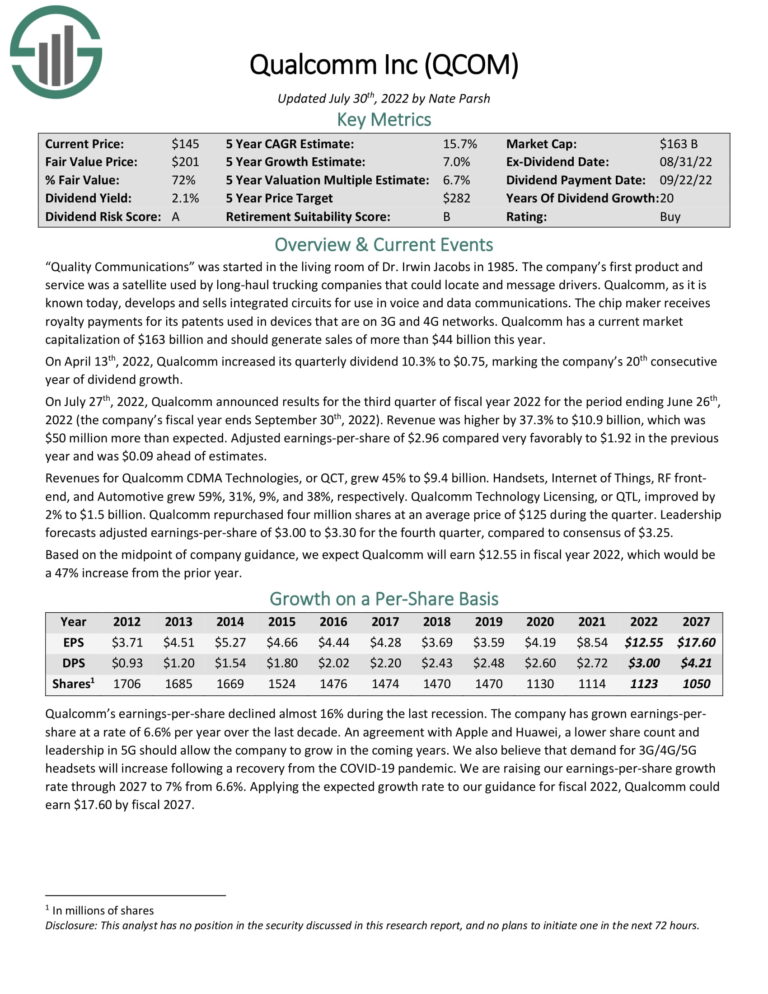

Click here to download our most recent Sure Analysis report on Qualcomm (preview of page 1 of 3 shown below):

Sonoco Products Co. (SON)

Our next stock is Sonoco, a maker of consumer packaging products globally. The company makes a wide array of paper, textile, food, chemical, cable, and packaging products.

Sonoco was founded in 1899, produces about $7.3 billion in annual revenue, and trades with a market cap of $5.7 billion.

Sonoco trades for 9 times earnings, which we assess at just 56% of fair value. Like Qualcomm, we see this as driving the potential for 12%+ annual returns to shareholders as the valuation reflates over time.

The stock also sports a dividend that is double that of the S&P 500 at 3.4%. Not only that, but Sonoco has a 40-year streak of dividend increases, putting it in a rare company on that measure as well.

We see growth at 5% annually, so we believe the stock can produce ~20% total returns in the years to come from its attractive blend of valuation, yield, and growth.

