Here Comes “The Fed Is Meeting!” Folly, Right On Schedule

If the past is prologue to the future, a 0.25% rate increase will send thousands of issues tumbling 3, 4, 5% and more. Is it possible the portfolios of the income stocks and mutual funds (ETF, CEF or open-end) you own will be yielding 3, 4 or 5% less the day or month after the rate rise? Unlikely. Yet this knee-jerk reaction strikes every time we are within a week of the Fed meeting. I know this because our profitable investments in this arena are now executing as our trailing-stop prices are reached.

“Weird,” you say. “But how does that make me any money?” Here’s how…

The selloff is overdone not only numerically but also “geographically.”’ That is, stocks in almost every sector are punished simply because they pay a good dividend. This makes no sense. Many dividend-paying companies, most notable for their yield, do better when rates are higher, not worse -- yet their stocks will sell off, too.

Nowhere is this more in evidence than among the best-quality utilities and REITs. We currently own just one utility, Madison Gas & Electric, now called MGE Energy (MGEE) and I don’t recommend it today. (I bought it as a growth utility when it was $21.13 a share; it’s now above $60 and has been paying me better than 5% a year ever since. For some positions, especially those in our asset classes that are designed for good ballast, you really can hold forever.)

This boring utility held like a rock through the 2007-2009 decline

We own more REITs, however, and if the usual reaction to a Fed rise holds, we will soon own more. If you are in any business that rents property (very often whether you know it or not from a publicly-traded REIT or one of their subsidiaries) one thing is certain besides death and taxes: your rents will go up when your lease is up for renewal. The same holds true if you rent your apartment. Here’s something else you know: if interest rates are higher, meaning your landlord’s borrowing and other costs have gotten higher, your rents will increase by that factor, as well.

So why the selloff in REITs that begins this week and will likely continue next week? No logic, but a wonderful opportunity. Yes, as rates rise, the yield currently paid by REITs may become incrementally less attractive than it was last week. But also, as rates rise, increased borrowing costs will be passed along via rent increases to commercial and residential tenants. In this area I particularly like triple-net-lease REITs and am taking some profits on currently-held REITs in the health care and alternative energy field in order to have cash available to buy the very best of these.

There are two triple-net lease REITs that I particularly respect for the quality of their balance sheets, the savvy of their management teams, and the sustainability of their revenue and earnings streams. Now if I can just get the final piece of the puzzle to fall into place – a price I’m happy to pay. That moment may come this week or next.

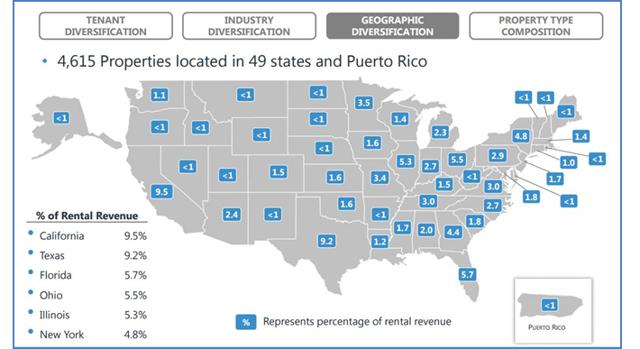

Realty Income (O) is already owned by some clients and has been for a long, boring, profitable time. The story at O is that it owns more than 4,600 properties, most of which are free-standing, triple-net-lease, single-tenant properties. They cover the waterfront, with tenants in 49 states and Puerto Rico and in 47 diverse industries.

The company’s latest coup has been to add industrial, manufacturing, warehousing and distribution, and office buildings to their portfolio. They also recently brought on a portfolio of 7-Eleven stores. This new tenant may represent only 2% of the portfolio but it is one that generates enough revenue in good times and bad to meet its obligations. Other, larger, tenants include Walgreens at 7% of the portfolio, FedEx at 5.5%, Dollar General at 4.2%, and LA Fitness at 4%. Like these, most tenants are either non-discretionary or quite defensive during downturns.

The company pays a dividend monthly that yields an annual 4.2% at its current price and has a history of increasing those dividends every single year. It has never missed paying a dividend since its founding in 1971.

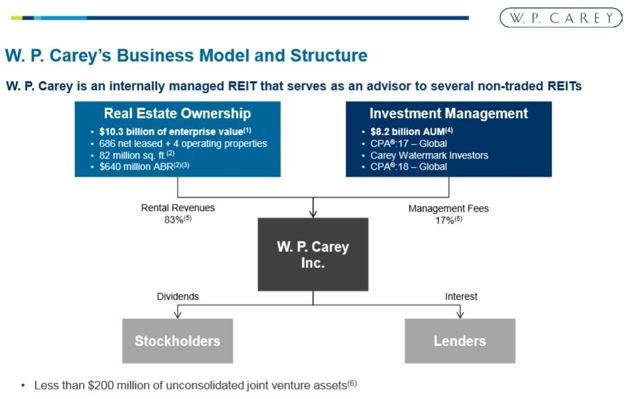

The second company I favor and some clients already own at lower prices is W.P. Carey (WPC). It is the nation’s 3rd-biggest net-lease REIT after O and Vereit (VER), though it is a global firm not limited to just the USA. One big difference between WPC and O is that O relies heavily on the retail sector, albeit defensive and non-discretionary retailers that don’t depend on consumers having discretionary income to spend.

WPC on the other hand has most of its properties rented to industrial firms and for office services. Retail comprises just 1/6th of the mix, just above warehousing as another key component. And more than a third of its business comes from properties outside the US, primarily in Germany, the UK and other European nations.

Carey also manages some private (that is, non-publicly-traded) REITs. Unlike other externally-managed entities, however, WPC management receives no compensation, bonuses or incentive compensation for their efforts. Their successes in this area flow directly to WPC shareholders.

The company pays a dividend priced to yield 6.2% and sells at a Funds From Operations ratio of just 13.

I plan to purchase both firms on the pullback I expect to see as a result of the knee-jerk reaction from a likely Fed rate increase.

Disclaimer: I encourage you to do your own due diligence on issues I discuss to see if they might be of value in your own investing. Past performance is no guarantee of future ...

more

Thanks for sharing

Thanks for the insight into what's behind the #REITs sell-off. Does sound like an opportunity indeed!

At least we don't have to wait long to find out if this plays true again this time...

;>}