10 One Decision Stocks To Buy Now

Image Source: Pixabay

A “one decision stock” is a stock that you buy (the buy is the one decision) and hold for the long run.

There are no other decisions needed, because one decision stocks have durable and strong competitive advantages coupled with shareholder friendly managements. They reward investors more the longer they hold them.

“I don’t want a lot of good investments; I want a few outstanding ones. If the job has been correctly done when a common stock is purchased, the time to sell it is almost never.”

– Investing legend Philip Fisher

The idea behind one decision stocks is to identify businesses that are likely to reward shareholders with rising value on a per share basis over long periods of time, and hold onto these businesses regardless of market fluctuations.

The phrase was popularized with the “Nifty Fifty” stocks of the late 1960’s and early 1970’s. Three of the “Nifty Fifty” stocks that have compounded investor wealth over the last ~50 years are below:

What do these stocks have in common?

What the 3 stocks above have in common is that they are all Dividend Aristocrats, a group of 66 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

There are several advantages to “one decision investing”.

The first and most prominent is that it puts a greater emphasis on your buy decisions.

If your expected holding period is a month, the underlying quality of the business for the stock you are buying doesn’t matter much at all…

But if you are buying and holding “forever”, then the quality of the business is paramount.

The following 10 one decision stocks have increased their dividends for over 25 years, making them Dividend Aristocrats.

In addition, all 10 have Dividend Risk Scores of ‘A’ in the Sure Analysis Research Database (our highest rating), and dividend payout ratios below 50%, indicating strong dividend safety.

As a result, these one decision stocks can be counted on for many years of continued dividend increases in the future.

The one decision stocks below are ranked by dividend yield, from lowest to highest.

One Decision Stock To Buy Now: Genuine Parts Co. (GPC)

- Dividend Yield: 3.4%

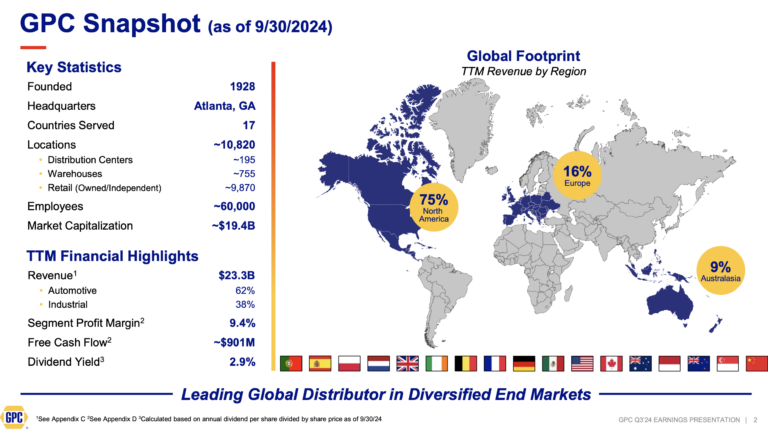

Genuine Parts has the world’s largest global auto parts network, with more than 10,800 locations worldwide. As a major distributor of automotive and industrial parts, Genuine Parts generates annual revenue of nearly $23 billion.

Source: Investor Presentation

It operates two segments, which are automotive (includes the NAPA brand) and the industrial parts group which sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers.

Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care.

The company reported its third-quarter 2024 results, with sales reaching $6.0 billion, a 2.5% increase from the previous year.

Net income fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) also decreased to $1.88 compared to $2.49 last year.

Click here to download our most recent Sure Analysis report on GPC (preview of page 1 of 3 shown below):

One Decision Stock To Buy Now: Johnson & Johnson (JNJ)

