Small Business Hesitation

Image Source: Pixabay

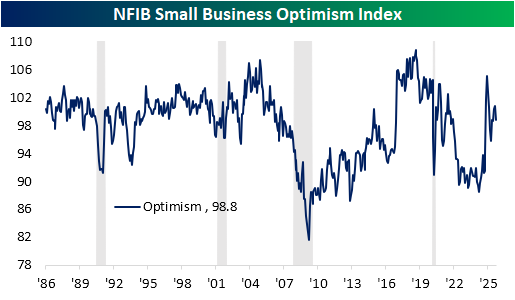

The continued US government shutdown means there remains a drought in official economic data, putting extra emphasis on unofficial data points. One such set of data is the monthly small business optimism from the NFIB released this morning. The headline index dropped to 98.8 in September versus 100.8 previously in August. As we often note, including in our discussion of the report's labor market readings in today's Morning Lineup, the NFIB survey has historically leaned right similar to how Michigan Confidence has leaned left. Such biases mean that the data has to be taken with a grain of salt and some categories become more worthwhile in gauging economic health than others. As shown below, optimism surged in the wake of President Trump's election last year. A similar surge was seen following the 2016 presidential election and vice versa after President Biden won in 2020. At current levels, optimism is middling versus the past decade's range.

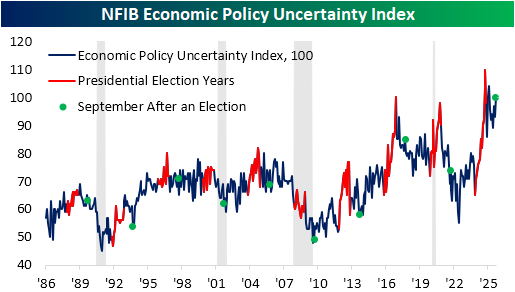

One area that is far from middling is uncertainty. Again, this is another indicator from NFIB that is a bit more sensitive to politics. Typically, the Economic Policy Uncertainty Index soars during Presidential election years and then pulls back in the following months; usually, that pullback is regardless of which party came out on top. During last year's run up to the election, this index saw a record climb, but interestingly, it has yet to reverse lower as it usually does after elections.

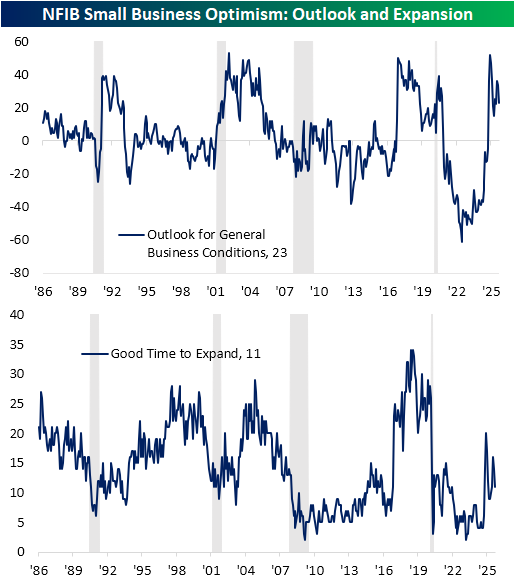

In other words, small businesses are still on edge when it comes to policy. That is putting a dampener on sentiment with fewer businesses reporting a positive outlook for the economy/general business conditions. Similarly, fewer respondents reported that they view now as a good time to expand their businesses.

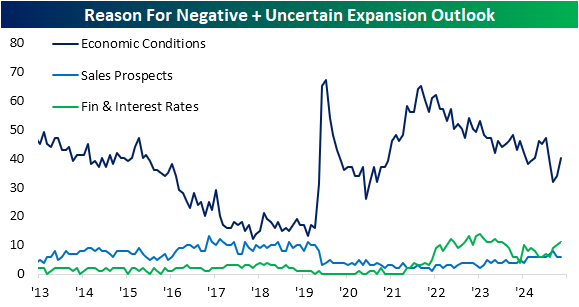

When it comes to the question of business expansion, respondents are also asked for the reasons for given outlooks. For those reporting negative and uncertain outlook, the largest share of respondents (40%) reported that it is due to economic conditions. That is up versus the multi-year low of 32% two months prior. While that reading is rebounding, it hasn't really reversed the downtrend of the past several years. While not shown in the chart below for legibility, the next two most common reasons given were cost of expansion and political climate; each of those came in at 12% which is right in line with their respective average over the past year. Finances and interest rates were right on their heels at 11%, and this reading has the more interesting trend. The share viewing rates and finances as restrictive to expansion has steadily been climbing despite the latest rate cuts.

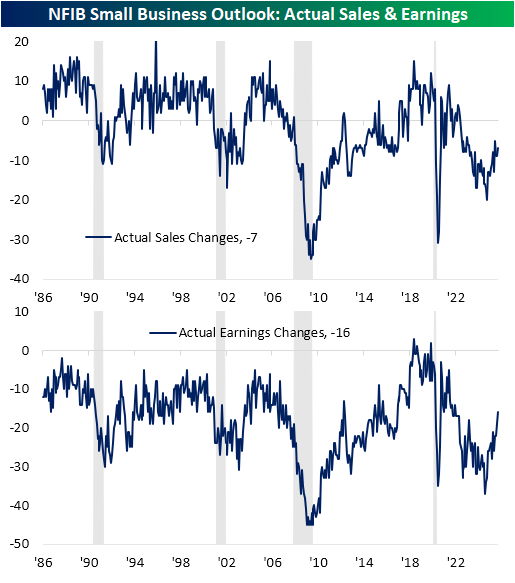

Finally, we would note that sales prospects are not a very common reason given for a negative or uncertain expansion outlook, and paired with other categories in the report, would overall suggest solid demand. As shown below, actual sales changes are negative (as has been the norm for the better part of the past 20 years) but approaching some of the strongest levels since Q1 2023. Meanwhile, actual earnings changes have rocketed higher up to the best level since December 2021.

More By This Author:

Q3 Earnings Season BeginsHomebuilders Struggle

Tech And Utilities Lead The Way

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more