Why The Stock Market Might Move Higher In The Short Term, Revisited

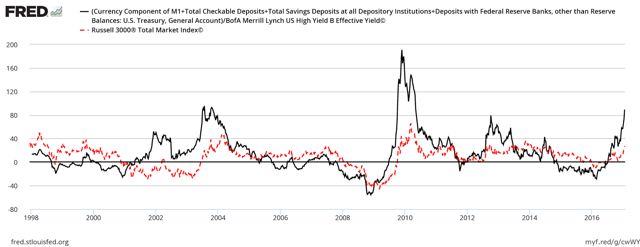

At the very beginning of February this year, I wrote an article titled Why The Stock Market Might Move Higher In The Short Term which included the following chart and concluding words:

Despite lofty valuations, the still high money supply growth rate and low interest rates present many yield-seeking investors few other options than to put their money in the stock market. As long as this remains true, the stock market may move higher still.

Nearly eight months later, the above chart looks considerably less bullish. In fact, it now looks decisively bearish.

And with lofty stock market valuations now even loftier, there are few fundamentals left to support even higher valuations. Which means a highly unreliable supporter of ever-higher stock market prices is today playing an exceedingly important role; the greater fool. In other words, the bull market could end or pop very soon.

Disclosure: I am short U.S. mid-caps.

Disclosure: None.

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!