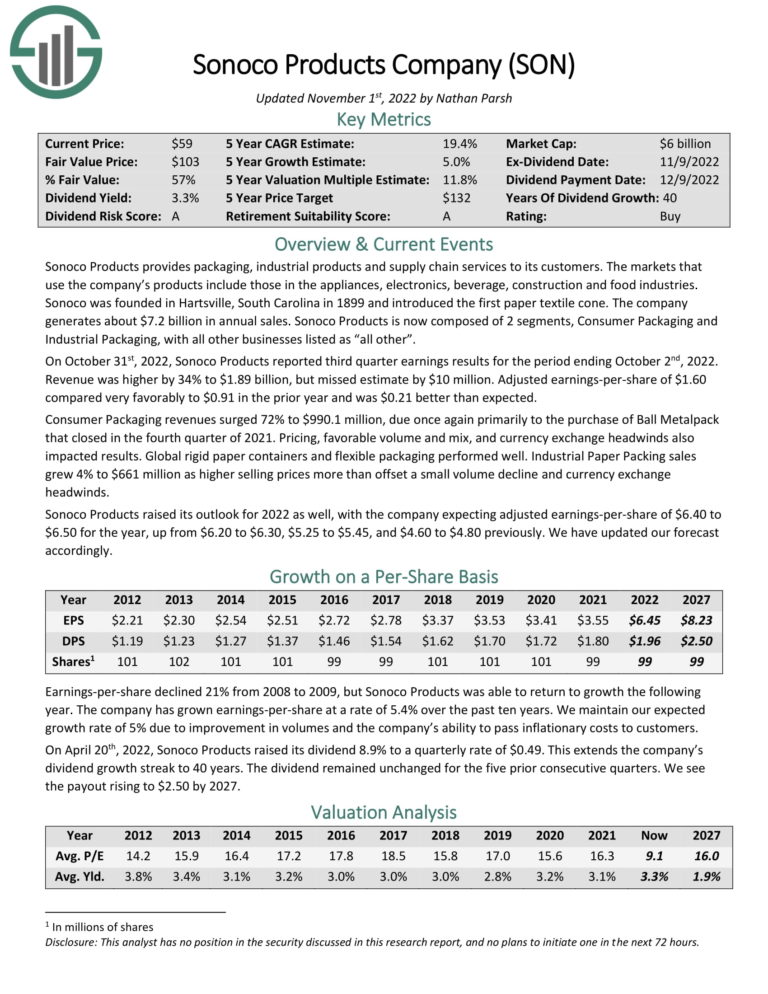

Click here to download our most recent Sure Analysis report on Sonoco Products Co. (preview of page 1 of 3 shown below):

Williams-Sonoma, Inc. (WSM)

Our next stock is Williams-Sonoma, the upscale home goods retailer that owns brands such as Williams-Sonoma, Pottery Barn, West Elm, Mark and Graham, and more. It operates more than 500 stores, was founded in 1956, and generates about $8.8 billion in annual revenue. The stock has had a rough 2022 and has a current market cap of $8.2 billion.

The stock trades at just over 8 times earnings, which we believe is about 40% undervalued. That could drive a tailwind of ~11% to total returns in the years to come.

The yield is also up to 2.6%, which is well ahead of the stock’s historical yields, owing to the low valuation. The company has a 16-year streak of annual dividend increases, which is quite good for a cyclical retailer.

We see 4% growth ahead for Williams-Sonoma, so when we add this to the valuation tailwind and yield, we believe shareholders can see 17% total annual returns in the years to come.

