10 Rock Solid Dividend Stocks For Decades Of Rising Income

Image Source: Pixabay

This article will list the 10 Dividend Kings with the highest 5-year dividend growth rate, from lowest to highest.

With their outsized dividend growth potential, these 10 Dividend Kings are rock solid dividend stocks to buy and hold for the long run.

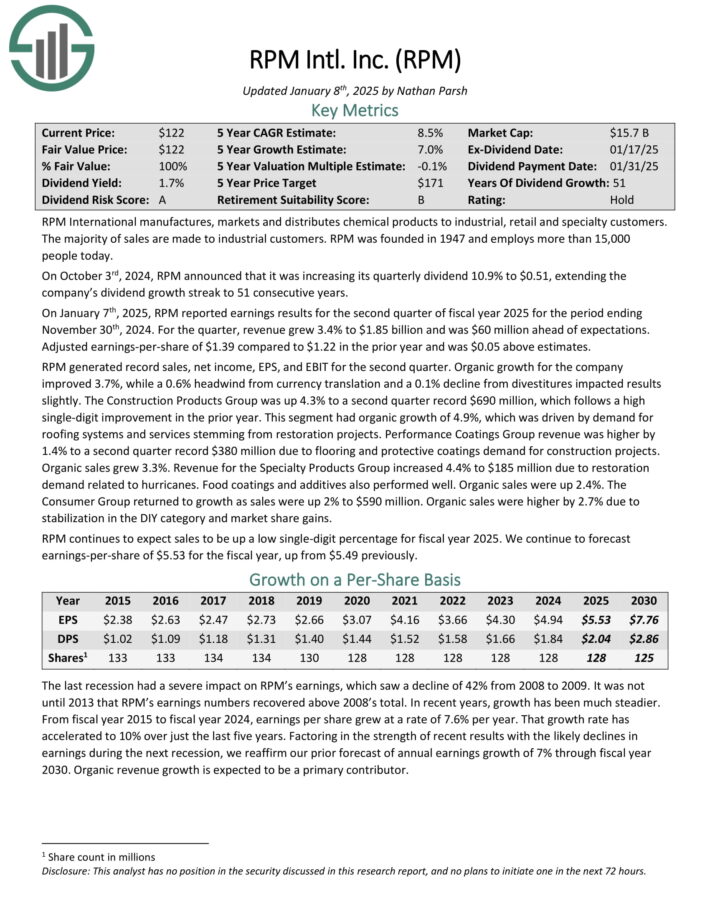

Rock Solid Dividend Stock: RPM International (RPM)

- 5-year dividend growth: 7.0%

RPM International manufactures, markets and distributes chemical products to industrial, retail and specialty customers. The majority of sales are made to industrial customers.

On October 3rd, 2024, RPM announced that it was increasing its quarterly dividend 10.9% to $0.51, extending the company’s dividend growth streak to 51 consecutive years.

On January 7th, 2025, RPM reported earnings results for the second quarter of fiscal year 2025. For the quarter, revenue grew 3.4% to $1.85 billion and was $60 million ahead of expectations. Adjusted earnings-per-share of $1.39 compared to $1.22 in the prior year and was $0.05 above estimates.

RPM generated record sales, net income, EPS, and EBIT for the second quarter. Organic growth for the company improved 3.7%, while a 0.6% headwind from currency translation and a 0.1% decline from divestitures impacted results slightly.

The Construction Products Group was up 4.3% to a second quarter record $690 million, which follows a high single-digit improvement in the prior year. This segment had organic growth of 4.9%, which was driven by demand for roofing systems and services stemming from restoration projects.

Performance Coatings Group revenue was higher by 1.4% to a second quarter record $380 million due to flooring and protective coatings demand for construction projects. Organic sales grew 3.3%.

