Quicker Recovery Than Financial Crisis?

It’s ironic that after we talked about how the ADP report has been so wrong this year it isn’t being followed as much that it was fairly accurate this month. Remember, November’s ADP report stated there were 307,000 private sector jobs added. In the BLS report, there were 344,000 private sector jobs added which missed estimates for 590,000, and the lowest estimate which was 400,000.

This report was so bad that it was good because it means a stimulus is more likely. Mitch McConnell has been holding back on stimulus packages because of the great jobs reports. This might make him give in since it seems like the December report is only going to get worse. The 10-year yield certainly sees a stimulus as it rose 6 basis points to 0.97% after the report came out. Normally, a bad report would have caused it to fall a few basis points.

The short sellers can’t catch a break. Whether reports are good or bad, stocks rally. Even with the vaccines and rising rates, the Nasdaq 100 keeps hitting records (up 10 straight days as of Monday). Value stocks are doing well (best month ever in November) along with the most shorted stocks. Short sellers have nowhere to hide.

Just Getting Back To Even

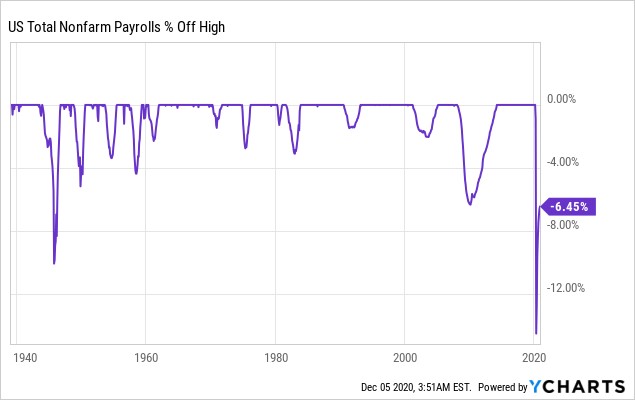

This was a pretty bad labor report because October’s private sector job creation was revised down 29,000 to 877,000 along with the miss this month. Overall November job creation was 245,000 which was less than half of estimates (500,000). As you can see from the chart below, employment is 6.45% off its pre-recession peak (9.8 million off peak employment). That’s near the trough of the last recession which was -6.34%.

We are only just approaching the worst of the financial crisis despite having 7 months of amazing job creation. Plus, initial unemployment claims rose in the past 2 weeks excluding the Thanksgiving-effected report. Furthermore, 13.4 million people are on the precipice of losing their pandemic unemployment insurance (December 26th). It’s not a good situation. On the positive side, despite the recent weakness, we could see another spike in job creation once vaccines are distributed enough to cause herd immunity.

Courier Saves This Report

The government lost 99,000 jobs as the chart below shows. The good news is unlike in October, these losses were almost all because of the census which caused 93,000 in losses. State employment was flat and local employment was down 13,000. As you can see from the chart below, transportation and warehousing created 145,000 jobs. That’s 59% of all jobs created. Amazon is hiring the most jobs any company has ever hired in such a short amount of time. Online ordering is changing the economy. It’s scary because Amazon is trying to make all these jobs obsolete by using robots. There were 82,000 courier jobs created.

There's an interesting #ecommerce story in the payroll data: #Retail trade: -35K (seasonally adj)

— Daniel Zhao (@DanielBZhao) December 4, 2020

Transportation & warehousing: +145K!

That's largely driven by:

Couriers & messengers: +82K

Warehousing & storage: +37K

Truck transport.: +13K#JobsReport #JobsDay 7/ pic.twitter.com/99CDZd6F7M

Private education lost 6,000 jobs and healthcare added 60,000 jobs. Remember, contrary to what you would think, healthcare was decimated by the pandemic because of the decline in elective surgeries. Retail lost 35,000 jobs and restaurants lost 17,000 jobs. Those will probably get worse in December. It’s impressive restaurants didn’t lose more jobs considering the recent decline in reservations in the past few weeks. Many restaurants are holding on for dear life. Manufacturing added 27,000. That’s not that many if Markit is right about manufacturing optimism being the strongest in years.

Recovery Timing

The underemployment rate fell from 12.1% to 12%. The unemployment rate fell from 6.9% to 6.7% which sounds better than it is. It sounds better than it is because the labor force participation rate fell 0.2% to 61.5% which means it is down 1.9% from before the recession. The prime-age labor force participation rate fell 0.3% to 80.9% which is 2.1% below where it was in February. The economy is still missing 9.8 million jobs.