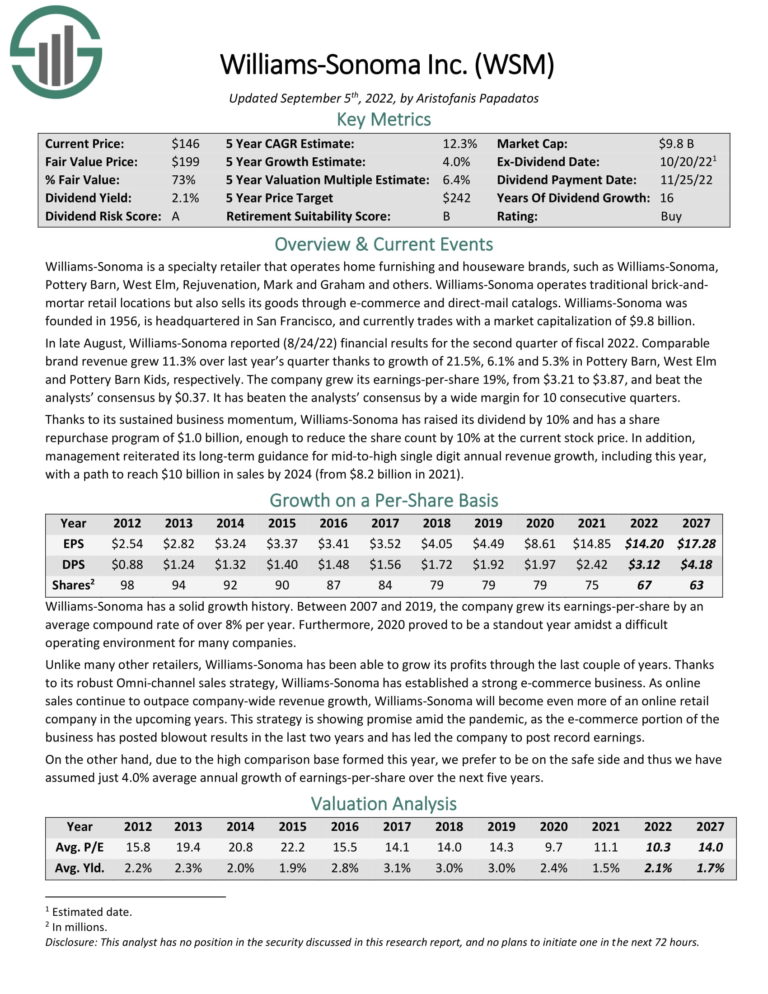

Click here to download our most recent Sure Analysis report on Williams-Sonoma, Inc. (preview of page 1 of 3 shown below):

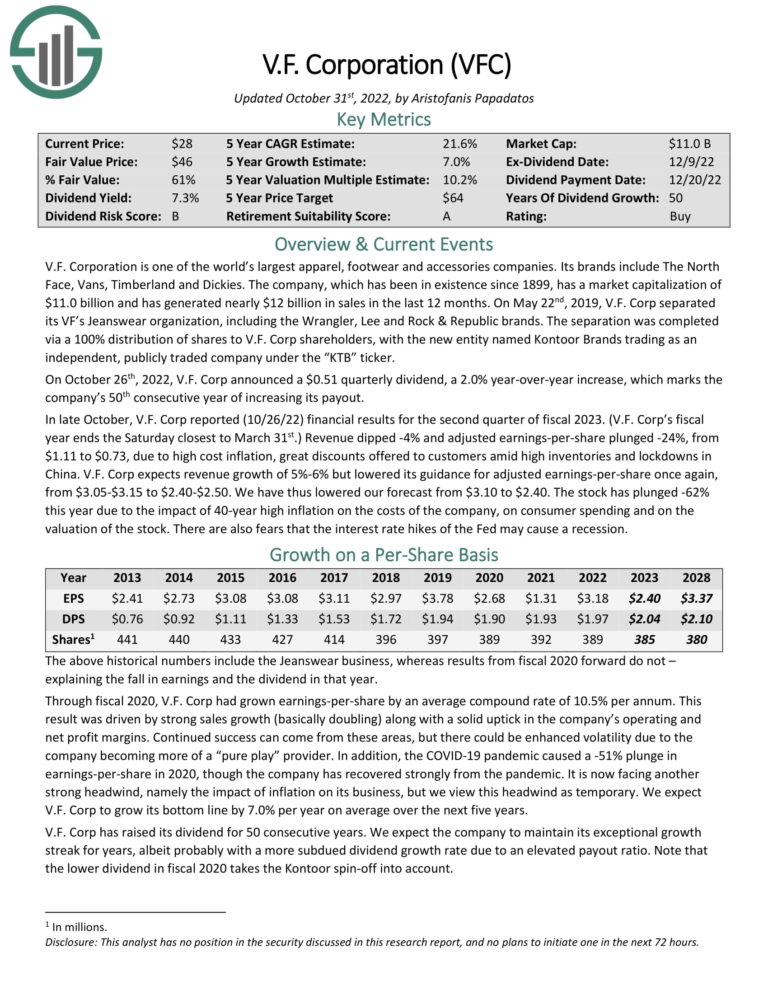

V.F. Corp. (VFC)

Next up is V.F. Corporation, a global designer, manufacturer, and distributor of various apparel, footwear, and accessory brands for men, women, and children. The company owns lucrative brands such as Vans, Supreme, Timberland, and the North Face, among others.

V.F. was founded in 1899, generates $11.7 billion in annual sales, and trades with a market cap of $11 billion.

Shares trade for about 12 times earnings, which we believe is nearly 40% undervalued. That has the potential to drive a tailwind of 10% in the years ahead.

V.F. is not only undervalued but is an outstanding dividend stock. The company is a Dividend King, meaning it has raised its payout for 50 consecutive years. It also yields a staggering 7.1% today. When combined with 7% expected growth, we think V.F. buyers today have the potential to earn 21%+ total annual returns in the years to come.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

