Housing: Is It A Good Inflation Hedge?

Over long periods, the inflation-adjusted price of homes in the U.S. has tended to increase by a little more than 1% per year. However, this doesn't mean that owning a home is a good way to make a 1% real return on your money.[Let me explain.]

Written by Scott Grannis (Calafia Beach Pundit)

According to the Census Bureau, new homes have been getting bigger and bigger: since 1973, the average new house increased from 1660 square feet to 2687 square feet, for an annualized increase of 1.15%. New homes today are 1,000 square feet larger than they were in 1973, and living space per person has nearly doubled. Bigger and better houses explain why inflation-adjusted home prices have increased by a little more than 1% per year. On balance, and over long periods, homes maintain their value, relative to other goods and services. They are a thus a decent inflation hedge, nothing more.

Conclusions

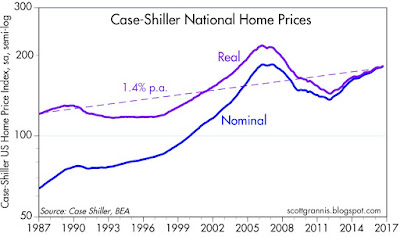

1. The first of the charts above shows indices of real and nominal national home prices since 1987, according to Case Shiller.

- Over that period, the annualized real rate of increase in home prices was 1.4%, only slightly faster than the long-term increase in the size of homes.

2. The second of the charts above shows real existing single-family home prices since 1968.

- Over that period its annualized increase was about 1.1% per year, very much in line with the increasing size and quality of homes.

In short, housing has been a decent inflation hedge, holding its value over long periods - nothing more

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

more

Housing is a zirpish QE inflating bubble. It is a decent hedge if the existing policies continue until they collapse. It is a horrible bet if the existing Federal Reserve policies end. The recent past is not a good indicator for the future here. This is merely a bet that the bubble will continue to grow long enough for you to be ok for a while. In reality, betting now is probably too late just like it was for the late housing bets in the last cycle.