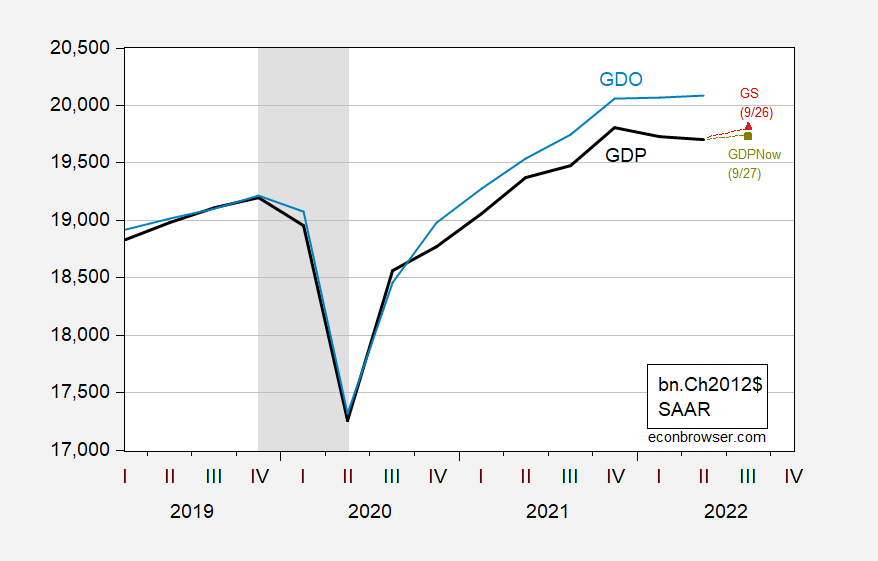

Q3 Growth Vs. Benchmark Revisions

Lackluster growth is nowcasted for Q3 by Atlanta Fed (0.3% SAAR), somewhat faster by Goldman Sachs (1.2%). It’s important to remember that the impact on the implied level of GDP might be dwarfed by the annual benchmark revision. And for the first time, the annual benchmark revision will come September 29th, rather than the end of July.

Figure 1: GDP (black), GDO (blue), GDPNow nowcast (chartreuse square), Goldman Sachs nowcast (red triangle), all in billions Ch.2012$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA Q2 second release, Atlanta Fed (9/27), Goldman Sachs (9/26), NBER, and author’s calculations.

We don’t know what the revision will do to the trajectory of GDP, but we do know that overall, GDO better predicts what revised GDP will eventually look like than reported GDP. The first annual benchmark revision can sometimes lead to noticeable changes. For instance, the 2018 annual benchmark implied that Q1 GDP was 0.4 percentage points higher than originally reported.

Revisions are discussed in detail in this BEA article.

More By This Author:

Messages From The MarketCFNAI In August

Weekly Economic Activity In The UK, And Two Self-Inflicted Wounds