- Dividend Yield: 3.4%

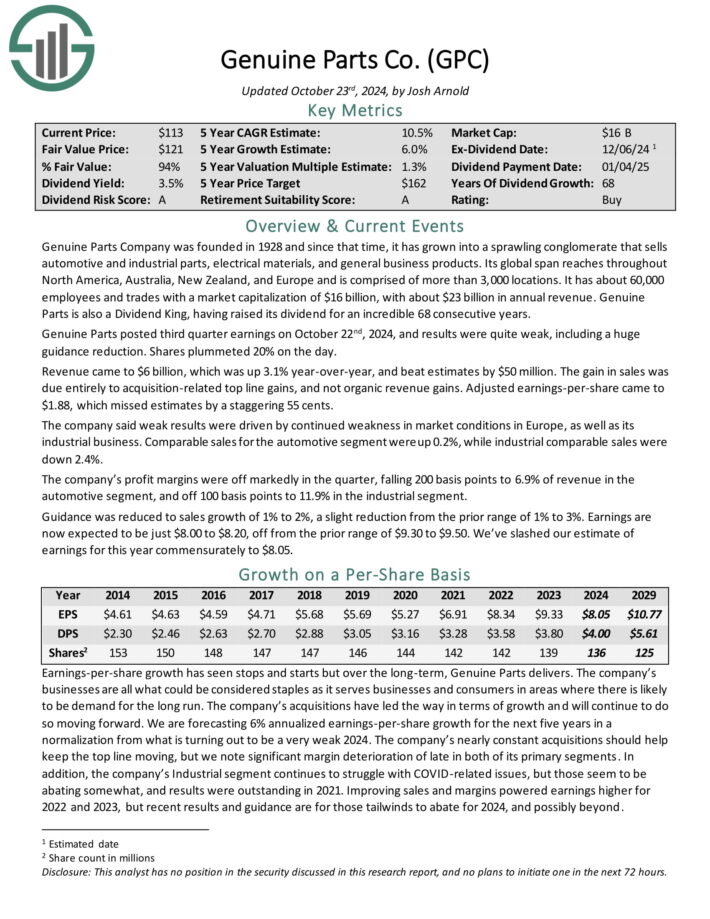

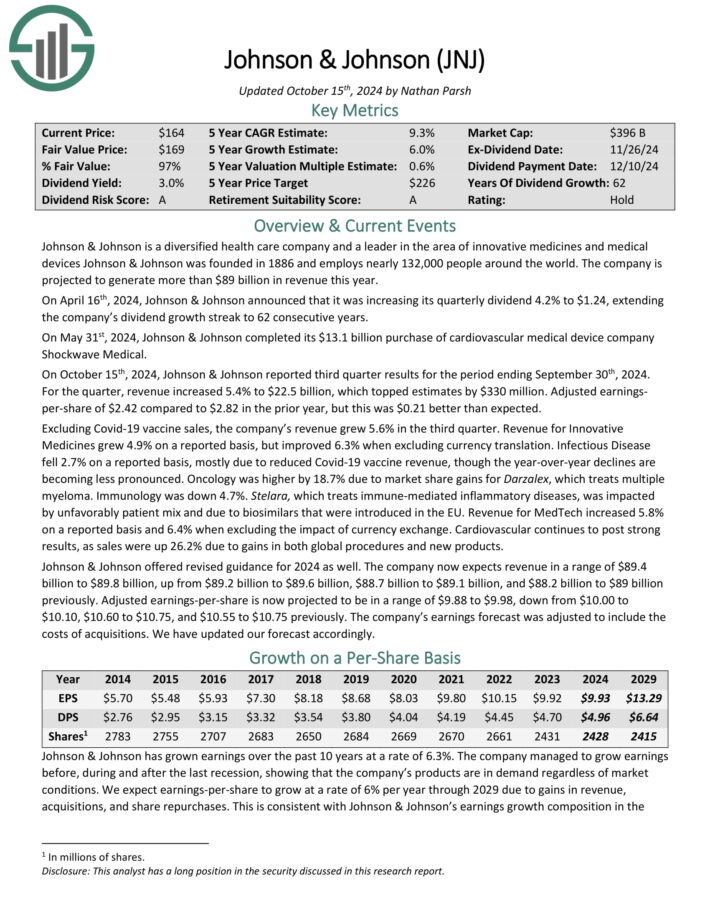

Johnson & Johnson was founded in 1886 and has transformed into one of the largest companies in the world. Johnson & Johnson is a mega-cap stock. The company generates annual sales above $99 billion.

Johnson & Johnson operates a diversified business model, allowing it to appeal to a wide variety of customers within the healthcare sector. J&J now operates two segments, pharmaceuticals and medical devices, after spinning off its consumer health franchises.

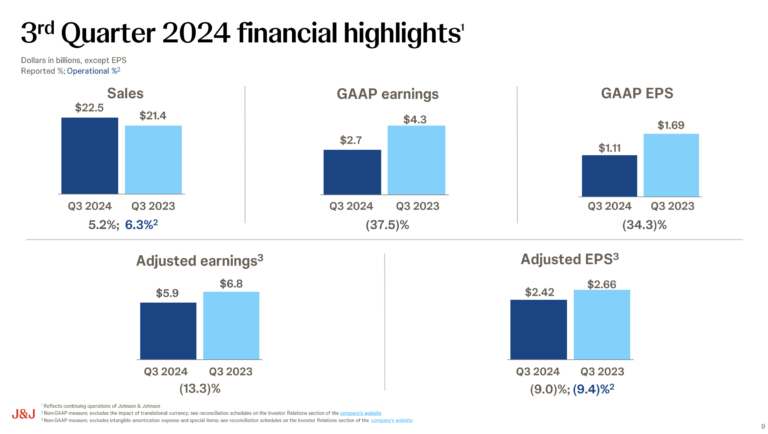

Johnson & Johnson reported third-quarter 2024 sales growth of 5.2%, reaching $22.5 billion, with operational growth of 6.3%.