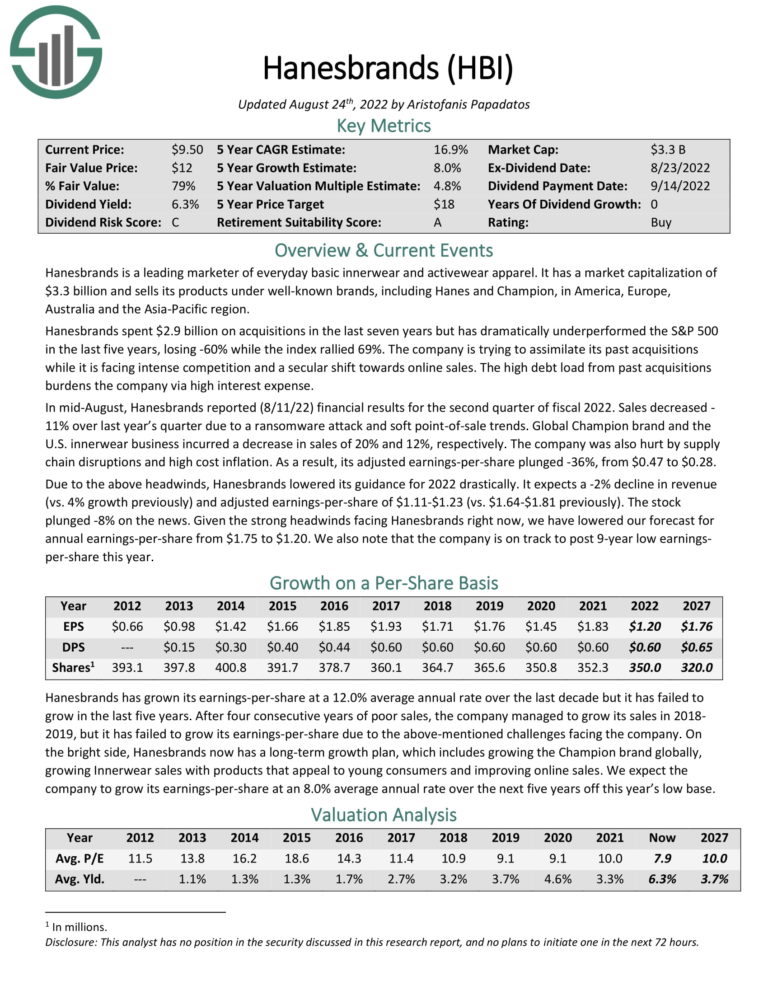

Hanesbrands Inc (HBI)

Hanesbrands is our next stock, another consumer goods company that designs, manufactures, and distributes a range of low-cost apparel for men, women, and children. Hanesbrands sells essentials that are accessible for every budget, so it thrives on high volumes.

Hanesbrands was founded in 1901, generates about $6.4 billion in annual revenue, and trades with a market cap of $2.5 billion.

Shares trade for less than six times this year’s earnings estimate, meaning we think it is at least 40% undervalued today. That offers the potential for a tailwind of more than 11% annually in the years to come.

Hanesbrands doesn’t have a dividend increase streak, but it does have a huge current yield of 8.5%. That puts the stock in an extremely rare company on a pure income basis.

We see 8% growth annually from a low base of earnings for this year, so in total, we think buyers of the stock today could enjoy total returns of 24% annually in the next five years.

Click here to download our most recent Sure Analysis report on Hanesbrands Inc. (preview of page 1 of 3 shown below):

