Revisiting The Relationship Between Debt And Long-Term Interest Rates

Image Source: Pexels

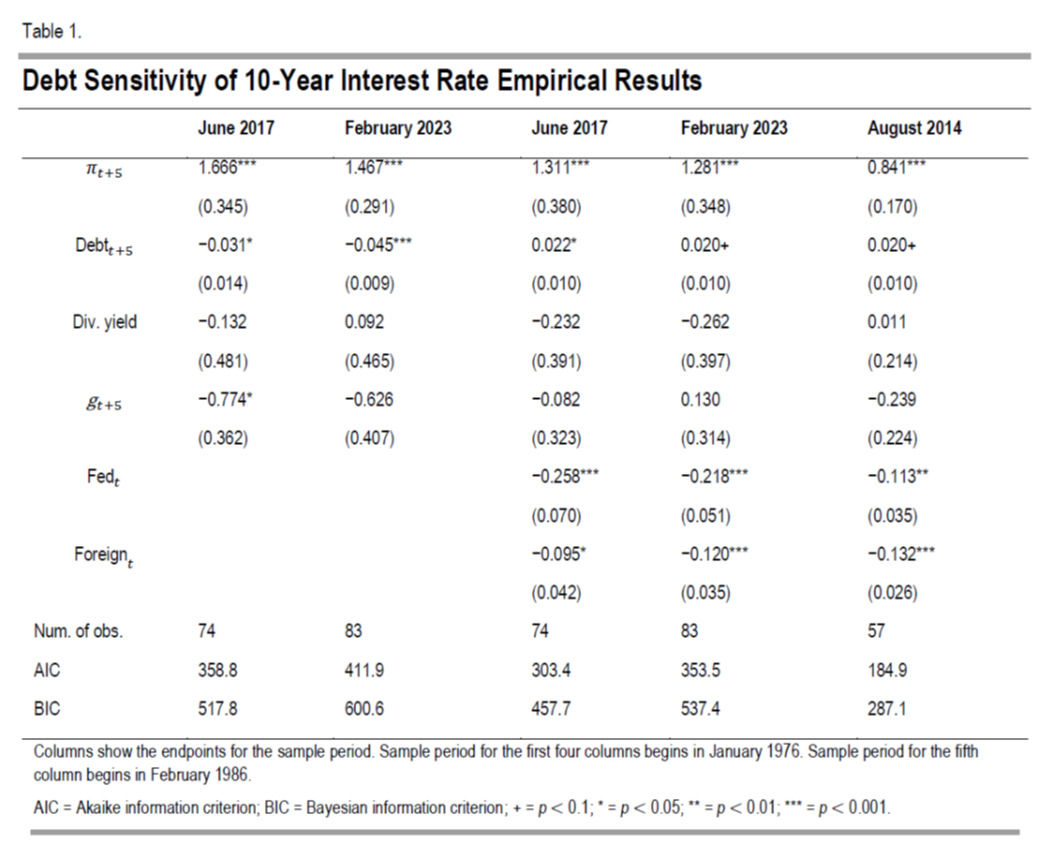

From CBO, a working paper by Andre R. Neveu (FDIC) and Jeffrey Schafer (CBO) on the debt sensitivity of the interest rate (DSIR):

Source: Neveu and Schafer (2024)

Each percentage point of increase in debt-to-GDP results in 2 bps increase in yields.

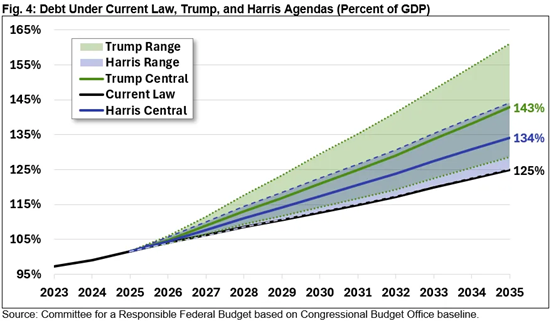

This parameter of interest given the possibility of a fast upward trajectory in debt-to-GDP, as shown here:

Source: CRFB, Oct 28, 2024

Of course, 2bps per ppt could be low or high. This is somewhat smaller than the estimates we found (Chinn and Frankel, 2004) in data up to 2002.

Maybe Trump will break all his promises, and debt proceeds at baseline. Or maybe he and the Congress will cut Social Security and Medicare benefits (dubious he’d raise taxes on high earners). But I’m guessing he’ll just tank the economy by raising tariffs, expanding deportations, and elevating policy uncertainty while extending the TCJA further blowing a hole in the budget.

More By This Author:

Intra-industry Trade EstimatedWhen Econ 101 Isn’t Enough: Oren Cass On Trade

Sentiment, Confidence, And Expectations: The Latter Is Down