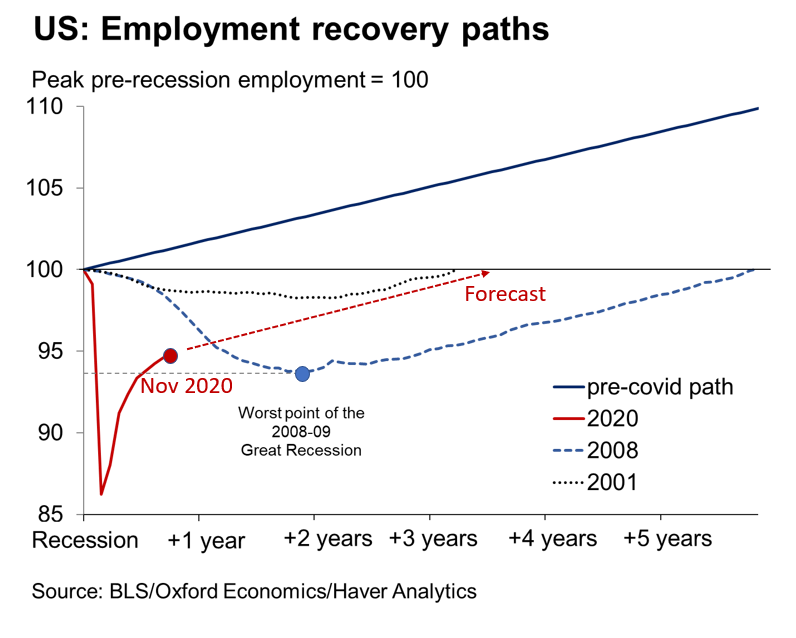

As you can see from the chart below, Oxford Economics predicts a full recovery 3.5 years after the recession started which means it is a little less than 3 years away. This should be a quicker recovery than the financial crisis, but that depends on how quickly the vaccines are distributed.

Not As Bad As 2008-09

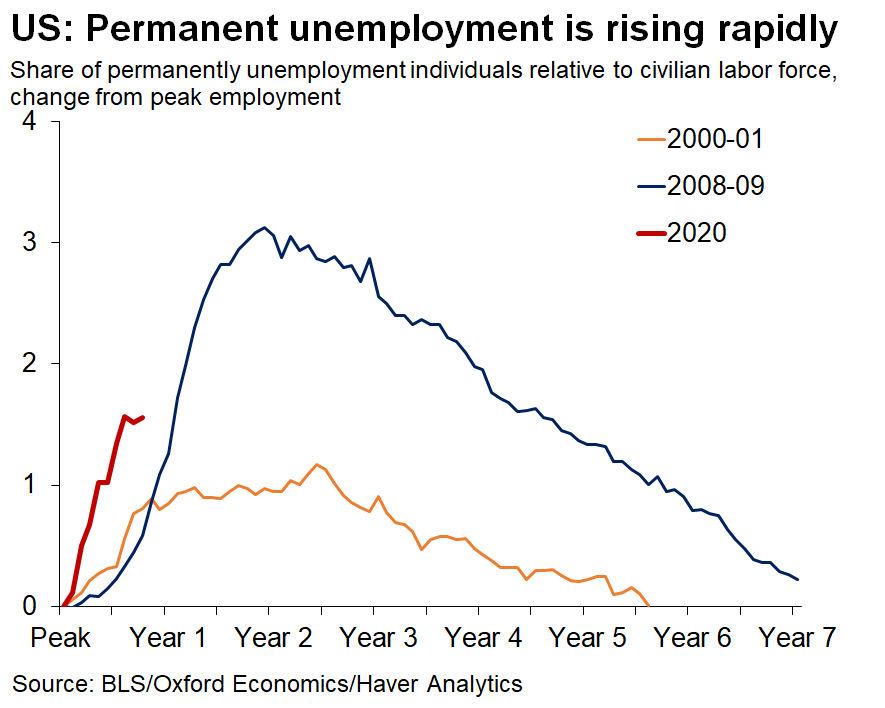

One way the labor market isn’t as bad as the last recession is permanent unemployment. As you can see from the chart below, the number of permanently unemployed people as a percentage of peak employment is worse than the 2001 recession but less than the peak during the financial crisis recession. This is one aspect where this November report wasn’t terrible as the number of permanently unemployed people only rose from 3.684 million to 3.743 million which is slightly below the September peak (3.756 million). That peak will probably be broken in the next couple months, but we are very close to the end of this increase. Once the vaccines go out, we will see a real recovery in the labor market.

Average hourly wage growth was 0.3% which beat estimates for 0.1% and last month’s 0.1%. Yearly growth stayed at 4.4% which beat estimates by a tick. The average workweek stayed at 34.8 hours which met estimates. Average weekly wage growth was 5.9% which was the highest since May. We’ve seen high wage growth in this recession because the economy changed causing some industries to actually have very tight labor markets. Usually, wage growth comes from composition effects in recessions as low wage workers lose their jobs. We are actually seeing some legitimate wage hikes in the winning industries in the COVID-19 economy.

Conclusion

This wasn’t a good jobs report which was actually bullish for cyclical stocks because the market immediately priced in a stimulus. Short sellers can never win. The labor market recovery has only gotten us to the depths of the financial crisis. Without transportation and warehousing, this would have been a terrible report. Recognize the census suppressed the overall reading. The economy is missing 9.8 million jobs most of which should come back when the economy reopens after the vaccines go out. The good part of this recession is there weren’t as many permanent job losses so the recovery can be quicker than after the financial crisis.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more