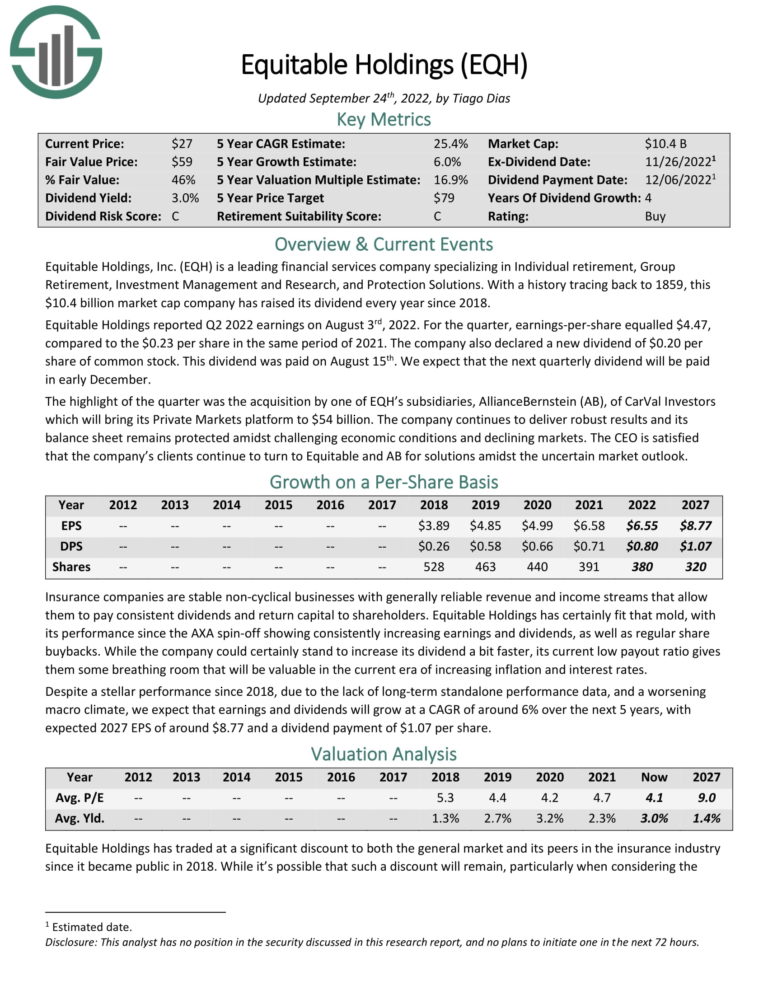

Equitable Holdings Inc (EQH)

Our next stock is Equitable Holdings, a global financial services company. The company offers retirement products and investment and insurance services, primarily. Equitable was founded in 1859, generates nearly $14 billion in annual revenue, and trades with a market cap of $11.3 billion.

Equitable trades for an almost unbelievable 4.6 times this year’s earnings, which is half of our projected fair value multiple. That implies 14%+ annually from the valuation reflating just to get back to historical levels.

The company’s dividend growth streak is just 4 years, but it has a respectable 2.7% current yield. In addition, the stock has only traded on its own since 2018, so it has effectively raised its dividend every year as a publicly-traded company.

We think the company can deliver 6% annual growth, so combining all of these factors means we forecast total annual returns of nearly 23% in the years to come.

Click here to download our most recent Sure Analysis report on Equitable Holdings Inc. (preview of page 1 of 3 shown below):

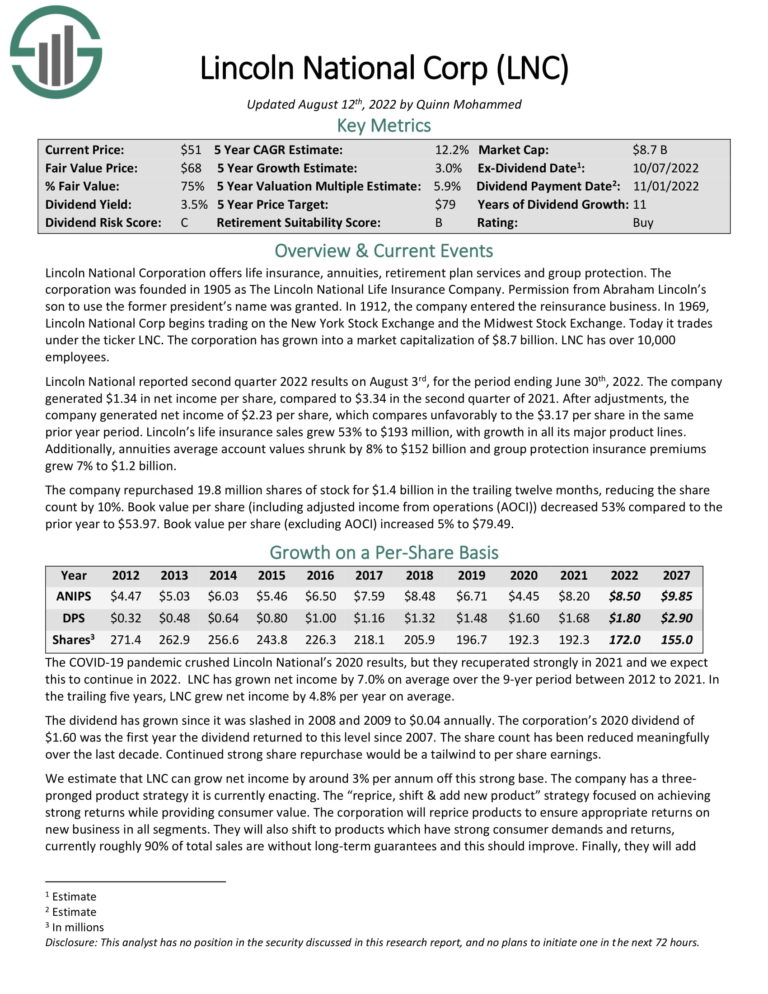

Lincoln National Corp. (LNC)

Our next stock is Lincoln National, an insurance and retirement products business in the US. The company offers a wide variety of standard retirement and insurance lines to consumers, institutions, governments, and the like.

