Q4 GDP Revised Lower As Core PCE Unexpectedly Comes In Hot

One month after the first Q4 GDP estimate surprised to the upside, coming in at 2.9% vs expectations of a 2.6% number, moments ago things gradually reverted to normalcy for a Biden admin that has seen its fair share of grossly manipulated economic data, when the BEA reported in its 2nd estimate of Q4 GDP that the economy actually grew almost as expected one month ago, revising the GDP print to a 2.7% (2.68% to be precise) increase from 2.9%.

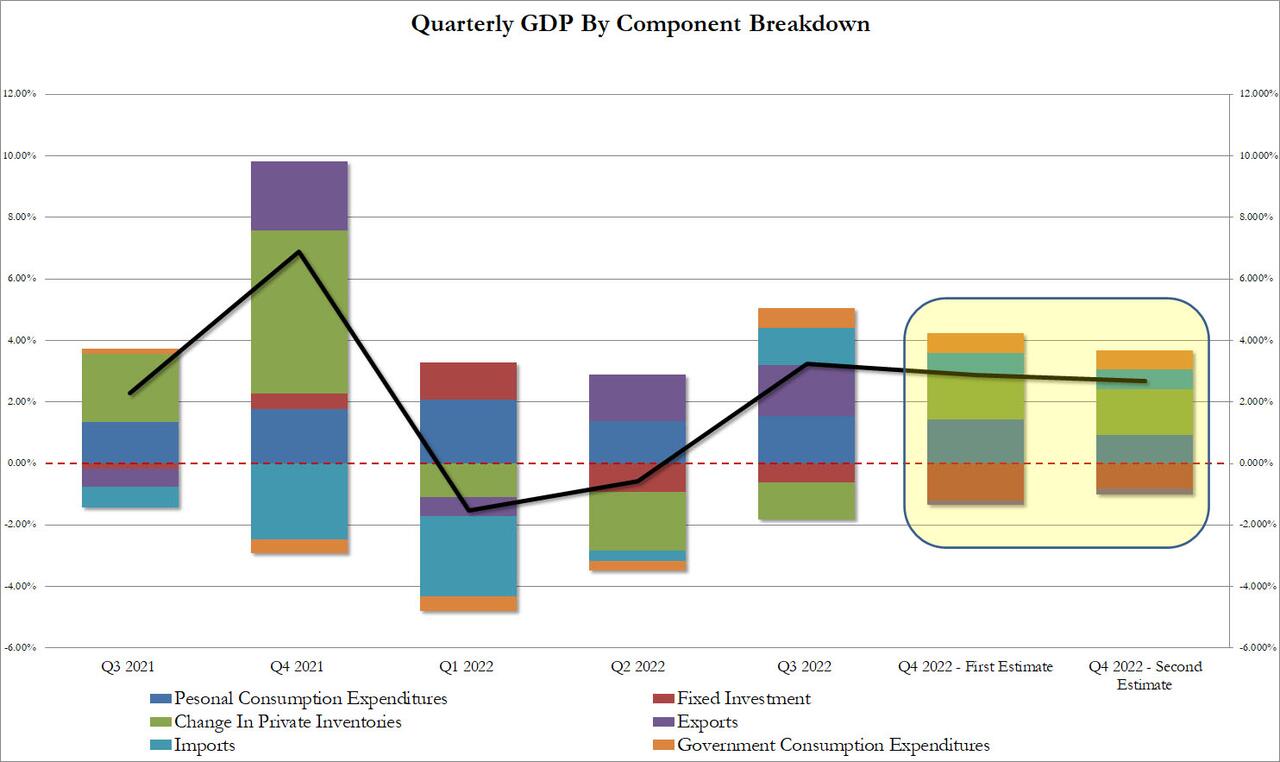

The fourth-quarter increase in real GDP reflected increases in inventory investment, consumer spending, business investment, federal government spending, and state and local government spending which were partly offset by decreases in housing investment and exports. Imports, which are a subtraction in the calculation of GDP, decreased.

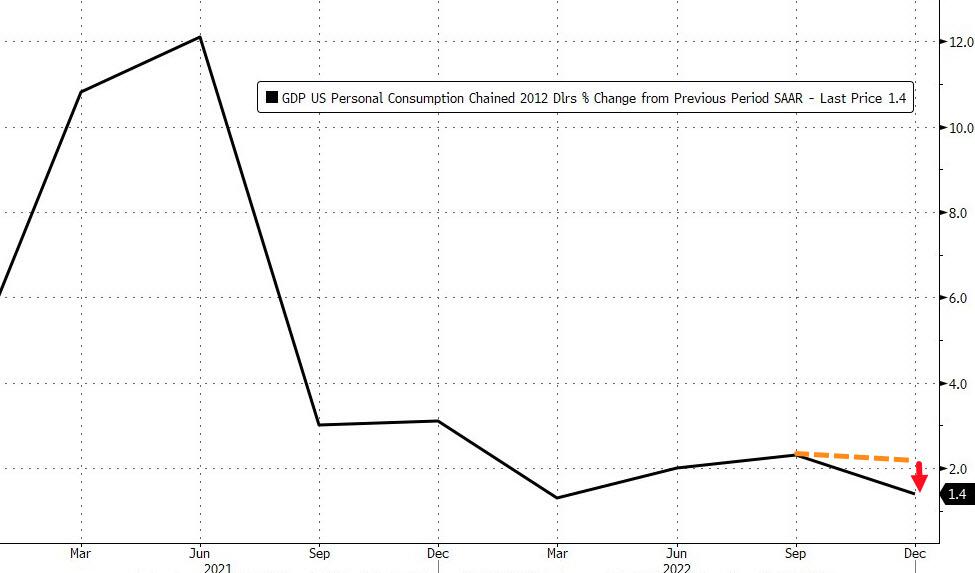

Turning to the revisions from the first estimate, real GDP was revised down 0.2% from the “advance” estimate and reflected a sharp downward revision to consumer spending (both goods and services) that was partly offset by an upward revision to business investment.