Source: Investor Presentation

However, earnings per share (EPS) decreased by 34.3%, largely due to a one-time special charge and acquired in-process research and development (IPR&D).

Adjusted EPS fell 9.0% to $2.42, driven by the same IPR&D impact. The company made significant advancements, including approvals for treatments like TREMFYA and RYBREVANT, and the submission of a new general surgery robotic system, OTTAVA.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

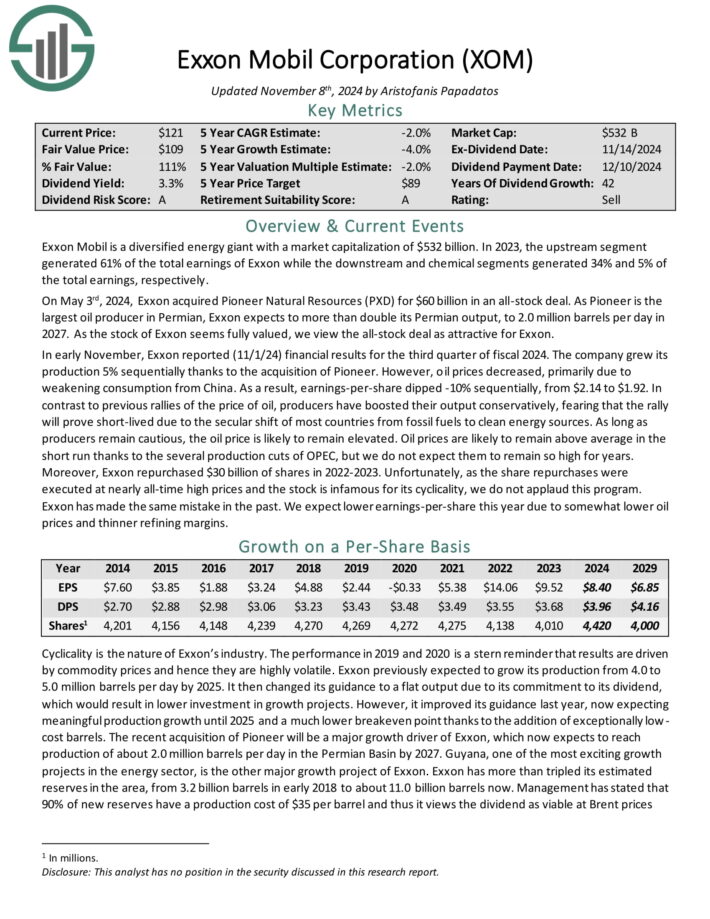

One Decision Stock To Buy Now: Exxon Mobil Corp. (XOM)

- Dividend Yield: 3.6%

Exxon Mobil is a diversified energy giant with a market capitalization above $500 billion. In 2023, the upstream segment generated 61% of the total earnings of Exxon while the downstream and chemical segments generated 34% and 5% of the total earnings, respectively.

On May 3rd, 2024, Exxon acquired Pioneer Natural Resources (PXD) for $60 billion in an all-stock deal. As Pioneer is the largest oil producer in Permian, Exxon expects to more than double its Permian output, to 2.0 million barrels per day in 2027.

Source: Investor Presentation

In early November, Exxon reported (11/1/24) financial results for the third quarter of fiscal 2024. The company grew its production 5% sequentially thanks to the acquisition of Pioneer.

However, oil prices decreased, primarily due to weakening consumption from China. As a result, earnings-per-share dipped -10% sequentially, from $2.14 to $1.92.

The recent acquisition of Pioneer will be a major growth driver of Exxon, which now expects to reach production of about 2.0 million barrels per day in the Permian Basin by 2027.

Guyana, one of the most exciting growth projects in the energy sector, is another major growth project. Exxon has more than tripled its estimated reserves in the area, from 3.2 billion barrels in early 2018 to about 11.0 billion barrels now.