Click here to download our most recent Sure Analysis report on RPM (preview of page 1 of 3 shown below):

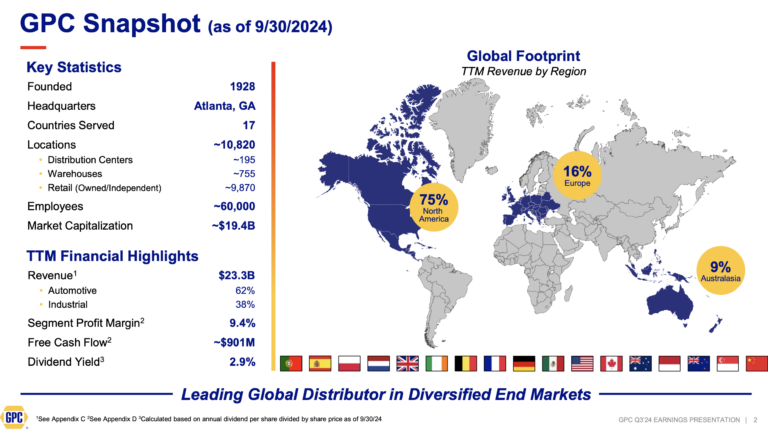

Rock Solid Dividend Stock: Genuine Parts Company (GPC)

- 5-year dividend growth: 7.0%

Genuine Parts has the world’s largest global auto parts network, with more than 10,800 locations worldwide. As a major distributor of automotive and industrial parts, Genuine Parts generates annual revenue of nearly $23 billion.

Source: Investor Presentation

It operates two segments, which are automotive (includes the NAPA brand) and the industrial parts group which sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers.

Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care.

The company reported its third-quarter 2024 results, with sales reaching $6.0 billion, a 2.5% increase from the previous year.

Net income fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) also decreased to $1.88 compared to $2.49 last year.

Click here to download our most recent Sure Analysis report on GPC (preview of page 1 of 3 shown below):

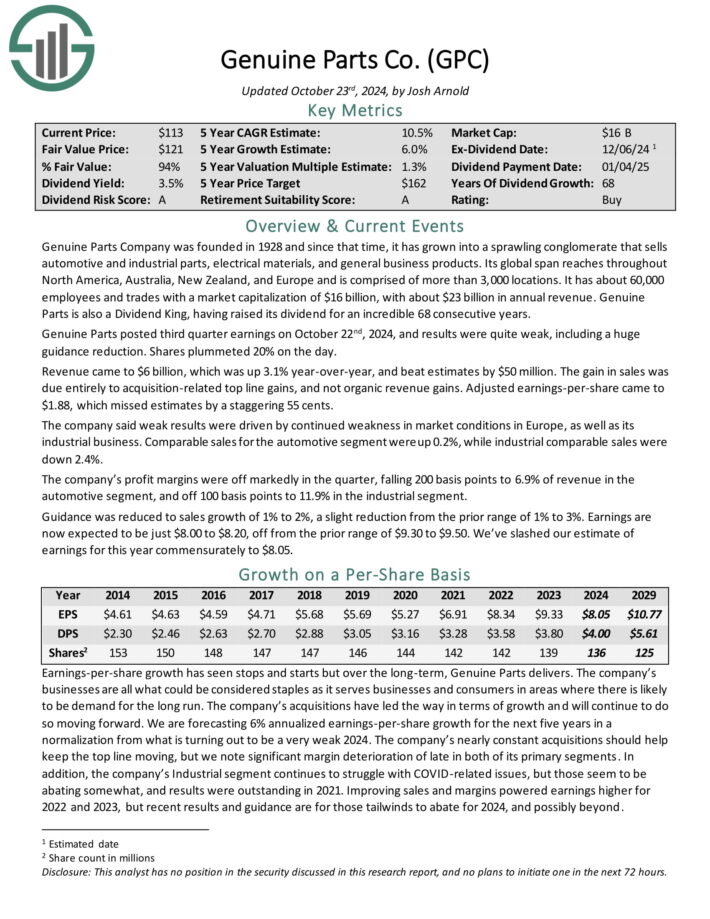

Rock Solid Dividend Stock: Illinois Tool Works (ITW)

- 5-year dividend growth: 7.0%

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

Last year the company generated $16.1 billion in revenue.

On October 30th, 2024, Illinois Tool Works reported third quarter 2024 results for the period ending September 30th, 2024. For the quarter, revenue came in at $4.0 billion, shrinking 1.6% year-over-year.

Sales declined 3.3% in the Automotive OEM segment, the largest out of the company’s seven segments.

The Specialty Products segment grew revenues by 5.7%. Meanwhile, Food Equipment, Test & Measurement and Electronics, Welding, Polymers & Fluids and Construction Products saw revenue decline -0.2%, -0.2%, -1.3%, -1.9%, and -8.1%, respectively.

