Someone Give The Nasdaq A Mint

With three of the four trillion dollar stocks (Microsoft, Amazon.com, and Alphabet) in the Nasdaq trading at all-time highs today, it’s no surprise that both the Nasdaq 100 and broader Nasdaq Composite are both at record highs this morning. From a breadth perspective, though, neither index is as strong.

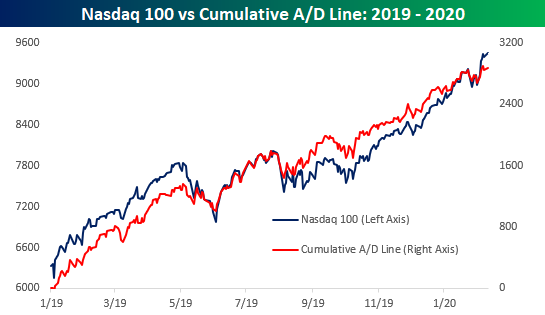

For starters, even though the Nasdaq 100 is at new highs, the cumulative A/D line is marginally lower than its high last week. It’s far from a major divergence but does illustrate the fact that some of the largest stocks are carrying the weight of everyone else.

(Click on image to enlarge)

The divergence between the Nasdaq 100’s price and cumulative A/D line is hardly wide enough to get working up over at this point, but for the broader Nasdaq Composite itself, which includes a much larger universe of smaller companies, the divergence is much more notable. In this instance, the Nasdaq’s cumulative A/D line saw a much larger pullback than price during the most recent pullback, and the magnitude of the bounce last week and into today has been relatively anemic. This is a much more notable divergence, and one that should it continue to drag on will become a concerning trend.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our full suite of research and interactive ...

more