10 Best Stocks For Compounding Dividends

Image Source: Pixabay

Income investors looking for compounding dividends over time, should consider high-quality dividend growth stocks. These stocks have the ability to raise their dividends over time, thereby unleashing the power of compounding dividends.

This is why Sure Dividend often recommends the Dividend Aristocrats, a select group of 66 S&P 500 stocks with 25+ years of consecutive dividend increases.

They are the ‘best of the best’ dividend growth stocks. The Dividend Aristocrats have a long history of compounding dividends for shareholders.

Dividend Aristocrats must have 25+ years of rising dividends, be a member of the S&P 500 Index, and meet certain minimum size and liquidity requirements.

Due to their strong dividend history and durable competitive advantages, the Dividend Aristocrats are a great place to start looking for compounding dividends.

This article will explain the concept of compounding dividends in greater detail, as well as a list of the top 10 stocks for compounding dividends right now.

What Is Compounding Dividends?

Put simply, compounding is the act of earning interest on previously-earned interest. In this way, investors could think of compounding like the snowball effect.

When you push a small snowball down a hill, it continuously picks up snow. When it reaches the bottom of the hill it is a giant snow boulder.

The snowball compounds during its travel down the hill. The bigger it gets, the more snow it packs on with each revolution.

The snowball effect explains how small actions carried out over time can lead to big results.

In the same way, investing in high-quality dividend growth stocks can generate large amounts of dividend income over long periods of time.

That’s because dividend growth stocks tend to pay rising dividends every year. And then you can reinvest those rising dividends to purchase more shares each year.

This results in an increase in the total number of shares you own, as well as an increase in the dividend per share, for a powerful compounding effect.

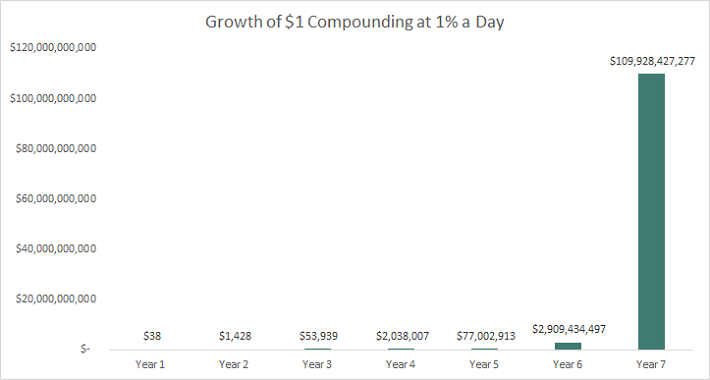

Here’s the power of compound interest:

Imagine you invested $1 that compounded at 1% a day. In 5 years your $1 would grow to over $77 million. You would be the richest person in the world by year 7.

Keep in mind that compounding is not a get rich quick scheme. It takes time – and lots of it. There are no investments that compound at 1% a day in the real world.

The stock market has compounded wealth (adjusting for inflation) at ~7% a year over the long run. At this rate an investment in the stock market has historically doubled every 10.4 years.

The 10 Best Stocks For Compounding Dividends

The following 10 stocks are our top-ranked stocks for compounding dividends, based on a qualitative assessment of dividend history, current yield, and payout ratios.

All the stocks in the list below have current yields above 2%, at least 25 consecutive years of dividend increases, and payout ratios below 70%.

In addition, the 10 best stocks for compounding dividends below have Dividend Risk Scores of A or B.

This combination is likely to result in sustained dividend increases over time, thereby compounding dividends to create long-term wealth.

The stocks are ranked in order of their 5-year dividend growth rate, from lowest to highest.

#10: Bank OZK (OZK)

- Payout Ratio: 26.9%

- Years of Dividend Increases: 30

- 5-Year Dividend Growth Rate: 7.0%

Bank OZK is a regional bank that offers services such as checking, business banking, commercial loans and mortgages to its customers in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California.

On October 1st, 2024, Bank OZK announced a $0.41 quarterly dividend, representing a 2.5% raise over the last quarter’s payment and a 10.8% raise year-over-year. This marks the company’s 57th consecutive quarter of raising its dividend.