Net income equaled $1,160 million or $3.91 per share compared to $772 million or $2.55 per share in Q3 2023. In the third quarter, ITW repurchased $375 million of its shares.

It also raised its dividend by 7% to $6.00 annually, marking its 61st consecutive annual dividend increase.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

Rock Solid Dividend Stock: Stepan Co. (SCL)

- 5-year dividend growth: 8.0%

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to just a handful of industries.

Source: Investor presentation

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted third quarter earnings on October 30th, 2024, and results were mixed. Adjusted earnings-per-share came in well ahead of expectations at $1.03, which was 38 cents better than expected.

Revenue fell almost 3% year-over-year to $547 million, and missed estimates by over $30 million.

Global sales volume fell 1% year-over-year, as double-digit growth in several of the company’s Surfactant end markets were fully offset by demand weakness in Polymers.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

Rock Solid Dividend Stock: W.W. Grainger (GWW)

- 5-year dividend growth: 8.0%

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies.

Grainger has more than 4.5 million active customers, with more than 30 million products offered globally.

Source: Investor Presentation

On October 31st, 2024, W.W. Grainger reported its Q3 results for the period ending September 30th, 2024. Sales were $4.39 billion, up 4.3% on a reported basis and up 4.0% on a daily, constant currency basis (adjusted) compared to last year.

Results were driven by solid performance across the board. The High-Touch Solutions segment achieved sales growth of 3.3% due to solid volume growth in all geographies. In the Endless Assortment segment, sales were up 8.1%.

Revenue growth for the segment was driven by core B2B customers at Zoro and strong performance across MonotaRO, most notably with Enterprise customers.

Net income equaled $486 million, up just 2.8% compared to Q3-2022. Earnings-per-share came in at $9.87, 4.7% higher year-over-year.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