Click here to download our most recent Sure Analysis report on XOM (preview of page 1 of 3 shown below):

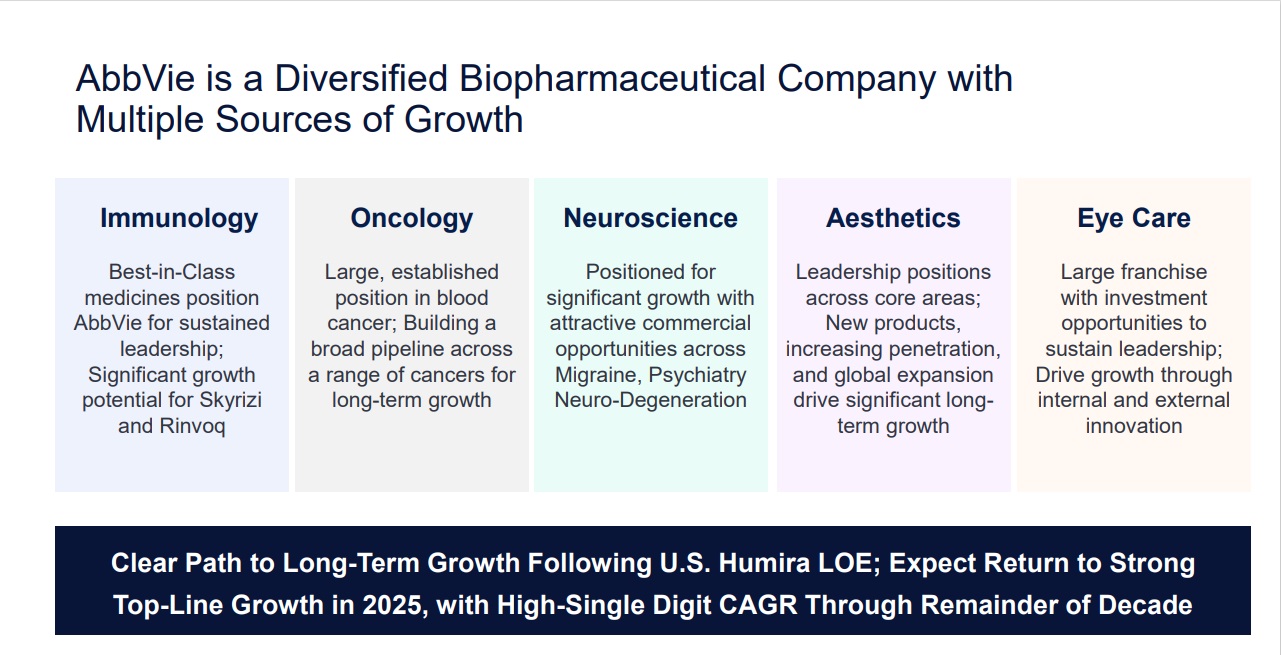

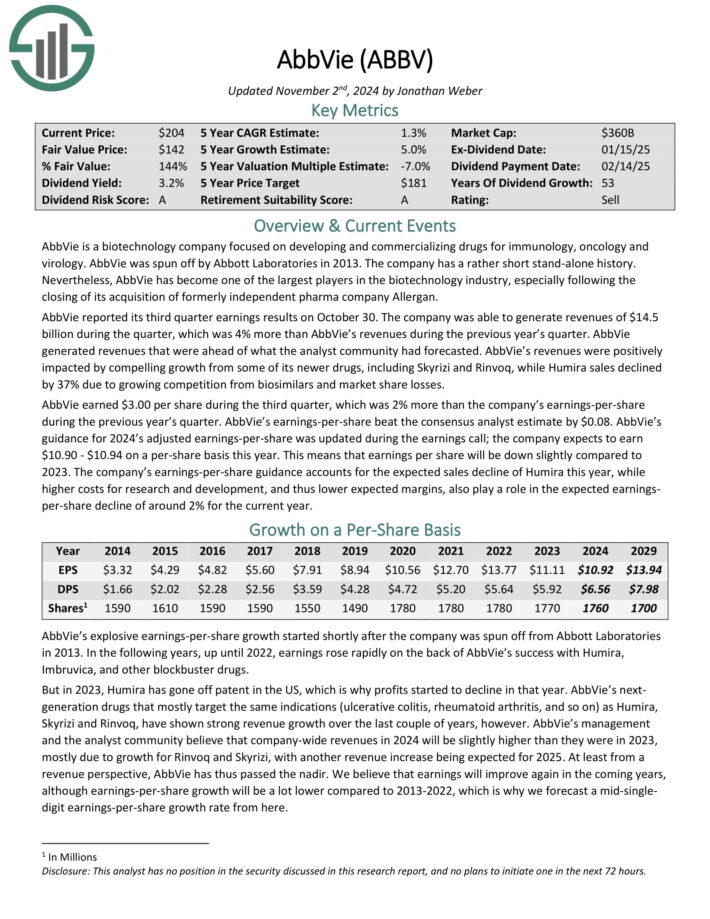

One Decision Stock To Buy Now: AbbVie Inc. (ABBV)

- Dividend Yield: 3.7%

AbbVie is a pharmaceutical company spun off by Abbott Laboratories (ABT) in 2013. Its most important product is Humira, now facing biosimilar competition in Europe and the U.S., which has had a noticeable impact on the company.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

Source: Investor Presentation

AbbVie reported its third quarter earnings results on October 30. The company was able to generate revenues of $14.5 billion during the quarter, which was 4% more than AbbVie’s revenues during the previous year’s quarter.