Specifically, this is how the revisions affected the 2.7% GDP bottom line:

- Personal consumption was revised from 1.42% to just 0.93%, as the spending spree that supposedly defined the end of 2022 fizzled.

- Fixed Investment offset much of this, however, with the original GDP deduction of -1.20% declining to just -0.81%

- The Change in Private Inventories was effectively flat, or 1.47% vs 1.46% in the initial estimate

- Net exports were a smaller contributor to GDP, adding 0.46% vs the 0.56% initial estimate

- Government added 0.63%, in line with the 0.64% print initially.

As a reminder, with the change in private Inventories set to tumble as consumers save even more now that the Covid excess stimies have run out (and thus spend less), this means that Q1 GDP will come in far cooler than this print.

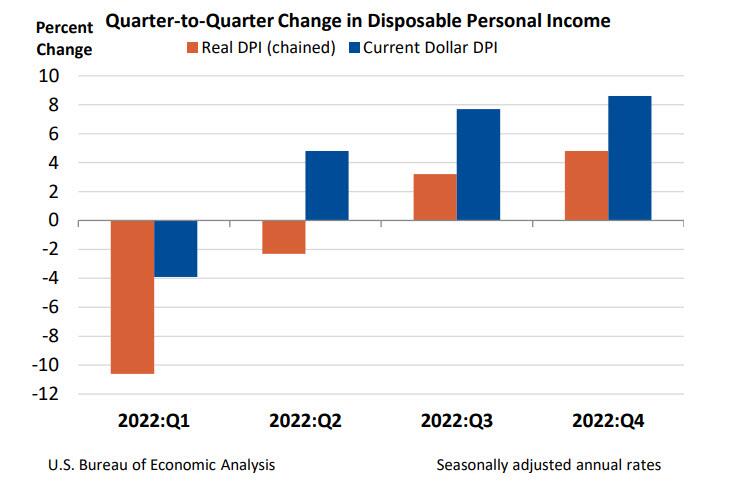

The BEA also reported that as a result of recent revisions, real disposable personal income (DPI)— personal income adjusted for taxes and inflation—increased by 4.8% in the fourth quarter after increasing by 3.2% in the third quarter. Current-dollar DPI increased 8.6% in the fourth quarter, following an increase of 7.7% (revised). The increase in current-dollar DPI for the fourth quarter primarily reflected increases in compensation and personal current transfer receipts. On the other hand, personal savings as a percentage of DPI was 3.9% in the fourth quarter, compared with 3.2% (revised) in the third quarter.

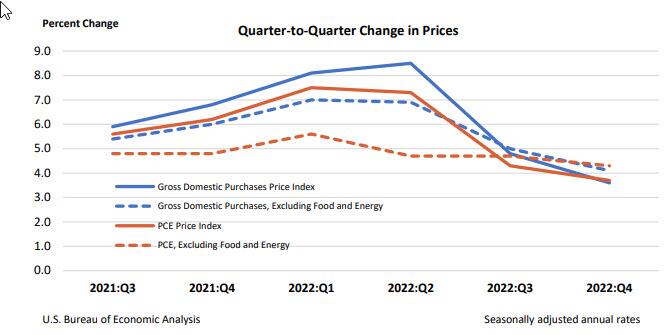

Yet while GDP was revised lower, as the BEA finally admitted that the US consumer was getting tapped out, the market generally ignored the aged data as we have much more granular monthly updates; however what did spook futures was the BEA's sharp upward revision to the GDP Price Index and Core PCE, which unexpectedly came in red hot:

- GDP Price Index 3.9% vs 3.5% in the first estimate, and well above the 3.5% consensus estimate.

- Core PCE Q/Q up 4.3% vs 3.9% in the first estimate, and also well above the 3.9% consensus estimate.

Despite the upward revision, the trend remains a declining one, even if the slope is somewhat shallower: as the BEA also notes, GDP prices, the prices of goods and services purchased by U.S. residents, increased by 3.6% in the fourth quarter after increasing 4.8% in the third quarter. Excluding food and energy, prices increased by 4.1% after increasing by 5.0%.

In kneejerk response, emini futures slid from session highs hit just before the GDP print by some 10 points as traders were spooked by the hotter core PCE print, although they promptly rebounded remembering that this data is quite stale and that tomorrow we will get a more timely update for Personal Income, Spending, and PCE Deflator for January, and which will likely show continued disinflation.

More By This Author:

WTI Extends Losses After Another Massive Crude BuildFOMC Minutes Suggest Fed Fears Financial Conditions Decoupling, Warns Of Equity Valuations

Struggling Intel Cuts Dividend By 66% To Conserve Cash

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more