Regional Fed Manufacturing Indexes Suggest 2025 Trends Are Slowly Abating

`

Image Source: Pexels

Although the federal government shutdown has been over for a month and a half, most of the data that has been released has lagged badly, especially including data on sales, spending, and business orders. That means that the most current measures of these are the ISM manufacturing and non-manufacturing reports, due later this week and next week, and the regional Fed banks’ manufacturing and services indexes.

While certainly not perfect, in the aggregate they at least sketch an outline of where the economy has been going in the past month. With the last regional manufacturing index reported this morning, here is the December update for that sector.

The chart below includes, in order, NY, Philadelphia, Richmond, Kansas City, and Texas. Month-over-month changes are in parentheses, with the absolute values for December following. The final number is the average change and absolute number for all 5 together.

Regional Fed: NY. PHL. RVA. KC. TX. Avg

Headline: (-22.6) -3.9; (-8.5) -10.2; (+8) -7; (-7) 1; (-0.5) -10.9; (-7.5) -5.2

New Orders (-15.9) 0.0; (+13.6) 5.0; (+14) -8; (+2) 0; ( -11.2) -6.4; (+0.5) 1.9

Prices Paid (-11.4) 37.6; (-13.5) 43.6 (-0.3) 6.5; (+4) 40; (+0.7 ) 36.0; (-4.1) 31.5

Prices Rec’d (-4.2) 19.8; (+6.7) 24.3; (+1.9) 5.0; (+9) 22; (-2.6) 6.2; (+2.1) 15.5

Wages* (n/a) n/a; (n/a) n/a; (0) 24; (n/a) n/a; (+6.4) 21.8); (+3.2) 23.0

Employment (+0.7) 7.3; (+6.9) 12.9; (+6) -1; (-15) -4; (-3.3) -1.1; (-0.9) 2.8

____

* only 2 of the banks report this information

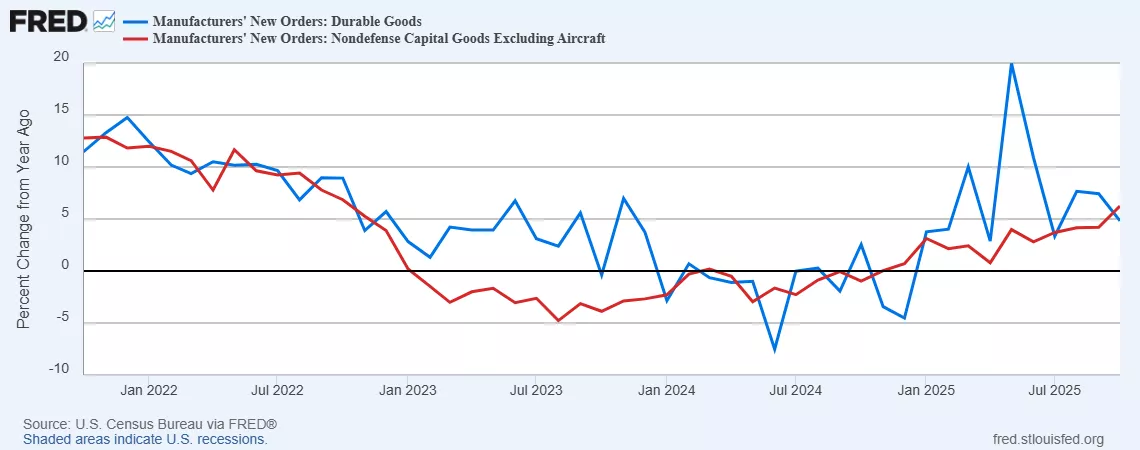

Last week, durable goods and core capital goods orders were updated through October, showing a -2.2% decline and a 0.5% gain, respectively. On a YoY basis, the trend of increasing strength has continued, at +4.8% and +6.2% respectively:

The December regional Fed reports suggest that while new orders have continued to be positive, the increasing trend has abated, with overall actual contraction of production. Prices paid by manufacturers continue to increase, but at a slower pace, while the prices they receive have firmed. Meanwhile, employment is barely positive, but wage growth continues.

Tomorrow, the Texas Fed will report on that region’s service sector, and that (larger) portion of the economy for December can be examined as well.

More By This Author:

How The “Wealth Effect” Fueled Q3 GDPThe Low Pace Of Firings Continues To Christmas

Strong Q3 GDP, But Long Leading Components Are Mixed; First Preliminary Positive Signs For Production In October