Rebound

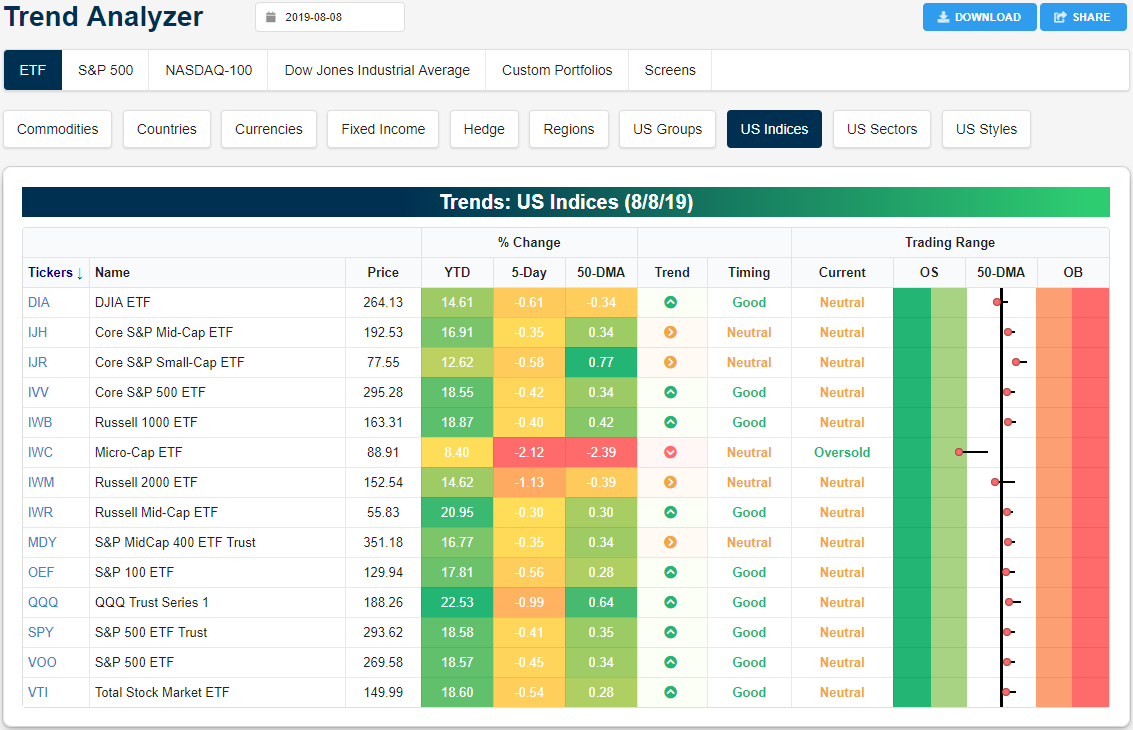

Equities are still lower than they were at the end of last week, but the past few days have seen a massive rebound which has eliminated most of the past week’s declines. Yesterday’s rally brought most of the major index ETFs back above their 50-DMAs.Only the Dow (DIA), Micro-Cap (IWC), and Russell 2000 (IWM) did not manage to break back above these levels. While IWM and DIA are both less than 0.4% away from their 50-day, IWC has much more progress to make until it does the same as it sits 2.39% below its moving average.IWC is also the only ETF of this group that is oversold and in a downtrend. Other major index ETFs have held onto their uptrends and are still showing good timing scores.

(Click on image to enlarge)

While the past week’s price action has been volatile, from a purely technical standpoint the past few days’ gains have marked a higher low on a longer-term chart for many of these ETFs. The Dow (DIA) and mid-cap ETFs like the Core S&P Mid-Cap (IJH) and S&P MidCap 400 (MDY) all found logical support close to the 200-DMA. On the other hand, IWC’s bottom earlier this week marked a lower low.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer, Chart Scanner, and much ...

more