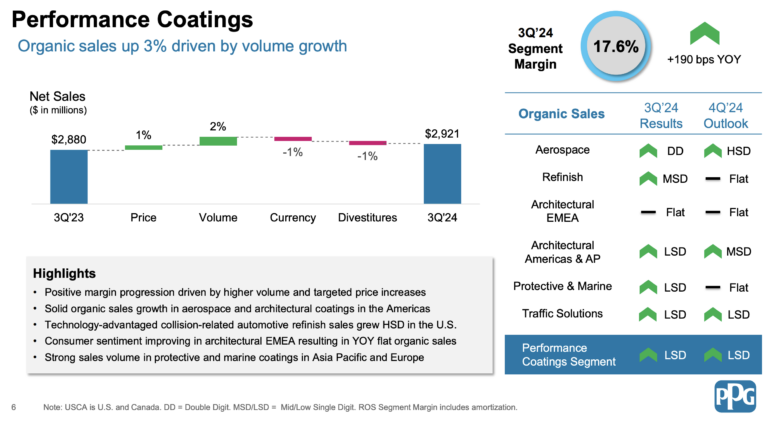

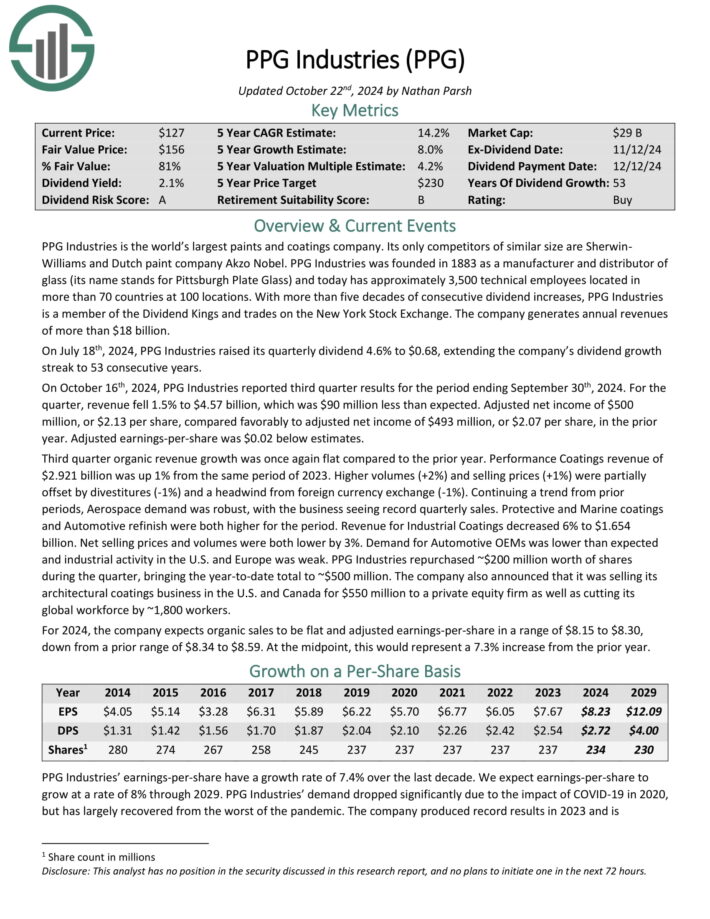

Rock Solid Dividend Stock: PPG Industries (PPG)

- 5-year dividend growth: 8.0%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023.

Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

Rock Solid Dividend Stock: Lowe’s Companies (LOW)

- 5-year dividend growth: 9.0%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). It operates or services more than 1,700 home improvement and hardware stores in the U.S.

Lowe’s reported third quarter 2024 results on November 19th, 2024. Total sales came in at $20.2 billion compared to $20.5 billion in the same quarter a year ago.

Comparable sales decreased by 1.1%, while net earnings-per-share of $2.99 compared to $3.06 in third quarter 2023.

Adjusted EPS was even lower at $2.89. The company continues to be negatively impacted from a reduction in DIY discretionary spending.

The company repurchased 2.9 million shares in the quarter for $758 million. Additionally, it paid out $654 million in dividends.

The company narrowed its fiscal 2024 outlook and now expects to earn adjusted diluted EPS of $11.80 to $11.90 (from $11.70 to $11.90 previously) on total sales of $83.0 to $83.5 billion.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