In mid-October, Bank OZK reported (10/17/24) results for the third quarter of 2024. Total loans and deposits grew 15% and 20%, respectively, over last year’s quarter. Net interest income grew 6% over the prior year’s quarter, despite higher deposit costs.

Earnings-per-share grew 4%, from $1.49 to a new all-time high of $1.55, and exceeded the analysts’ consensus by $0.01. Bank OZK has exceeded the analysts’ consensus in 16 of the last 18 quarters.

Click here to download our most recent Sure Analysis report on OZK (preview of page 1 of 3 shown below):

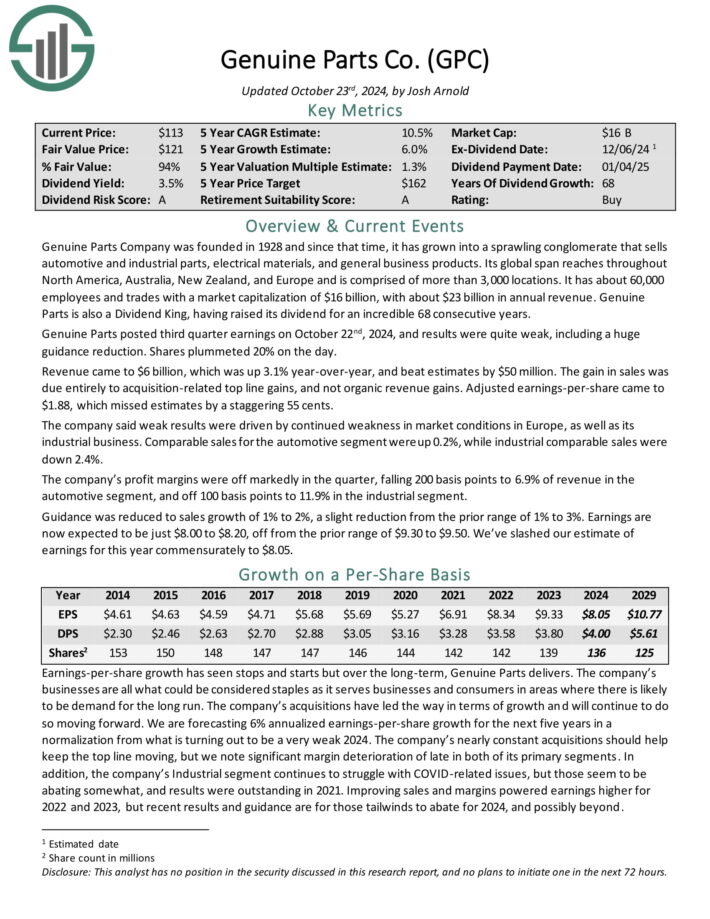

#9: Genuine Parts Company (GPC)

- Payout Ratio: 49.7%

- Years of Dividend Increases: 68

- 5-Year Dividend Growth Rate: 7.0%

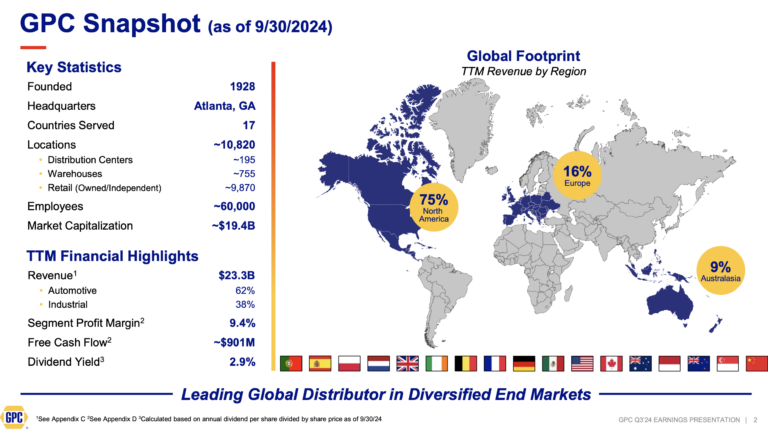

Genuine Parts has the world’s largest global auto parts network, with more than 10,800 locations worldwide. As a major distributor of automotive and industrial parts, Genuine Parts generates annual revenue of nearly $23 billion.

