The Market Is Bullish On These 11 Stocks

The official presidential election season is now underway. Both parties have held their nominating conventions, and we have less than a hundred days until we know who will be the 45th president of the United States. With both candidates sporting the highest unfavorable ratings since those statistics were first measured and facing multiple scandals dogging both nominees, it seems fairly certain this will be one of nastiest contests for the White House in memory. No one exactly knows how this match-up will play out, but here are my four election predictions nonetheless.

Prediction 1: The “winning” candidate will receive 45% or less of the popular vote. With the Libertarian Party polling almost 10% recently and the Green Party with near five percent, either major candidate that gets 45% of the vote is probably the winner. This is a “voting against” election more than any contest I can remember. Mr. Trump and Mrs. Clinton are currently neck and neck in the polls although the latter has an easier electoral path to victory. I think whichever party wins the presidency will get thumped in the 2018 mid-terms as the outcome will not resolve the current political rancor of the nation.

Prediction 2: This lack of election mandate means that we will continue to have divided government after the election. To this point, Mr. Trump has not been the albatross around the Republicans’ neck that a good portion of the media thought he would be. This obviously could change before the election, but right now the Republicans look sure to keep their hold on the House and probably have a 40% to 50% chance of maintaining their leadership of the Senate as well.

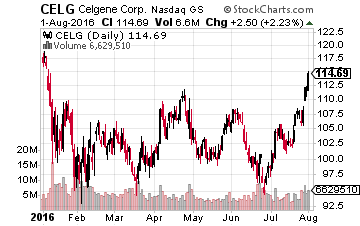

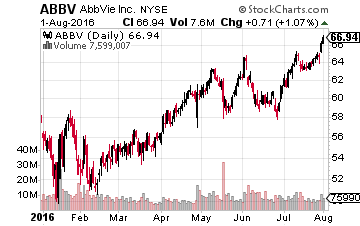

This means no major legislation will be able to get through without some bipartisanship support. In terms of how this will affect the market could mean fears around measures to restrain drug prices are probably overblown. This is one reason the biotech and pharma sectors have behaved much better recently after being locked into a bear market for most of the last year. Better than expected earnings from biotech stalwarts, AbbVie (ABBV), Amgen (AMGN) and Celgene (CELG), which all beat on the top and bottom line consensus, certainly were helpful as well. With the large caps in these sectors still near five-year lows as far as valuations are concerned, I am overweight both areas in my portfolio. These industries are also some of the few seeing good revenue and earnings growth even with these challenging global headwinds.

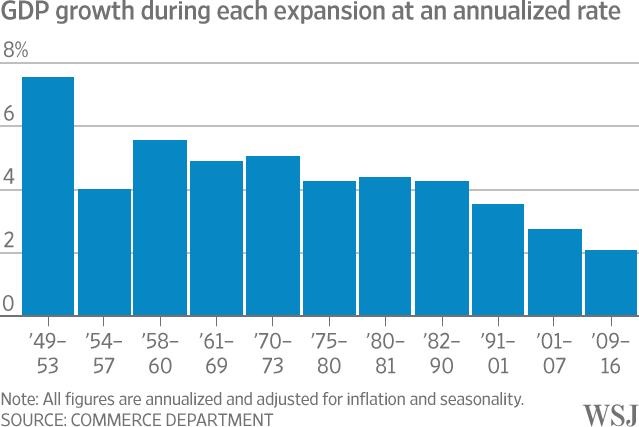

Prediction 3: Neither candidate will be able to reignite economic growth. The past seven years have seen by far the weakest post-war recovery on record. In addition, the current occupant of the White House will go down as the only president that served a full term in the nation’s history to never oversee one year of at least three percent GDP growth. This is in spite of historically low interest rates, the Fed quintupling its balance sheet, $800 billion dollars given in stimulus packages in 2009, and a near doubling of the country’s national debt.

To put all of that in perspective, the average GDP growth experienced in the four years after a recession officially ends is almost four and a half percent for the last nine post-war recoveries that preceded this one. The last deep recession (1980-1982) saw GDP rebound at a 5.3% annual clip from 1983-1986. We have managed two percent GDP growth over this “recovery,” and over the last three quarters we have grown at just over a stall speed of one percent.

Some of this is due to our aging demographics and a dismal global backdrop but part is due to ineffective fiscal and monetary policies as well as tepid productivity gains, over regulation and a steep decline in the labor participation rate. Unfortunately, I see neither candidate tackling the necessary tax, regulatory, and tort reform needed to significantly boost growth prospects.

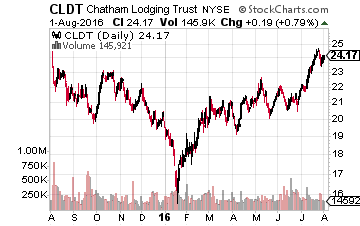

This means entities that can continue to deliver growth despite below trend domestic economic growth and anemic global demand will continue to be priced at a premium. Some names in this category include Facebook (FB), Alphabet (GOOGL) and Starbucks (SBUX). These companies should continue to be much sought after. It also means interest rates will remain near historical lows and high yielding concerns like Chatham Lodging Trust (CLDT) and Diamondrock Hospitality (DRH) will remain in demand.

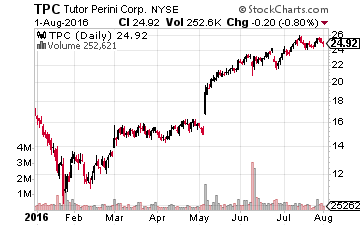

Prediction #4: One of the few areas of agreement and possible action from both parties after the election will be on infrastructure and housing. I expect a major infrastructure bill to be one of the few things that could garner bipartisan support. If we do get a significant infrastructure spending bill, Tutor Perini (TPC) and Sterling Construction (STRL) are two names I own that would benefit.

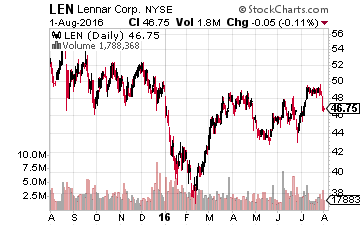

Both sides will also want to ensure that the recent improvement in the housing market continues as a big job creator. With mortgage rates at historical lows and with the home ownership rate at the lowest levels since 1965, this upward trend has years to run provided we do not have a significant recession. Homebuilders I like and own here include Lennar (LEN), TRI Pointe Homes (TPH), Taylor Morrison (TMHC) and LGI Homes (LGIH).

Those are my thoughts on the upcoming election and some investment plays in front of the second Tuesday in November.

Prediction #5: Domestic-focused small cap stocks will have a breakout year over the next 12 months. Fueled by low interest rates and cheap valuations, I expect M&A in the small cap sector to increase at a fast rate.

Disclosure: Long ABBV, AMGN, CELG, ...

more

Thanks for sharing