Solid 3Y Auction Prices "On The Screws" As Yield Tumbles

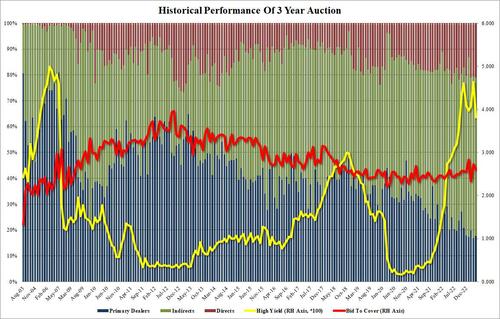

One month after the 3Y auction priced at 4.641% on March 7- the highest since Feb 2007 -just before the bank crisis swept across the US regional bank sector and also claimed the Credit Suisse scalp, moments ago the Treasury sold $40BN in 3Y paper at a high yield of just 3.810%, the lowest since Sept 22, one of the biggest monthly swings on record.

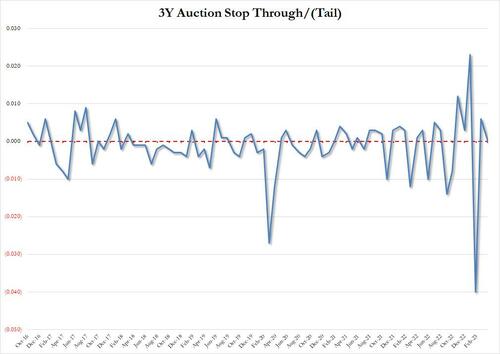

There was less volatility in the stop through, because three months after a record stop through, and two months after a record tail, today's auction stopped on the screws, in other words right on the When Issued which was also 3.810%.

The sharp drop in yield had an impact on the Bid to Cover which slid from 2.727 to 2.595, which was right on top of the 6-month recent average of 2.598.

The internals were average with Indirects taking down 61.3%, below last month's 62.5% and just below the recent average of 61.4%, and with Directs taking down 21.0%, or one of the highest in recent history, Dealers were left holding 17.7%, below the 19.95% recent average.

Overall, this was an unremarkable auction which priced right on top of expectations and averages and understandably had zero impact on the secondary market which meant 10Y yields traded near session highs just shy of 3.45% after trading as low as 3.38% earlier in the session.

More By This Author:

Goldman: Slowdown In Consumer Spending "Moved From Theory To Reality" In The Last 2 WeeksFed Survey Shows Inflation Expectations Re-Accelerated In March, Credit Access Worst Ever

Ports Of Los Angeles And Long Beach Close Due To Widespread Worker Shortages During Contract Talks

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more