Productivity Holds The Secret To Containing Inflation

Productivity is the basis of improved living standards and lies at the heart of this economic recovery. Businesses everywhere are searching for more efficient ways to deliver their products, especially in the face of rising prices. Without a steady improvement in productivity, future income growth will stall and the inflationary pressures will not likely abate. Income growth is essential to manage the huge pile of public debt that is the hallmark of our all our efforts to keep the economies afloat during the darkest days of the pandemic.

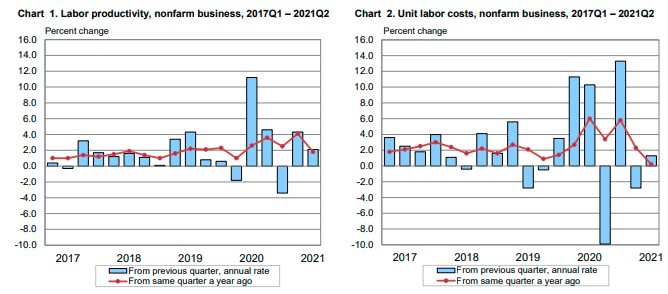

As the debate over inflation continues---- transitory and for how long? --- productivity and its sister concept, unit labour costs come into play. The accompanying two charts measure quarterly changes in productivity (Chart 1) and unit labour costs (Chart 2) which is a combined measure of wage and productivity changes. Hence, economists look to unit labour costs as one of the most important indicators of consumer price inflation.

Source: BLS

Even amidst the current economic malaise, there is scope for optimism that productivity growth will go a long way to promote economic growth. A recent paper, Post-Pandemic Productivity, presents the case for several factors in support of the outlook for strong productivity. It notes that following a lacklustre annual growth rate of 1% in 2013-18, productivity growth nearly doubled since. Granted, coming off a steep economic slump in mid-2020, cyclical factors explain the most recent surge in growth; however, the strength in the productivity rebound is worthy of note. As the paper notes,

One potential contributing factor is surging corporate investment activity, particularly in the technology space. Private investment in information-processing equipment has risen by over 10% in the US in the past year and is increasing at a rate well above its long-term trend. CEOs and CFOs suggest they expect to maintain high investment rates going forward. A similar query by the World Economic Forum indicated that between 85 and 95 percent of firms were accelerating, or looking to accelerate, the digitization of work processes because of COVID-19.

We all have participated in the tremendous advances in telecommunications during various lockdowns that allowed thousands of businesses to carry on remotely. Corporations now recognize the need to continue to investment in digitization of the workplace, initially because of COVID-19. We now expect that our daily lives will feature digital access to healthcare, expanded cloud computing, widespread use of fintech payments systems, teleconferencing replacing business travel, and accelerated growth of e-commerce.

So, how do these productivity developments relate to inflation and interest rates? Productivity improvements bring down costs--- unit labour costs--- and any acceleration in productivity performance will result in what economists like to call ‘good deflation’ in which the provision of goods and services become cheaper due to technological innovations. There is plenty of evidence that technology will continue to hold costs down which, in turn, will hold down long-term interest rates. The latter will be an all-important consideration in the debate about the management of public indebtedness.

Not only for developed countries, but far more so for those much less developed countries,"Productivity is the basis of improved living standards and lies at the heart of this economic recovery." But substitute growth for recovery.And the way that works for improving productivity is to have less expensive energy. Productivity runs on energy, as it always has. And what is happening to energy these days?? It is being made far more costly in the name of "green", and becoming a much bigger hurdle for the poorest sectors. Does anybody else see some cruelty in that? And more than a little bit of just plain evil?Even evil INTENT, not accident?