Existing Home Sales Drop To Lowest Full Year Total Since 1995

Image Source: Unsplash

Existing home sales fell for the 20th time in 23 months to a level last seen in 2010. Annual sales are at the lowest total since 1995.

National Association of Realtors data via the St. Louis Fed.

The National Association of Realtors notes Existing-Home Sales Slid 1.0% in December

Key Points

- Existing-home sales waned 1.0% in December to a seasonally adjusted annual rate of 3.78 million.

- Sales faded 6.2% from the previous year.

- The median existing-home sales price rose 4.4% from December 2022 to $382,600 – the sixth consecutive month of year-over-year price increases.

- On an annual basis, existing-home sales (4.09 million) fell to the lowest level in nearly 30 years, while the median price reached a record high of $389,800 in 2023.

- The inventory of unsold existing homes slumped 11.5% from the previous month to 1 million at the end of December, or the equivalent of 3.2 months’ supply at the current monthly sales pace.

Existing-Home Sales Seasonally Adjusted

Existing-Home Sales Supply

Existing-Home Sales Percent Year Ago

Existing-Home Sales Long Term

Chart courtesy of Trading Economics and the NAR

NAR Chief Economist (Cheerleader)

“The latest month’s sales look to be the bottom before inevitably turning higher in the new year,” said NAR Chief Economist Lawrence Yun. “Mortgage rates are meaningfully lower compared to just two months ago, and more inventory is expected to appear on the market in upcoming months.”

My Opinion

Never a worse time to buy.

Mortgage rates are down from 7.9 percent to 6.9 percent. But the median price is the highest ever. Until we see a combination of lower price and lower mortgage rates, home sales are headed nowhere even if they have bottomed.

Whereas the overall consensus thought there would be a recession last year, almost no one thinks so now. If we head into recession, the bottom is likely not in.

Too many people are stretching to buy a house, needing a huge percentage of their annual income to do so. To maintain standards of living, credit card use is soaring.

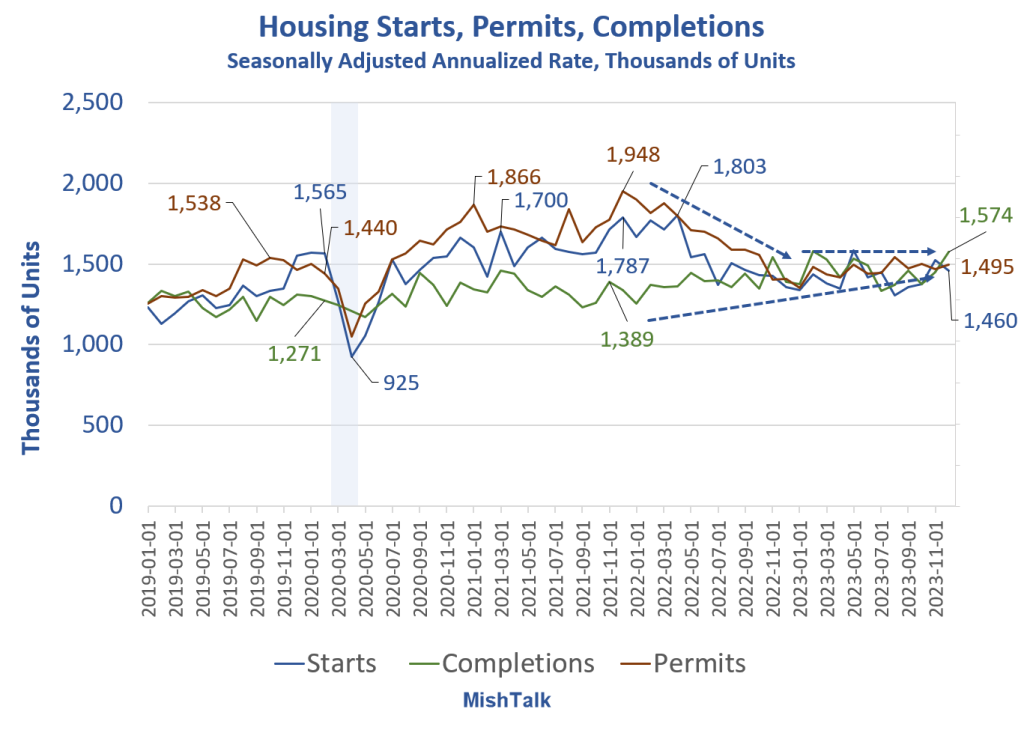

Housing Starts Drop 6.6 Percent on Top of Negative Revisions

Housing starts and permits continue to flounder as completions slowly rise.

Housing data from Census Bureau, chart by Mish.

