Seasonal Headwinds Dying Down For Claims

The S&P 500 is rallying this morning in the wake of today’s weekly jobless claims print which gave investors at least some hope that data is flying in the face of the Fed’s recent hawkishness. Whereas expectations called for initial claims to remain below 200K for the eighth week in a row, claims jumped by 21K to 211K. That is the highest reading since the week of December 24th.

As we have noted in recent weeks, although the seasonally adjusted number has gone on an impressive streak of sub-200K prints, the unadjusted number never fell below that threshold. This week saw the reading rise to 237.5K, the highest since only the second week of the year. As shown in the second chart below, the first few months of the year have historically seen claims fall with the current week standing out as one with consistently higher claims week over week. Although the direction of non-seasonally adjusted claims this week is not particularly unusual, the 35.4K increase was much larger than the historical median increase of 14k usually seen for the comparable week of the year.

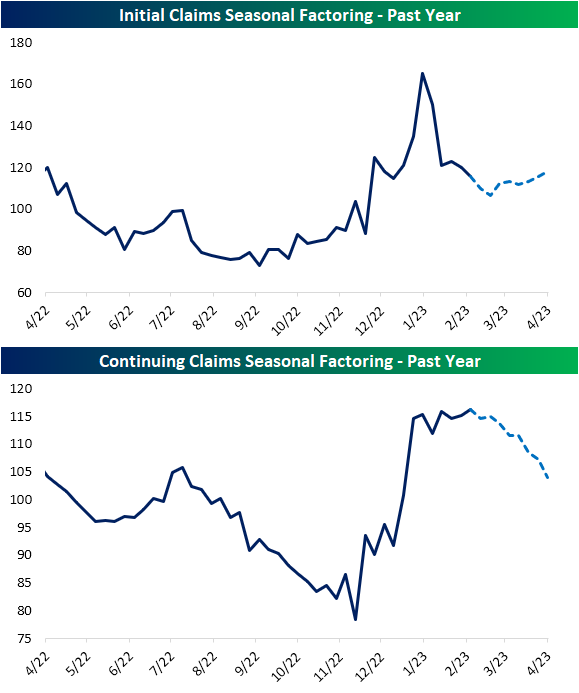

All of that means that claims in general are following seasonal patterns as could be expected. In the charts below, we show the seasonal factors for initial and continuing claims. Essentially, those factors represent how elevated claims are above what has been normal historically (a reading of 100 would indicate a normal reading). Looking ahead over the next several weeks, seasonal headwinds will persist but not to the same degree as the first couple of months of this year. As for continuing claims, the next several weeks will see seasonal factoring more consistently roll over even more sharply as we enter a period of the year with much less of a seasonal headwind.

Like initial claims, seasonally adjusted continuing claims came in above expectations this week rising back above 1.7 million. At current levels, claims matched the recent high from the week of December 17th which is back in the middle of the pre-pandemic range.

More By This Author:

Intraday Action Continues To Trump After HoursFedspeak Review As Powell Goes To Capitol Hill

Home Prices Falling Fast

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more