Revenues were positively impacted by compelling growth from some of its newer drugs, including Skyrizi and Rinvoq, while Humira sales declined by 37% due to growing competition from biosimilars and market share losses.

AbbVie earned $3.00 per share during the third quarter, which was 2% more than the company’s earnings-per-share during the previous year’s quarter. AbbVie’s earnings-per-share beat the consensus analyst estimate by $0.08.

AbbVie’s guidance for 2024’s adjusted earnings-per-share was updated during the earnings call; the company expects to earn $10.90 – $10.94 on a per-share basis this year.

Click here to download our most recent Sure Analysis report on AbbVie (preview of page 1 of 3 shown below):

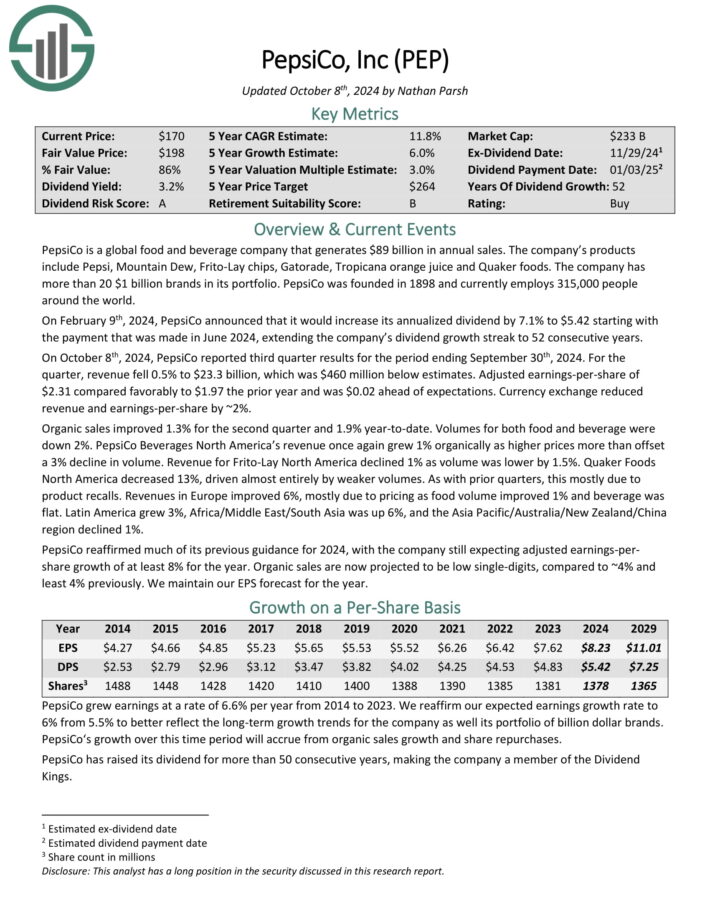

One Decision Stock To Buy Now: PepsiCo Inc. (PEP)

- Dividend Yield: 3.8%

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

a

On October 8th, 2024, PepsiCo reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 0.5% to $23.3 billion, which was $460 million below estimates.

Adjusted earnings-per-share of $2.31 compared favorably to $1.97 the prior year and was $0.02 ahead of expectations. Currency exchange reduced revenue and earnings-per-share by ~2%.

Organic sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for both food and beverage were down 2%.

PepsiCo Beverages North America’s revenue once again grew 1% organically as higher prices more than offset a 3% decline in volume.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

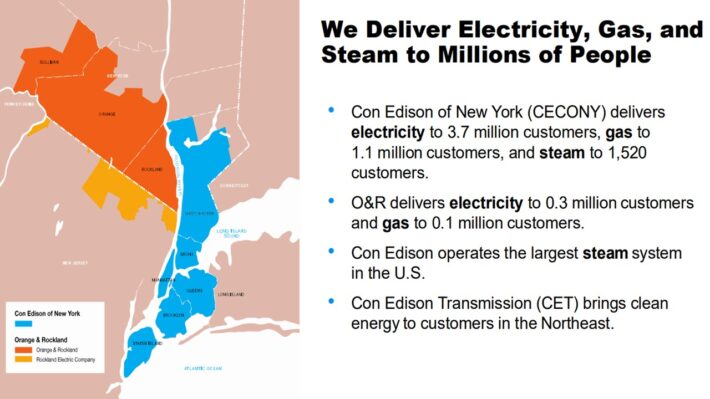

One Decision Stock To Buy Now: Consolidated Edison (ED)

- Dividend Yield: 3.8%

Consolidated Edison is a large-cap utility stock. The company generates nearly $15 billion in annual revenue and has a market capitalization of approximately $36 billion.

