Affordability Of New Homes Continues Decline

New homes continued to become less affordable for the typical American household according to the latest data published by the U.S. Census Bureau.

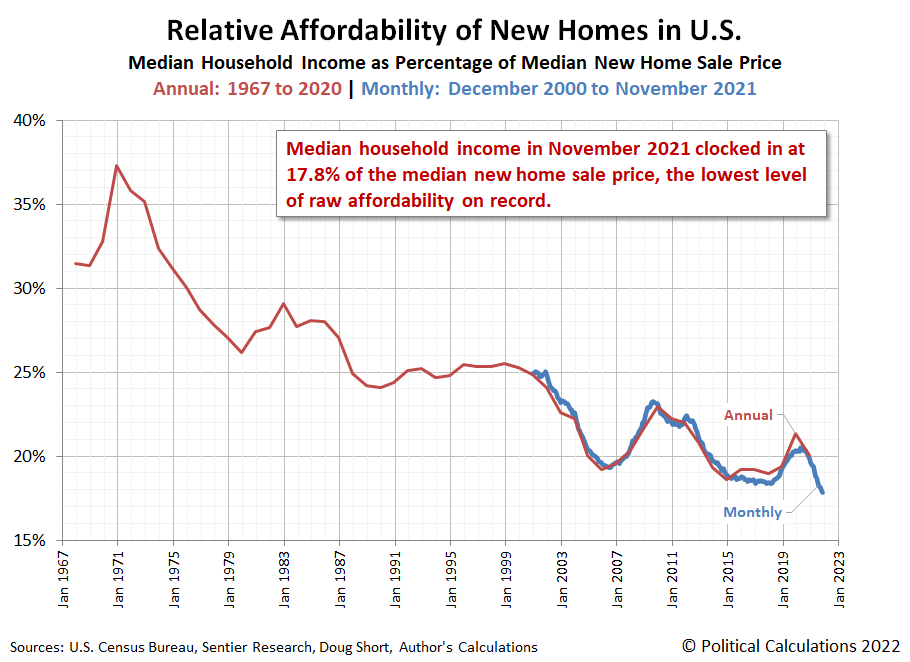

Data released just before the Christmas holiday for November 2021 confirms that trend, in which the raw measure of relative affordability for a new home reached a new all-time low. The following chart shows how low with annual data from 1967 through 2020 and with monthly data from December 2000 through November 2021:

A different measure of relative affordability that takes mortgage rates into account also points to new homes becoming more expensive. The next chart shows the mortgage payment of a median new home sold as a percentage of median household income from January 2000 through November 2021:

The cost of a mortgage payment for a median new home has risen from a pandemic recession low of 24.5% of median household income in April 2020 to 29.4% in November 2021. That's despite U.S. mortgage rates being held at near all-time lows during this period.

So not only is the U.S. new home market shrinking, rising prices for new homes mean housing is becoming less affordable for the typical American household. Isn't that the exact recipe for stagflation?

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 December 2021.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 December 2021.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 23 December 2021.