Short Circuit

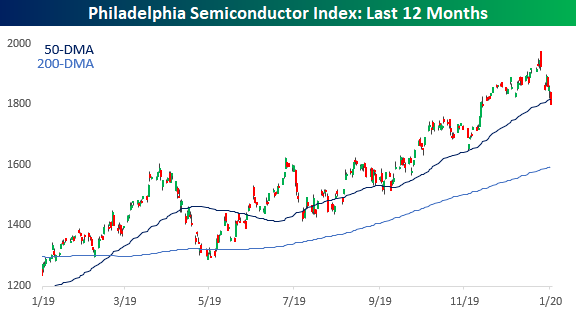

It was just a week ago that the Philadelphia Semiconductor Index (SOX) gapped sharply higher to record highs on the back of strong earnings from Intel (INTC). So much for that rally. By the end of the day last Friday, the SOX was actually down over 1%, and outside of a rally this past Tuesday, it has traded down every day since. From record highs on Friday morning, the SOX is closing out this week down more than 8% from last Friday’s highs and below its 50-day moving average (DMA) for the first time since October. For the last several months, the 50-DMA has acted as support for the SOX, so we’ll be watching closely to see how the index holds up in the days ahead. We’ve repeatedly discussed the importance of the semis as a barometer of the health of the broader market, so it will be important for the group to find its footing soon.

(Click on image to enlarge)

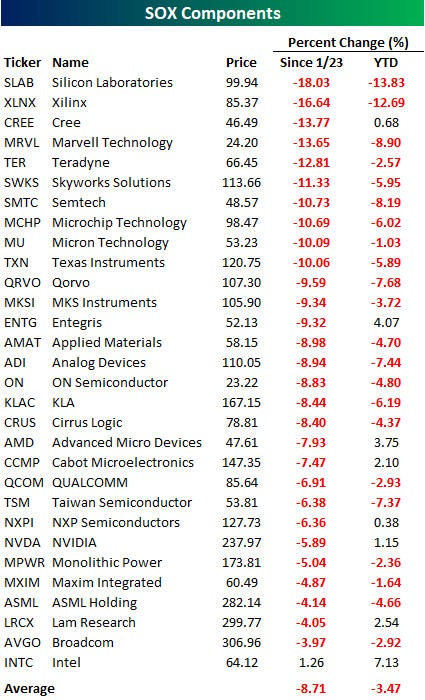

In terms of the SOX’s individual components, the weakness has been broad-based. Since its closing high on 1/23, every member of the SOX besides INTC is down, and INTC is barely up! The average performance of the index’s components since 1/23 has been a decline of nearly 9%, and a third of the components are down by double-digit percentages. Semis had been a leadership group for the market as recently as last week, but after the declines over the last five trading days, the average 2020 performance of stocks in the index is a decline of 3.5% and only eight components are up. Even for the semis, this has been a quick reversal.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional for full access to our research and market ...

more