The company serves 3.7 million electric customers, and another 1.1 million gas customers, in New York.

Source: Investor Presentation

It operates electric, gas, and steam transmission businesses, with a steam system that is the largest in the U.S.

On November 7th, 2024, Consolidated Edison reported third quarter results. For the quarter, revenue improved 5.7% to $4.1 billion, which topped estimates by $26 million.

Adjusted earnings of $583 million, or $1.68 per share, compared to adjusted earnings of $561 million, or $1.62 per share, in the previous year. Adjusted earnings-per-share were $0.10 more than anticipated.

As with prior periods, higher rate bases for gas and electric customers were the primary contributors to results in the CECONY business, which accounts for the vast majority of the company’s assets.

Average rate base balances are still expected to grow by 6.4% annually for the 2024 to 2028 period.

Click here to download our most recent Sure Analysis report on Consolidated Edison (preview of page 1 of 3 shown below):

One Decision Stock To Buy Now: Hormel Foods (HRL)

- Dividend Yield: 3.8%

Hormel Foods is a juggernaut in the food products industry with nearly $10 billion in annual revenue. It has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

It has also pursued acquisitions to drive growth. For example, in 2021, Hormel acquired the Planters snack nuts business from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s growth.

Source: Investor Presentation

Hormel posted fourth quarter and full-year earnings on December 4th, 2024, and results were in line with expectations. The company posted adjusted earnings-per-share of 42 cents, which met estimates. Revenue was off 2% year-on-year to $3.14 billion, also hitting estimates.

Operating income was $308 million for the quarter on an adjusted basis, or 9.8% of revenue. Operating cash flow was $409 million for Q4. For the year, sales were $11.9 billion, and adjusted operating income was $1.1 billion, or 9.6% of revenue. Adjusted earnings-per-share was $1.58. Operating cash flow hit a record of $1.3 billion.

Guidance for 2025 was initiated at $11.9 billion to $12.2 billion in sales, with organic net sales growth of 1% to 3%.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

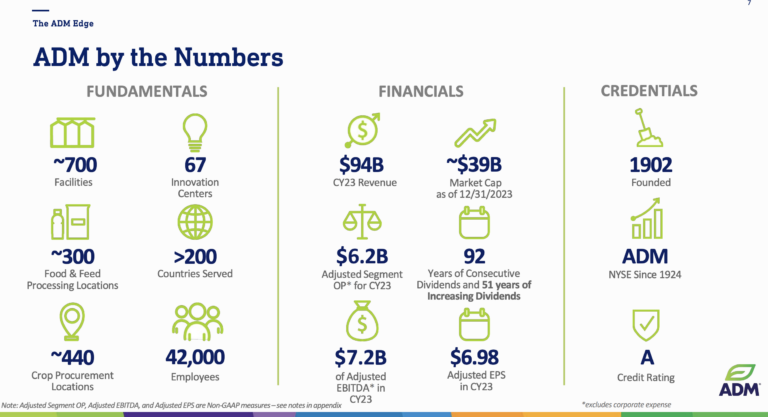

One Decision Stock To Buy Now: Archer Daniels Midland (ADM)

- Dividend Yield: 3.9%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States.

Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY) 2024 on November 18th, 2024.

The company reported adjusted net earnings of $530 million and adjusted EPS of $1.09, both down from the prior year due to a $461 million non-cash charge related to its Wilmar equity investment.