Source: Investor Presentation

It operates two segments, which are automotive (includes the NAPA brand) and the industrial parts group which sells industrial replacement parts to MRO (maintenance, repair, and operations) and OEM (original equipment manufacturer) customers.

Customers are derived from a wide range of segments, including food and beverage, metals and mining, oil and gas, and health care.

The company reported its third-quarter 2024 results, with sales reaching $6.0 billion, a 2.5% increase from the previous year.

Net income fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) also decreased to $1.88 compared to $2.49 last year.

Click here to download our most recent Sure Analysis report on GPC (preview of page 1 of 3 shown below):

#8: Air Products & Chemicals (APD)

- Payout Ratio: 55.1%

- Years of Dividend Increases: 42

- 5-Year Dividend Growth Rate: 7.0%

Air Products & Chemicals is one of the world’s largest producers and distributors of atmospheric and process gases, serving other businesses in the industrial, technology, energy, and materials sectors.

Air Products & Chemicals operates through three main business units: Industrial Gases – Americas, Industrial Gases EMEA, and Industrial Gases – Asia.

Air Products & Chemicals reported financial results for the fourth quarter of fiscal 2024 on November 7. The company generated revenues of $3.19 billion during the quarter, which was up 0.3% year-over-year, missing the analyst consensus estimate by $30 million.

Air Products & Chemicals was able to generate earnings-per-share of $3.56 during the fourth quarter, which was up 13% compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on APD (preview of page 1 of 3 shown below):

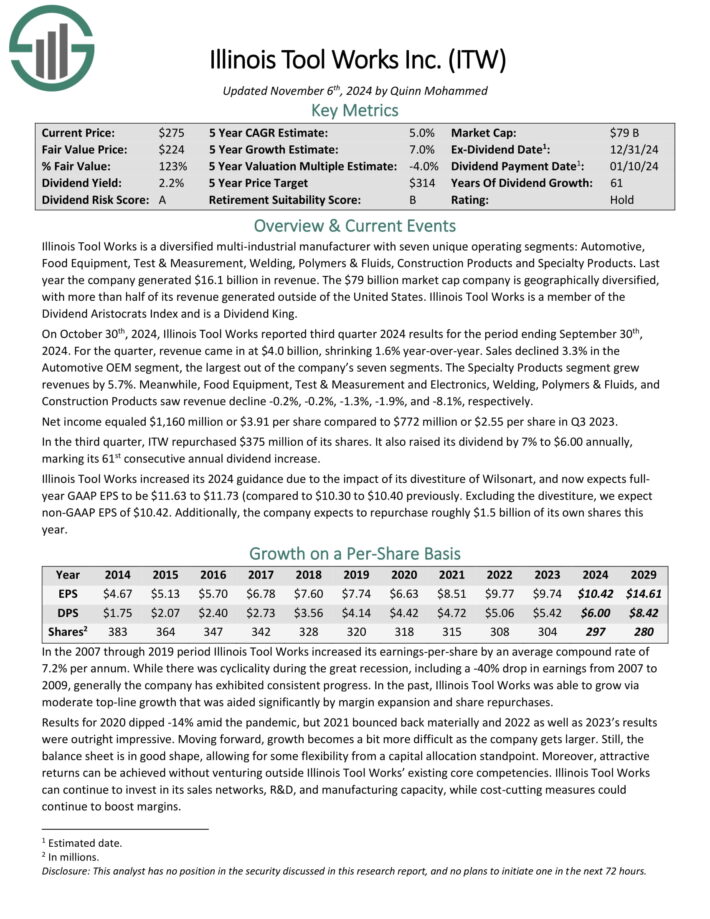

#7: Illinois Tool Works (ITW)

- Payout Ratio: 57.6%

- Years of Dividend Increases: 61

- 5-Year Dividend Growth Rate: 7.0%

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products.

Last year the company generated $16.1 billion in revenue.

On October 30th, 2024, Illinois Tool Works reported third quarter 2024 results for the period ending September 30th, 2024. For the quarter, revenue came in at $4.0 billion, shrinking 1.6% year-over-year. Sales declined 3.3% in the Automotive OEM segment, the largest out of the company’s seven segments.