Lincoln was founded in 1905, produces $18.5 billion in yearly revenue, and trades with a market cap of $5.6 billion.

Lincoln has one of the lowest valuations in our entire coverage universe of more than 800 stocks at 4.1 times this year’s earnings. That means the stock is undervalued by half against our fairly conservative estimate of fair value. That could result in a tailwind of 14.5% should the valuation move towards fair value over time.

That has also driven the yield up to 5.2% today, which is more than triple that of the S&P 500. We see a growth of 3% moving forward.

Combining these factors gives us estimates of more than 21% of total annual returns in the years to come, primarily from the valuation.

Click here to download our most recent Sure Analysis report on Lincoln National Corp. (preview of page 1 of 3 shown below):

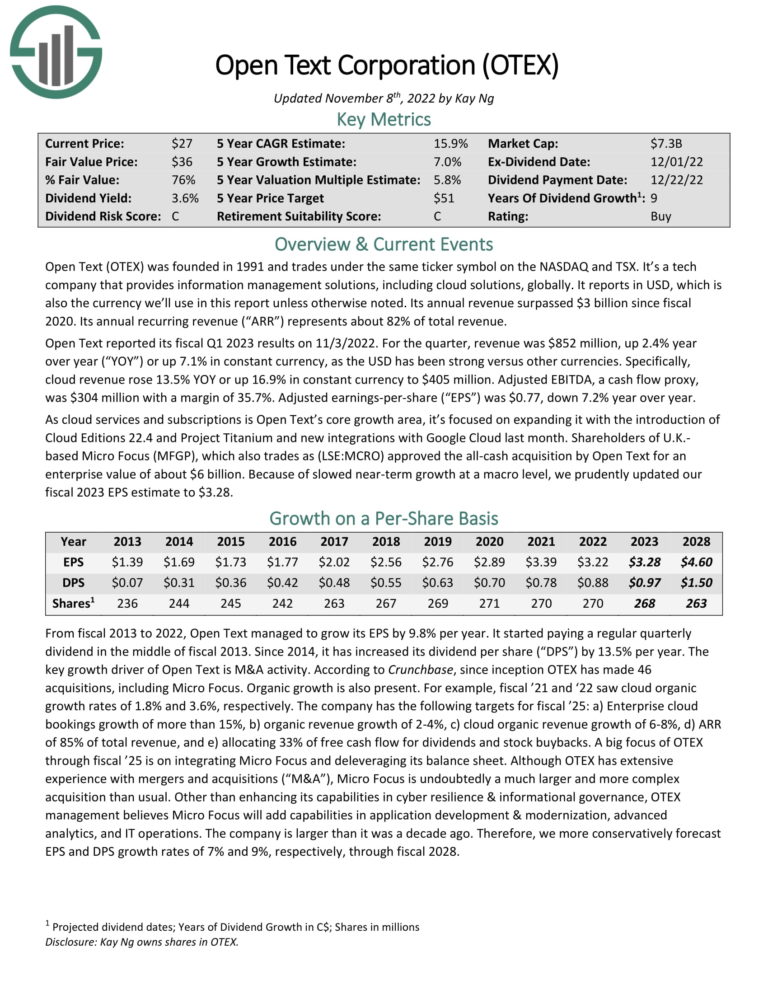

Open Text Corp (OTEX)

Next up is Open Text, a technology company that designs, develops, and markets information management software and solutions. The company has a variety of API, analytics, and cyber products, among others.

Open Text was founded in 1991, produces about $3.6 billion in annual revenue, and trades with a market cap of $7.3 billion.

The stock is trading for just over 8 times earnings today, which is a discount of more than 40% to fair value. That could drive a tailwind of 11% annually in the years to come, should the stock reflate to its fair value.

Open Text is also unique in the technology space in that it sports a 3.6% dividend yield. That’s well ahead of double the S&P 500’s average yield, and it has nine consecutive years of dividend increases.