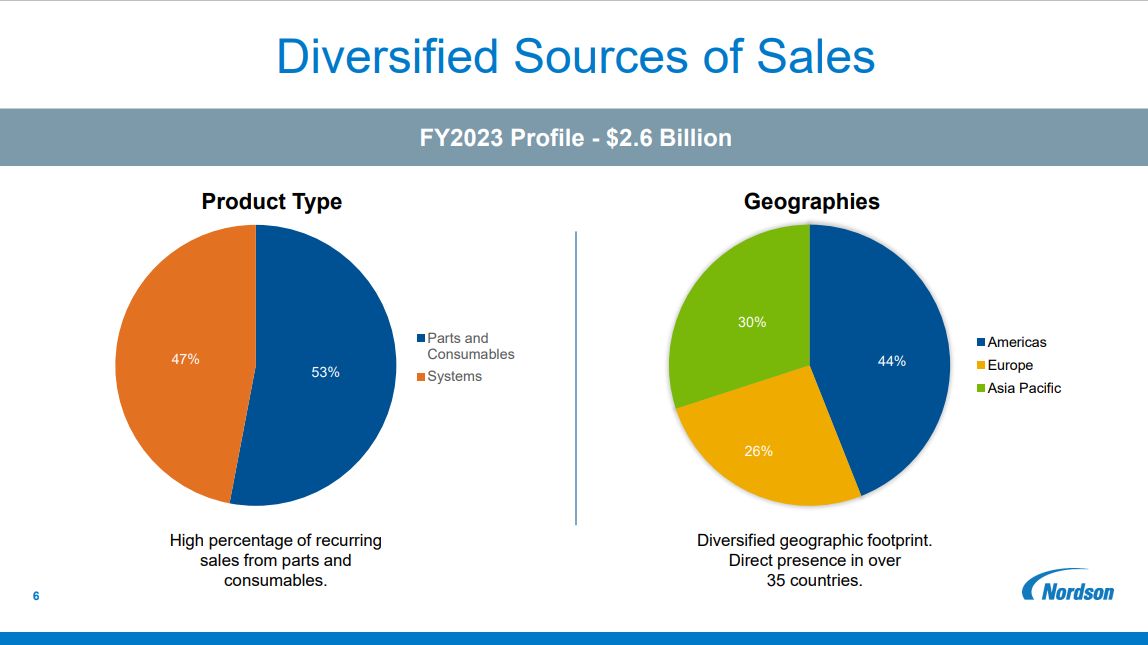

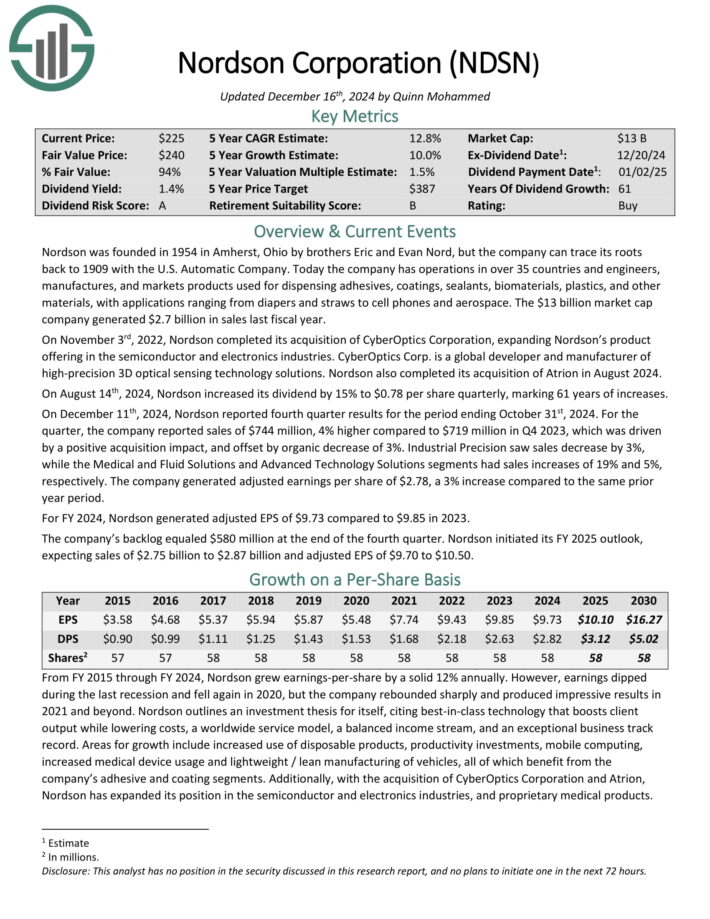

Rock Solid Dividend Stock: Nordson Corporation (NDSN)

- 5-year dividend growth: 10.0%

Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.

Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials.

Source: Investor Presentation

On August 14th, 2024, Nordson increased its dividend by 15% to $0.78 per share quarterly, marking 61 years of increases.

On December 11th, 2024, Nordson reported fourth quarter results for the period ending October 31st, 2024. For the quarter, the company reported sales of $744 million, 4% higher compared to $719 million in Q4 2023, which was driven by a positive acquisition impact, and offset by organic decrease of 3%.

Industrial Precision saw sales decrease by 3%, while the Medical and Fluid Solutions and Advanced Technology Solutions segments had sales increases of 19% and 5%, respectively.

The company generated adjusted earnings per share of $2.78, a 3% increase compared to the same quarter last year. For FY 2024, Nordson generated adjusted EPS of $9.73 compared to $9.85 in 2023.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

Rock Solid Dividend Stock: Parker-Hannifin (PH)

- 5-year dividend growth: 10.0%

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $16 billion.

Parker-Hannifin has paid a dividend for 72 years and has increased the dividend for 67 consecutive years.

Source: Investor Presentation

In late October, Parker-Hannifin reported (10/31/24) results for the first quarter of 2025. Sales grew 1% over last year’s quarter, to a new all-time high.

Adjusted earnings-per-share grew 4%, from $5.96 to $6.20, primarily thanks to robust demand in aerospace.

Parker-Hannifin exceeded the analysts’ consensus by $0.06. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 37 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

Rock Solid Dividend Stock: S&P Global (SPGI)

- 5-year dividend growth: 12.0%

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion.

Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P Global posted third quarter earnings on October 24th, 2024, and results were quite strong once again. Adjusted earnings-per-share came to $3.89, which was 25 cents ahead of estimates. Earnings were down from $4.04 in Q2, but much higher than $3.21 in the year-ago period.

Revenue soared 16% higher year-on-year to $3.58 billion, which also beat estimates by $150 million. Growth in the Ratings and Indices segment led the top line higher in Q3, although strength was broad.

With dividend growth above 10%, SPGI is one of the rock solid dividend stocks.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

More By This Author:

Monthly Dividend Stock In Focus: Sila Realty Trust

10 Ideal Retirement Investment Stocks

10 One Decision Stocks To Buy Now

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more