Real Retail Sales Decline In February, Forecast Further Deceleration In Jobs Growth

Unadjusted for inflation, retail sales declined -0.4% in February, although January’s blockbuster number was revised even higher, from up 3.0% to 3.2%. Adjusted for inflation, real retail sales fell -0.8%. The below graph, which norms this reading to 100, shows that real retail sales have essentially been flat for almost 1 1/2 years:

(Click on image to enlarge)

Nevertheless, that is still 14% higher than just before the pandemic hit 3 years ago.

The trend in the official retail sales number is confirmed by the weekly Redbook sales report, which came in at higher by 2.6% YoY earlier this week, the lowest increase since February 2021:

(Click on image to enlarge)

Redbook is not adjusted for inflation, so in real terms, Redbook has been declining YoY for several months.

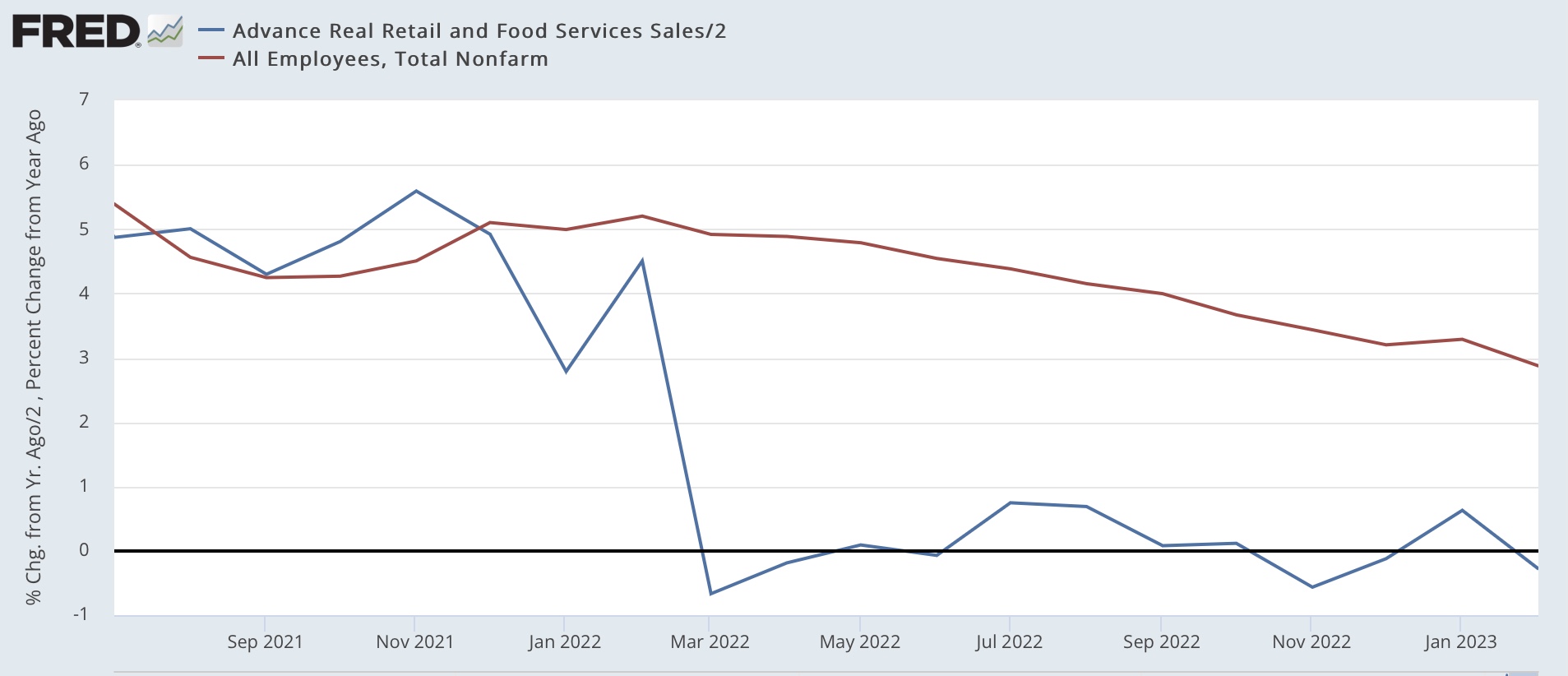

Because consumption leads to employment, the YoY% change in retail sales, /2, tends to lead jobs growth. Here’s what that looks like since July 2021:

(Click on image to enlarge)

Although I have discounted the YoY declines last spring vs. the pandemic stimulus spending spree of one year before, that there has been no growth in retail sales (except for January) since last summer strongly suggests that the deceleration in jobs growth is going to continue, and perhaps even intensify. Further, a YoY decline in real retail sales has almost always correlated with the onset of a recession. The continuing growth in jobs has been the biggest contraindication of that and is probably the only important reason we have not started into a recession yet.

In that regard, manufacturing and trade sales will also be released today. Adjusted for inflation, they are one of the 4 monthly indicators highlighted by the NBER in determining the onset of recessions. I plan on having a detailed comment later today, so stay tuned.

More By This Author:

Properly Measured, Consumer Prices Have Been In *Deflation* Since Last June

Thoughts On Silicon Valley Bank: Why The FDIC Plan Isn’t (But Also Is) A Bailout; And Why Systemic Risk Remains

February Jobs Report: The Decelerating Trend Resumes

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.