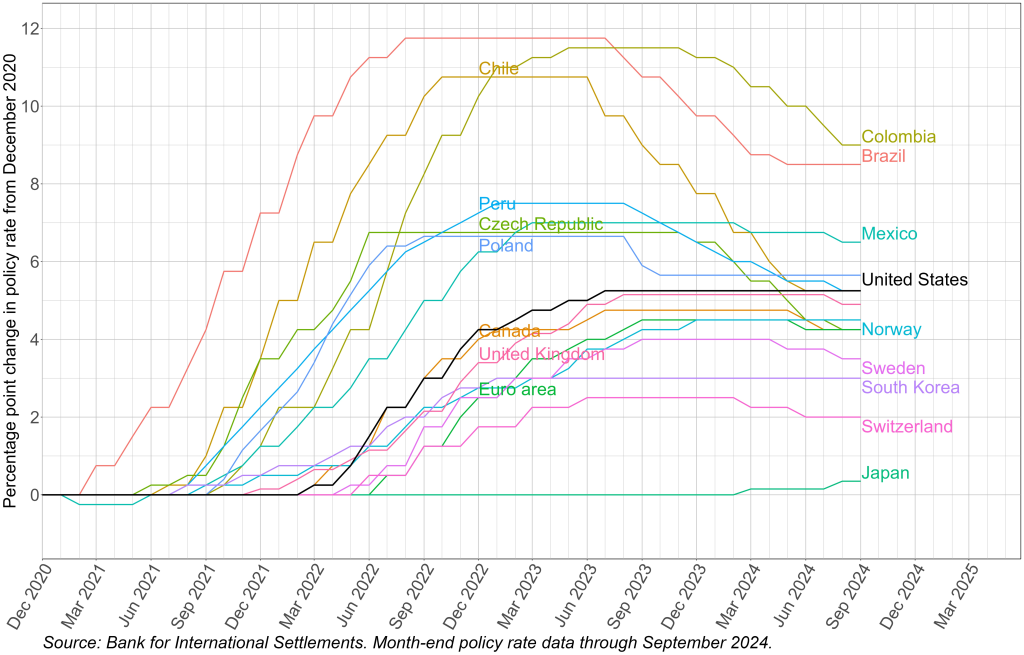

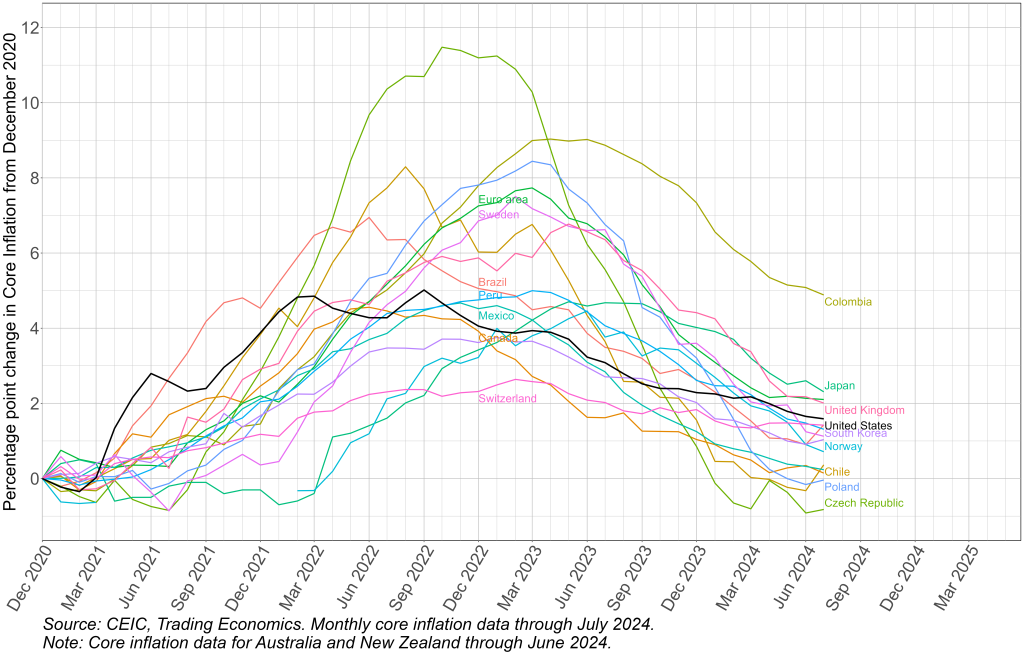

Steve Kamin: “The Fed Is (Nearly) The World’s Most Hawkish Central Bank”

From the article (published 9/10), two key graphs:

So…

…with inflation nearly down to target levels while signs of economic slowing mount, the Fed can afford to start reversing its exceptional monetary tightening.

So in today’s post, Kamin makes the case for 0.5% cut:

If the economy is close to balance and inflation likely to decline further, then interest rates should also be at normal levels. Economists refer to these as “neutral” rates, which means “the short-term interest rate that would prevail when the economy is at full employment and stable inflation.” Neutral interest rates cannot be directly observed, but reasonable estimates would center around three percent: two percent to compensate investors for inflation and an additional one percent to reflect real returns to capital. In fact, in the projections last released in June, Fed officials put that rate at 2.8 percent.

So, with inflation largely contained and the economy essentially in balance, interest rates should be closer to three percent than five percent. And even if there is greater strength in the economy than most economists judge, or if neutral interest rates are higher, there is still a very sizeable cushion between where interest rates are and where they need to be. This means that even a 0.5 percent rate cut can be made with little risk of re-igniting inflation.

More By This Author:

Business Cycle Indicators For August – NBER BCDC And OthersWhen Tariffs Last Bloomed – Soybean Edition

Manufacturing: When Tariffs Last Bloomed