Consolidated cash flows year-to-date reached $2.34 billion, reflecting strong operations despite market challenges.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

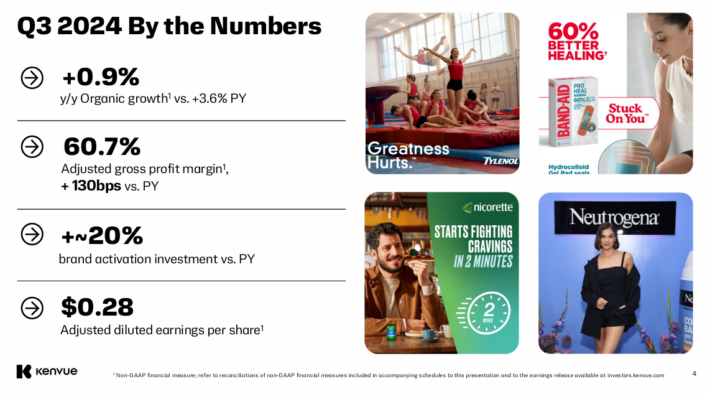

One Decision Stock To Buy Now: Kenvue Inc. (KVUE)

- Dividend Yield: 3.9%

Kenvue is a consumer products company that was spun off from Johnson & Johnson. It has three segments, including Self Care, Skin Health and Beauty, and Essential Health.

The Self Care product portfolio includes cough, cold, allergy, smoking cessation, and pain care products among others. Skin Health and Beauty holds products such as face, body, hair, and sun care. Essential Health contains products for women’s health, wound care, oral care, and baby care.

Well-known brands in Kenvue’s product line up include Tylenol, Listerine, Band-Aid, Neutrogena, Nicorette, and Zyrtec. These businesses contributed approximately 17% of Johnson & Johnson’s annual revenue.

On November 7th, 2024, Kenvue reported third quarter earnings results for the period ending September 30th, 2024. Revenue decreased 0.5% to $3.9 billion, which was $20 million less than expected.

Source: Investor Presentation

Adjusted earnings-per-share of $0.28 compared unfavorably to $0.31 last year, but this was $0.01 above estimates.

Organic sales were up 0.9% for the quarter, which follows a 3.6% improvement last year. For the quarter, pricing and mix benefit of 2.5% was offset by a 1.6% decline in volume.

Once again, volume growth in Essential Health was offset by weakness in Skin Health and Beauty and Self Care. Gross profit margin expanded 100 basis points to 58.5%.

Click here to download our most recent Sure Analysis report on KVUE (preview of page 1 of 3 shown below):

