Real Average Nonsupervisory Wages Near, Real Aggregate Nonsupervisory Payrolls At All-Time Highs

Now that we have the CPI reading for June, we can calculate how average wag earners are doing in “real” terms.

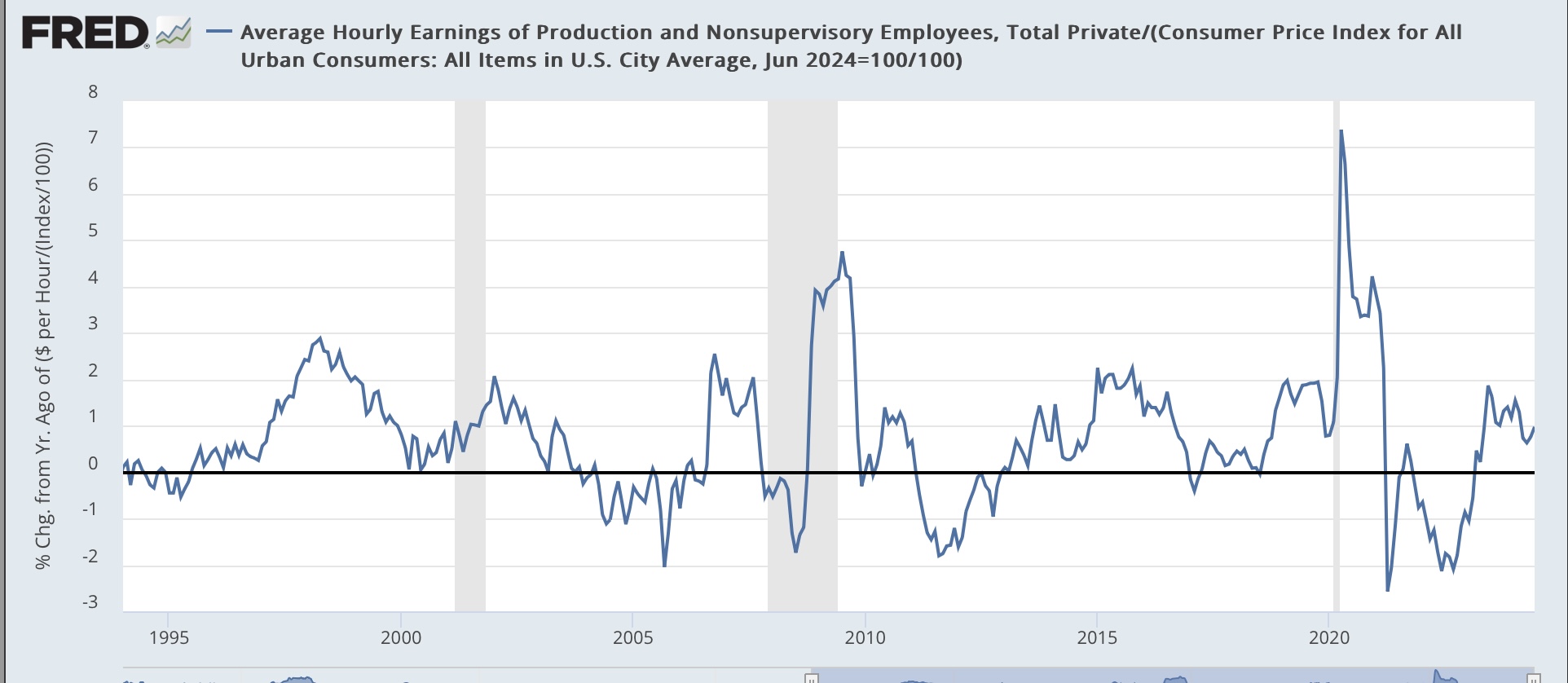

First, real average hourly nonsupervisory wages increased 0.4% for the second straight month. On a YoY basis, they have risen slightly under 1.0%:

This is on par for average real wage growth for the past 30 years.

More importantly, in absolute terms after declining earlier this year, real average hourly wages are at their highest level since September 2021, and only 0.1% below that month and December 2020 for the highest all-time real wages excluding the three lockdown months that were subject to extreme labor force distortions (since so many more low wage workers were laid off compared with office workers):

Although I won’t bother with the long term graph, the previous all-time high in January 1973 was never exceeded before the pandemic. June’s reading was 0.7% higher than that.

Second, and perhaps even more importantly, real aggregate nonsupervisory payrolls rose 0.2% in June to another all time record high (blue in the graph below, right scale). On a YoY basis, they are up 2.3% (red, left scale):

I particularly like this metric because, not only does it measure the “real” well-being of average American workers, but it has been an infallible short leading indicator for the economy for almost the past 60 years, as shown in the pre-pandemic historical graph of the same information as above (note blue line is in log scale to better show shorter term trends):

To recap what I have written previously, not only have absolute real payrolls always peaked at least several months before a recession, but the rolling over process has tended to be gradual rather than sudden. And on a YoY basis, real aggregate wages almost always turn negative within two months before or after the onset of a recession.

As shown in the first graph above, real aggregate nonsupervisory payrolls show no signs of rolling over. That is an excellent indication that the expansion has some time to go.

While I am at it, here is the latest monthly estimate through May of real median household income from Motio Research:

Per their calculations, real median household income is 0.2% its all-time non-lockdown high set this March.

More By This Author:

A Somnolent Consumer Price Report, With Headline Yoy Inflation Marginally Under 3%, Tests Whether 2% Inflation Is A Target Or A Ceiling For The FedOn Jobless Claims, The Unresolved Seasonality Hypothesis Is Holding Up

The Leading Sectors Of The Labor Market Are Still Generally Trending Positive