The Specialty Products segment grew revenues by 5.7%. Meanwhile, Food Equipment, Test & Measurement and Electronics, Welding, Polymers & Fluids and

Construction Products saw revenue decline -0.2%, -0.2%, -1.3%, -1.9%, and -8.1%, respectively.

Net income equaled $1,160 million or $3.91 per share compared to $772 million or $2.55 per share in Q3 2023. In the third quarter, ITW repurchased $375 million of its shares. It also raised its dividend by 7% to $6.00 annually, marking its 61st consecutive annual dividend increase.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

#6: Canadian National Railway (CNI)

- Payout Ratio: 46.2%

- Years of Dividend Increases: 29

- 5-Year Dividend Growth Rate: 7.0%

Canadian National Railway is the largest railway operator in Canada. The company has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico.

It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

On January 24th, 2024, Canadian National Railway increased its dividend 7% for the March 28th, 2024 payment date.

In the 2024 third quarter, revenue grew 2.4% to $2.97 billion, which beat estimates by $11 million. Adjusted earnings-per-share of $1.24 match last year’s result compared to $1.23 in the prior year and was $0.01 ahead of expectations.

For the quarter, Canadian National Railway’s operating ratio increased 110 basis points to 63.1%. Revenue ton miles (RTM) grew 2% from the prior year while carloads were lower by 2%.

Click here to download our most recent Sure Analysis report on CNI (preview of page 1 of 3 shown below):

#5: Medtronic plc (MDT)

- Payout Ratio: 51.2%

- Years of Dividend Increases: 47

- 5-Year Dividend Growth Rate: 7.4%

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 90,000 employees.

Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 46 consecutive years.

In mid-November, Medtronic reported (11/19/24) results for the second quarter of fiscal 2025. Organic revenue grew 5% over the prior year’s quarter thanks to broad-based growth in all the four segments. Earnings-per-share grew 1%, from $1.25 to $1.26, and exceeded the analysts’ consensus by $0.01.

As Medtronic performed slightly better than expected in the second quarter, it marginally raised its guidance for fiscal 2025. It expects 4.75%-5.0% organic revenue growth and raised its guidance for earnings-per-share from $5.42-$5.50 to $5.44-$5.50.

Click here to download our most recent Sure Analysis report on MDT (preview of page 1 of 3 shown below):

#4: NextEra Energy (NEE)

- Payout Ratio: 61.9%

- Years of Dividend Increases: 29

- 5-Year Dividend Growth Rate: 7.5%

NextEra Energy is an electric utility with two operating segments, Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”). FPL is the largest U.S. electric utility by retail megawatt hour sales and customer numbers.

The rate-regulated electric utility serves about 5.9 million customer accounts in Florida. NEER is the largest generator of wind and solar energy in the world. NEE was founded in 1925. NEE generates roughly 80% of its revenues from FPL.

NextEra Energy reported its Q3 2024 financial results on 10/23/24. For the quarter, the company reported revenues of $7.6 billion (up 5.5% year over year), translating to adjusted earnings of $2.1 billion (up 11% year over year). On a per share basis, adjusted earnings climbed 10% to $1.03.

The utility added ~3 GW of new renewables and storage projects to its backlog, including ~1.4 GW of solar and ~1.4 GW of battery storage, bringing its backlog to over 24 GW.

Year to date, it generated operating revenue of $19.4 billion (down 8.8% year over year), adjusted earnings of $6.0 billion (up 11%), and adjusted earnings per share (“EPS”) of $2.90 (up 9%).

Click here to download our most recent Sure Analysis report on NEE (preview of page 1 of 3 shown below):

#3: Stepan Company (SCL)

