High-Yield Medical Properties Trust Stock On Sale

Image Source: Pixabay

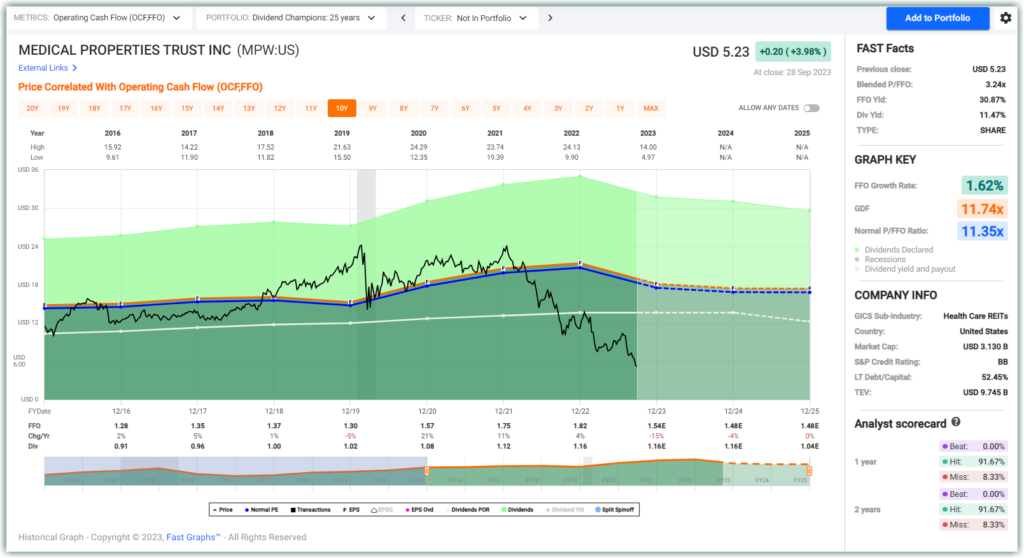

Update on Medical Properties Trust

Medical Properties Trust is a very controversial healthcare REIT. Most estimates range the fair value somewhere between $10 and $20 a share and the stock trades at around $5, just a little bit better than $5 a share.

You know, I’ve been coaxed and coerced and cajoled into doing an update on Medical Properties Trust.

First of all, it’s a specialty stock. It’s meant to be utilized in conjunction with a well-diversified portfolio in order to produce income, or I call it to turbocharge the income of a portfolio because of its high yield.

(Click on image to enlarge)

Medical Properties Trust stock was bought strictly to provide a higher level of income than you could get from traditional stock, and even after the dividend cut, the stock still does that.

I am content to hold this stock for years to come. Your decisions have to be your own. Enjoy the video!

Video Length: 00:10:36

More By This Author:

Growth, Income & Safety Is The Holy Trinity Of Dividend Growth Investing5 Dividend Growth Stocks With A Ratings And Very Little Debt

Are Consumer Staple Stocks Good Investments?

Disclosure: Long MPW

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more