Producer Price Inflation Tumbled In March Thanks To Gasoline

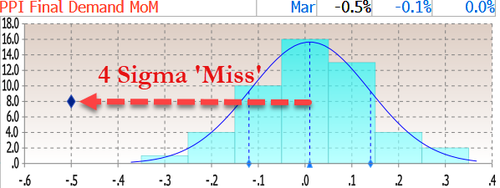

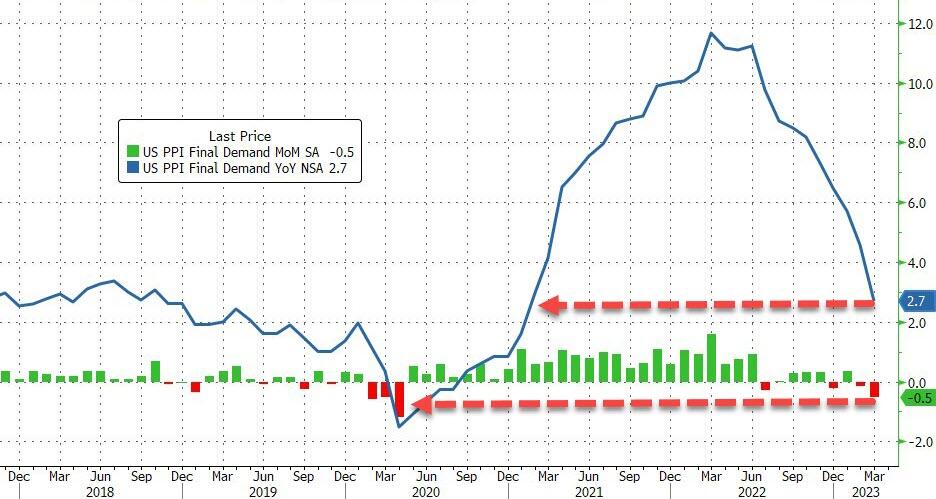

After yesterday's mixed picture on CPI (cool headline, hotter than expected sticky core), all eyes are on Producer Prices this morning which are expected to be unchanged MoM and tumble notably on a YoY basis. The print was actually considerably cooler than expected with the headline declining 0.5% MoM pushing PPI down to just 2.7% YoY...

Source: Bloomberg

That is the biggest MoM drop since April 2020 and the lowest YoY print since January 2021 (when the Biden term began) and a 4 standard deviation 'miss' from expectations...

Source: Bloomberg

As we warned last month, it was clear this was coming as the pipeline for PPI had already dropped to a drag...

Source: Bloomberg

Intermediate Demand is now deflationary.

Finally, we note that this is positive for margins theoretically as the CPI-PPI spread is at a record high...

Source: Bloomberg

Markets are reacting positively to this news (as they did with yesterday's CPI). The question is, can the markets hold these gains or unwind them like yesterday?

More By This Author:

Solid Buyside Demand For 10Y Auction Despite Modest Tail

Chicago Fed's Goolsbee Emerges As First Rate Hike Dissenter, Urges "Caution" Amid Bank Failures

Solid 3Y Auction Prices "On The Screws" As Yield Tumbles

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more