- Payout Ratio: 61.6%

- Years of Dividend Increases: 57

- 5-Year Dividend Growth Rate: 8.0%

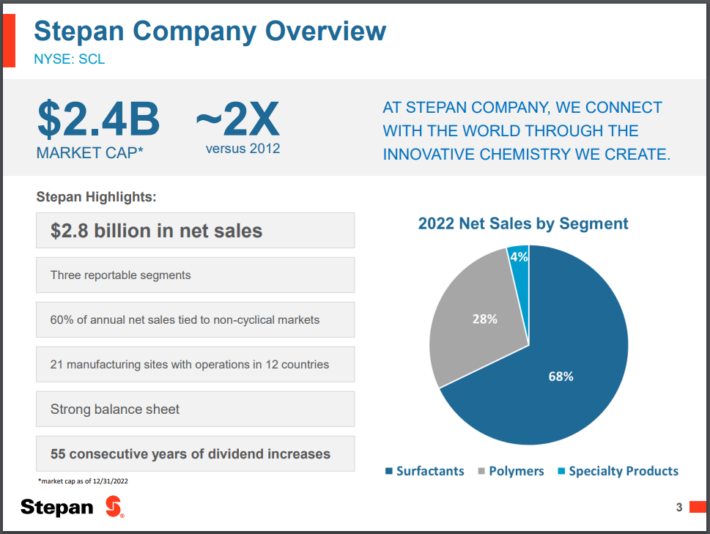

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to just a handful of industries.

Source: Investor presentation

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted third quarter earnings on October 30th, 2024, and results were mixed. Adjusted earnings-per-share came in well ahead of expectations at $1.03, which was 38 cents better than expected. Revenue, however, was off almost 3% year-over-year to $547 million, and missed estimates by over $30 million.

Global sales volume fell 1% year-over-year, as double-digit growth in several of the company’s Surfactant end markets were fully offset by demand weakness in Polymers.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

#2: Atmos Energy (ATO)

- Payout Ratio: 48.7%

- Years of Dividend Increases: 41

- 5-Year Dividend Growth Rate: 8.0%

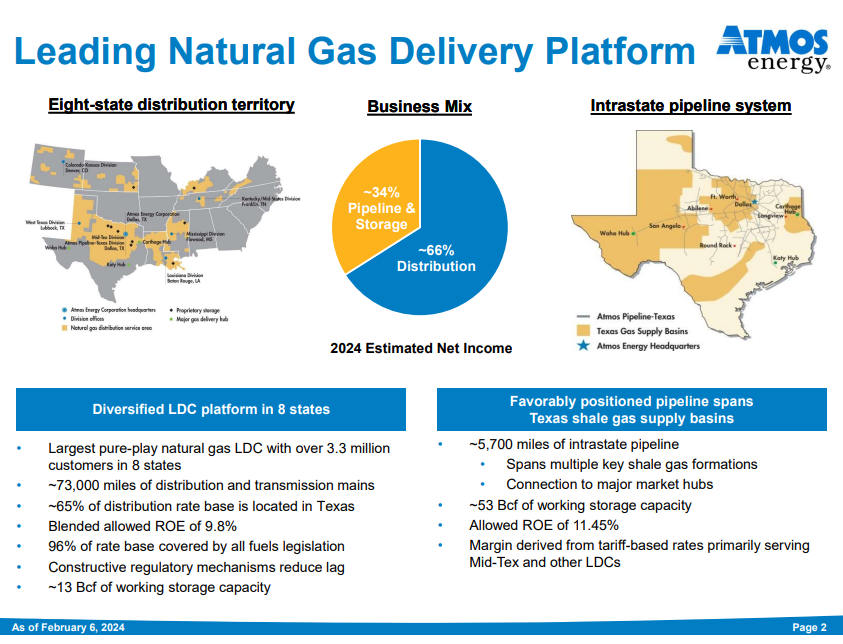

Atmos Energy can trace its beginnings all the way back to 1906 when it was formed in Texas. Since that time, it has grown both organically and through mergers.

The company distributes and stores natural gas in eight states, serves over 3 million customers, and should generate about $5 billion in revenue this year.

Source: Investor Presentation

Atmos has a 41-year history of raising dividends, putting it in rare company among dividend stocks.

Atmos posted fourth quarter and full-year earnings on November 6th, 2024, and results were largely in line with expectations. The company saw just over a billion dollars in net income for the year, and $134 million for the fourth quarter. On a per-share basis, earnings came to $6.83 and 86 cents, respectively.

For the quarter, distribution earnings came to $41 million, which was up from $38 million a year ago. Pipeline and storage earnings were $93 million, up from $81 million in last year’s Q4.

