Omega Healthcare: 10% Yield – Significantly Undervalued

REIT Omega Healthcare Investors Inc (OHI)

Short-term pain leading to long-term gain.

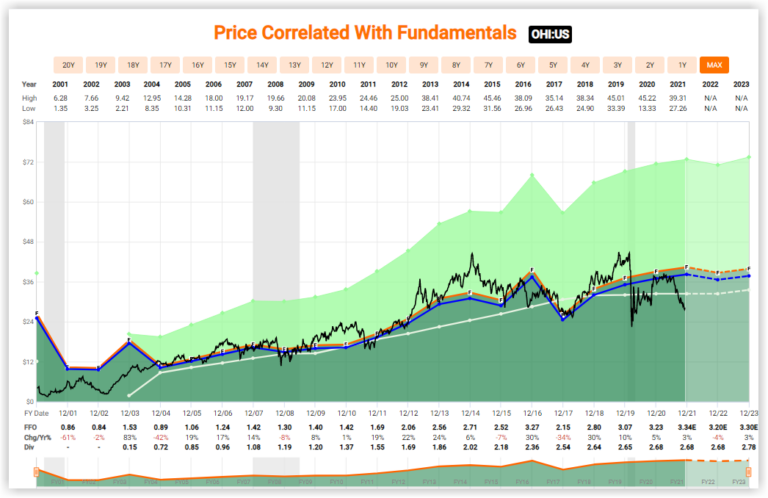

Omega Healthcare FAST Graph

Subscriber Request Series this week is Omega Healthcare: Update after the recent price drop. In this video, Mr. Valuation will illustrate that that despite temporary issues, Omega Healthcare represents a long-term opportunity for significant income and capital appreciation. In short, the company’s operating results support a higher valuation and this well-managed real estate investment trust (REIT) offers investors long-term potential at low levels of risk. The presentation I refer to in the video can be found here.

Video length 00:17:32

Disclosure: Long OHI at the time of writing.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or ...

more