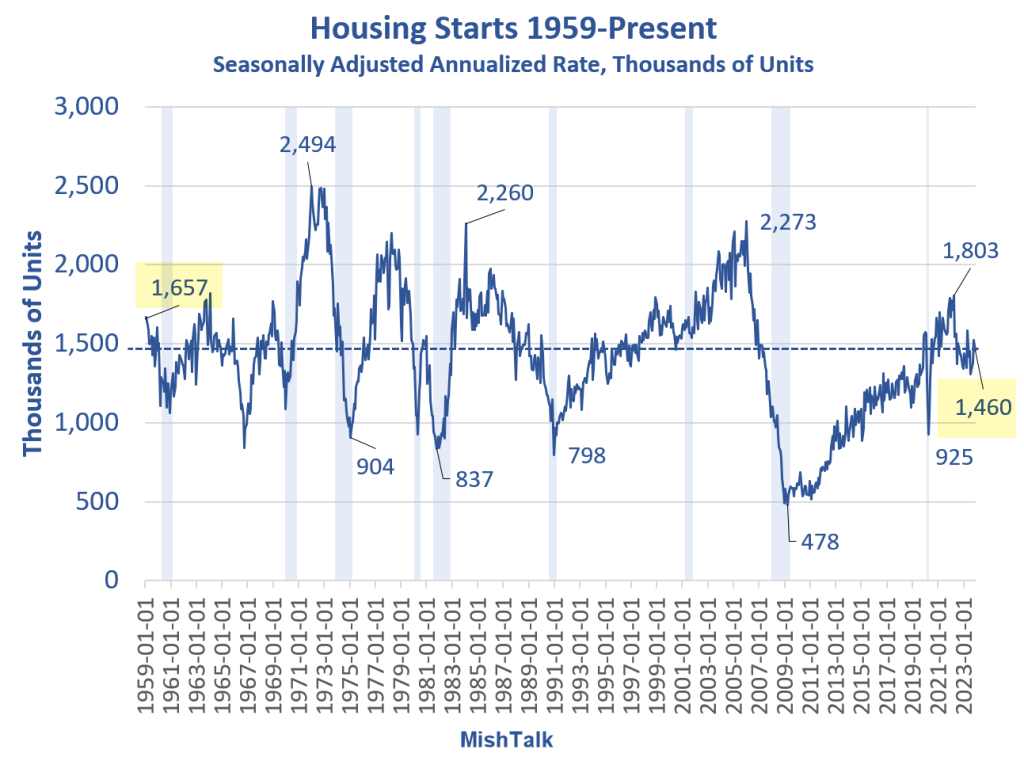

Housing Starts 1959-Present

Housing starts are well below where they were in 1959.

For further discussion, please see Housing Starts Drop 6.6 Percent on Top of Negative Revisions

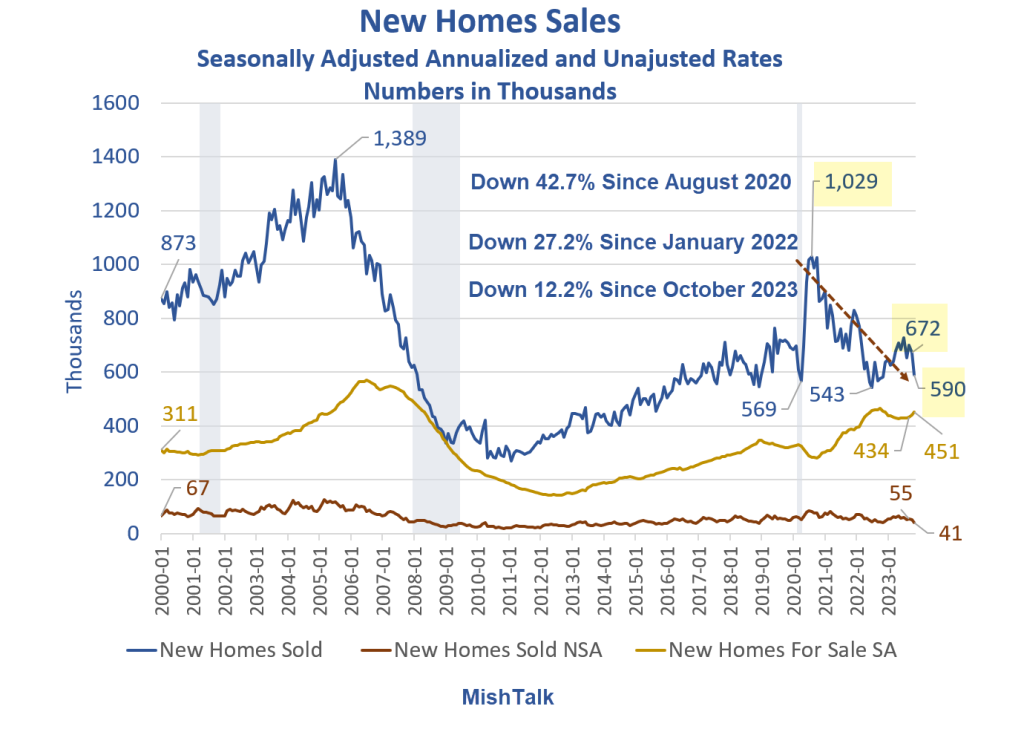

Huge Thud in New Home Sales

Home builders finally ran out of incentives or consumers finally got fed up with what they are getting for their money. Here’s the result in pictures.

New home sales from Census Department, chart by Mish

For discussion, Huge Thud in New Home Sales, Down 12.2 Percent in November

What About Insurance?

Please consider Canceled! Are You at Risk of Losing Your Home Insurance?

Insurance costs are soaring and companies are canceling policies and upping rates. Don’t blame climate change. I address the real reasons for this mess.

Are things really so bad that a recession can’t make worse? Is soft landing now insured? Inflation tamed?

I have my doubts, but we will find out.

More By This Author:

When Will Record Housing Units Under Construction Impact The Price Of Rent?

Housing Starts Drop 6.6 Percent On Top Of Negative Revisions

Bitcoin Technical Support And Resistance Levels, It’s Middle Of Nowhere Now

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more