For the year, distribution earnings rose from $580 million to $671 million. Pipeline and storage full-year earnings were up sharply from $306 million to $372 million, helping to drive another year of record earnings for Atmos.

Click here to download our most recent Sure Analysis report on ATO (preview of page 1 of 3 shown below):

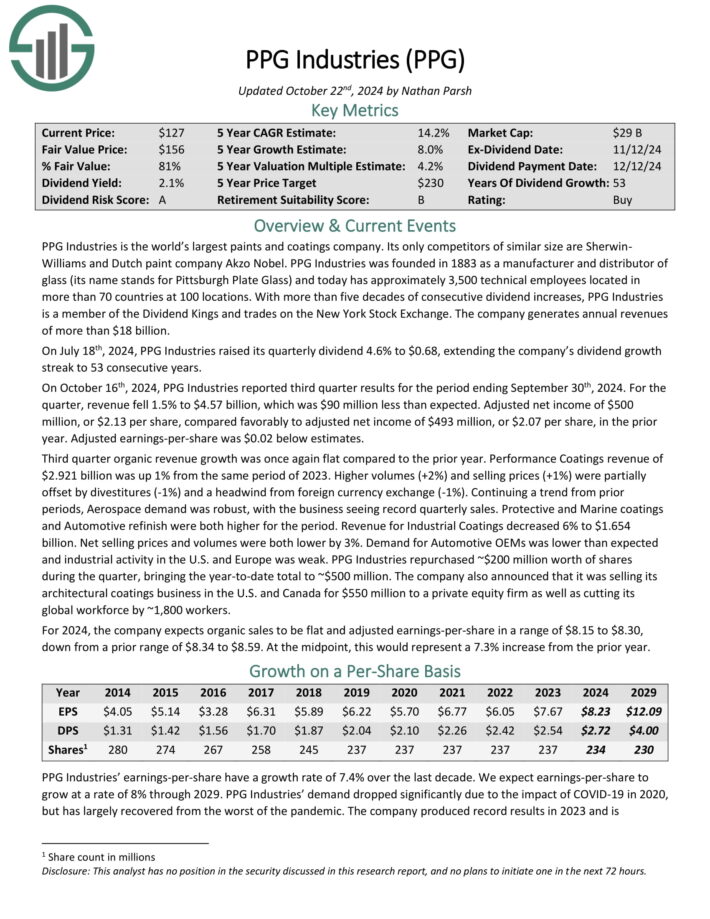

#1: PPG Industries (PPG)

- Payout Ratio: 33.0%

- Years of Dividend Increases: 53

- 5-Year Dividend Growth Rate: 8.0%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

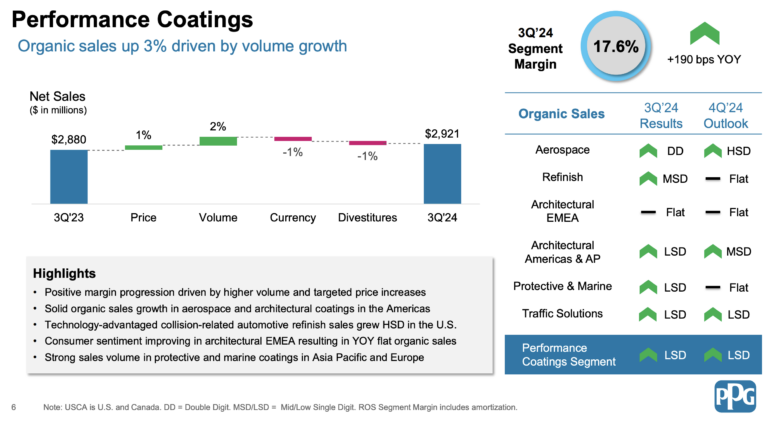

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023. Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

Final Thoughts

High-quality dividend growth stocks can build long-term wealth for shareholders. A major reason for this is the combination of dividend growth and dividend reinvestment.

The 10 stocks listed in the article represent some of the best stocks for dividend compounding.

More By This Author:

3 Hidden Gem Monthly Dividend Stocks

3 Dividend Aristocrats With Long-Term Growth

3 Dividend Kings You’ve Never Heard Of

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more