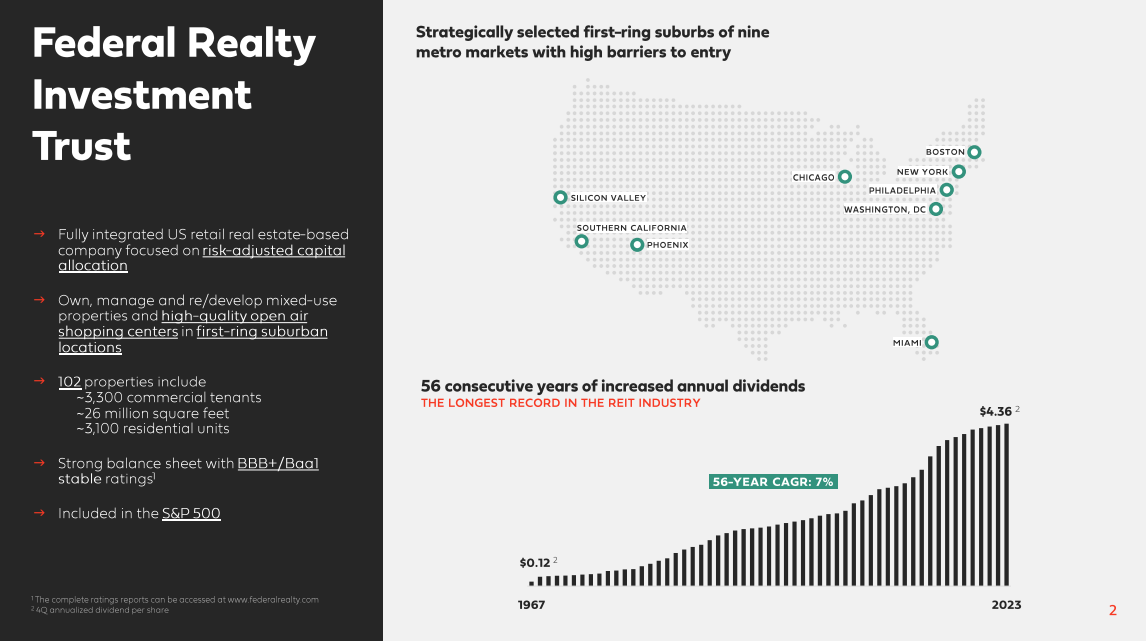

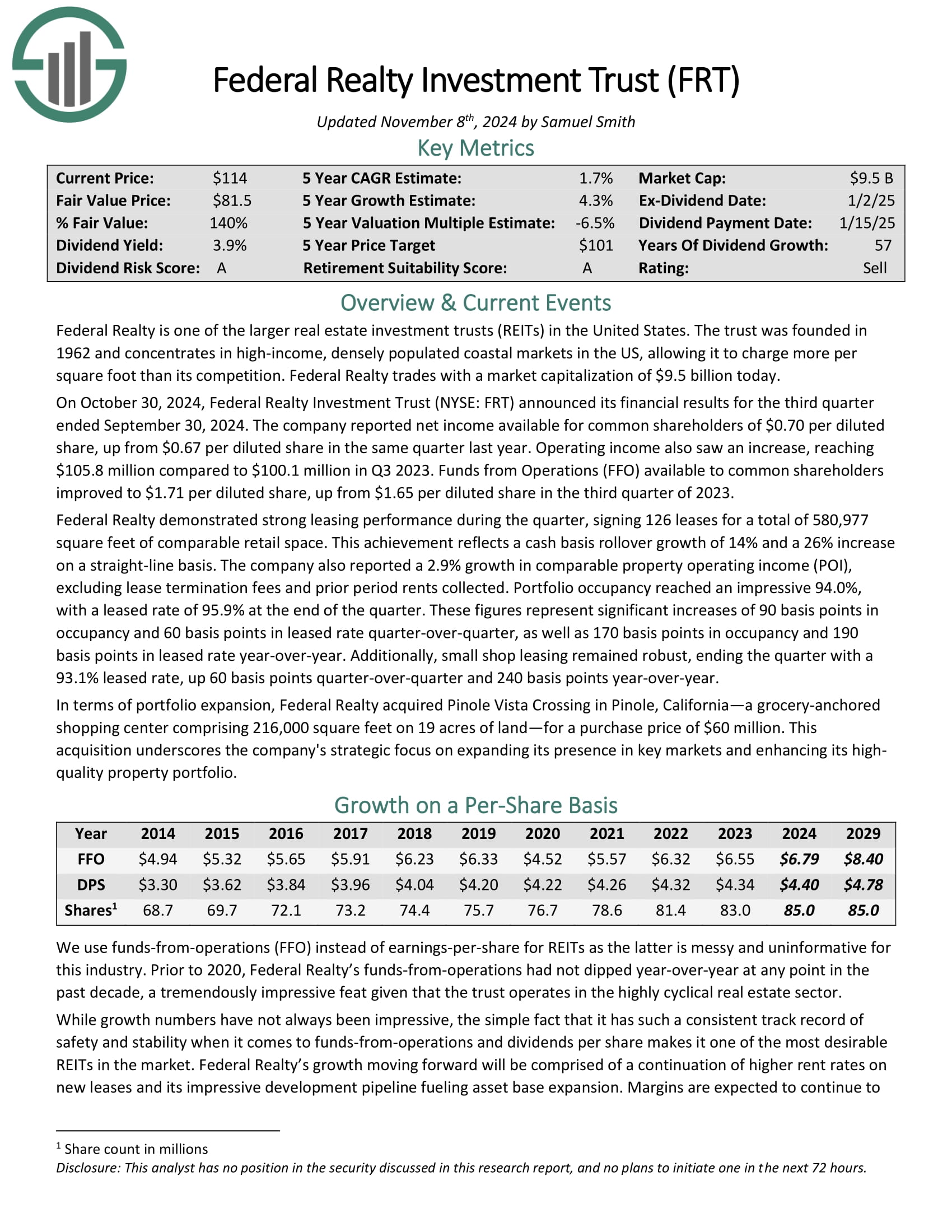

One Decision Stock To Buy Now: Federal Realty Investment Trust (FRT)

- Dividend Yield: 4.2%

Federal Realty was founded in 1962. As a Real Estate Investment Trust, Federal Realty’s business model is to own and rent out real estate properties.

It uses a significant portion of its rental income, as well as external financing, to acquire new properties.

Source: Investor Presentation

On October 30, 2024, Federal Realty Investment Trust announced its financial results for the third quarter ended September 30, 2024.

The company reported net income available for common shareholders of $0.70 per diluted share, up from $0.67 per diluted share in the same quarter last year. Operating income also saw an increase, reaching $105.8 million compared to $100.1 million in Q3 2023.

Funds from Operations (FFO) available to common shareholders improved to $1.71 per diluted share, up from $1.65 per diluted share in the third quarter of 2023.

Click here to download our most recent Sure Analysis report on Federal Realty (preview of page 1 of 3 shown below):

More By This Author:

Get Raises For Doing Almost Nothing With Dividend Stocks

10 Best Dividend Champions You’ve Never Heard Of

3 Micro-Cap Stocks With High Dividends

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more