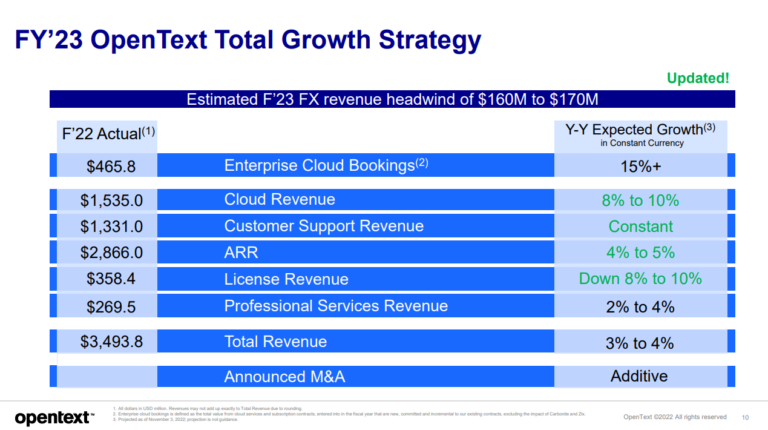

Source: Investor presentation

We expect 8% annual earnings-per-share growth over the medium term, which would be somewhat conservative compared to this guide for the company’s 2023 growth. Still, 8% would add nicely to total returns in the coming five years.

Altogether, we see 22%+ total annual returns for Open Text, derived from 8% earnings growth, the 3.6% yield, and a double-digit tailwind from the low valuation.

Click here to download our most recent Sure Analysis report on Open Text Corp. (preview of page 1 of 3 shown below):

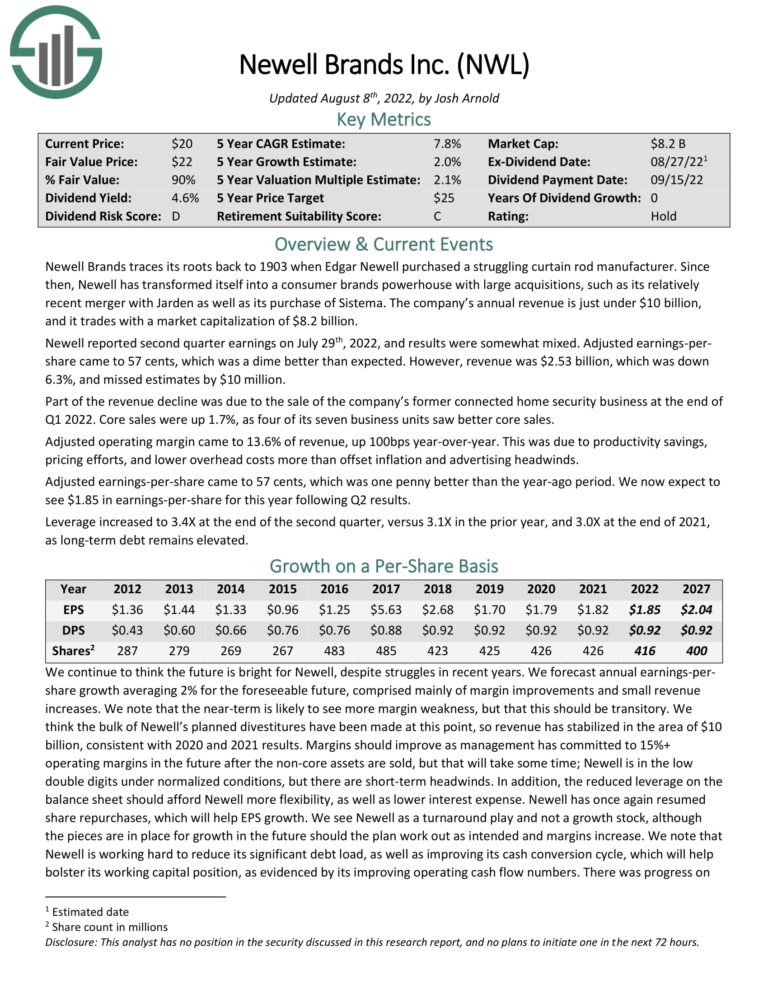

Newell Brands Inc (NWL)

Next to last is Newell Brands, a consumer goods company that designs, manufactures, and distributes a huge variety of kitchen, home goods, cleaning products, organization systems, and more. It owns brands such as Rubbermaid, Mr. Coffee, Calphalon, Yankee Candle, and other well-known brands.

The company was founded in 1903, produces $9.4 billion in annual revenue, and has a current market cap of $5.4 billion.

Newell trades for 7 times this year’s earnings, a 40%+ discount to where we assess fair value. That means the potential for a tailwind of 11%+ from a reflation of the valuation in the years to come.

In addition, Newell has a tremendous yield that is better than 7%, putting it in a very rare company on a pure income basis, even against REITs and other traditional sources of income.

Source: Investor presentation

We see growth potential as modest at just 2% annually, and we can see why above with Q3 and year-to-date results. The company is struggling to grow sales but has been at work on margin improvement efforts for several quarters while repurchasing stock. We think the combination of these will drive low levels of growth going forward.

Even so, total annual returns could reach nearly 18% in the years to come when considering the 11% valuation tailwind and 7% yield.

Click here to download our most recent Sure Analysis report on Newell Brands Inc. (preview of page 1 of 3 shown below):

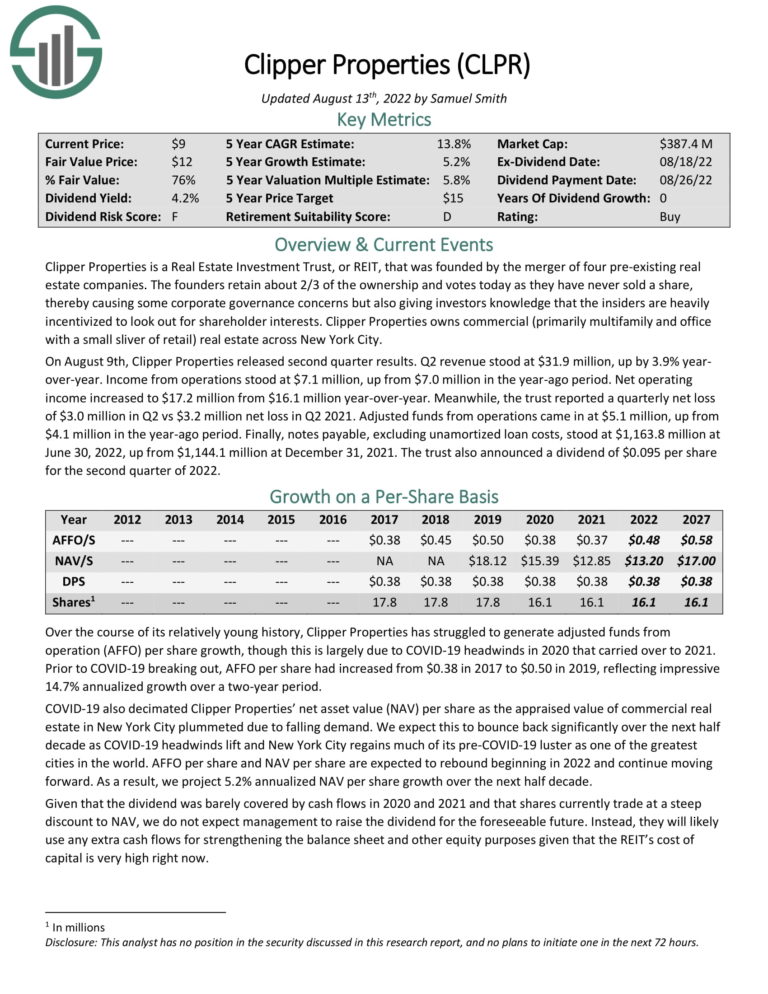

Clipper Realty Inc (CLPR)

Our final stock is Clipper Realty, a self-administered real estate investment trust, or REIT, that operates in New York City. Where most REITs attempt diversification, Clipper’s strategy is anti-diversification, focusing on one single market.

The REIT was founded in 2015, produces about $130 million in annual revenue, and trades with a market cap of $288 million.

Clipper trades for 13.5 times FFO, which is an earnings equivalent for the REIT sector. That also means it is about 45% undervalued, in our view, with the potential for a 13% tailwind to total returns as a result.

The yield is quite good at 5.9%, although some stocks in this list have stronger yields. Clipper lacks a dividend growth streak at present as well.

We see just over 5% annual growth in the years ahead, and when combined with the huge tailwind from the valuation and strong 5.9% yield, we see ~22% total annual returns for Clipper over the medium term.

Click here to download our most recent Sure Analysis report on Clipper Realty Inc. (preview of page 1 of 3 shown below):

Final Thoughts

While buying stocks that are out of favor can be tough emotionally, that is often the best way to yield strong returns over the long term. When stocks are out of favor, particularly strong dividend stocks like the 10 above, they offer better capital return potential and stronger dividend yields.

More By This Author:

3 Sin Stocks For High Returns

10 Spin-Off Stocks That Pay Dividends

Dividend Kings in Focus: V. F. Corporation

Disclosure: