Which Way Wednesday?

Earnings are now a mixed bag.

75 S&P companies have reported so far and 43% (32) have beaten expectations and the ones that have missed have been hit with average 3.9% drops vs the historic 2.4%, so not much tolerance for failing to hit those expectations. The ones that beat have only gone up 1.6% – indicating that good news is mainly priced into the current prices. The Banksters have led us so far – now we have to see if Tech, Industrials, Consumer Goods, Energy and Services can hold up.

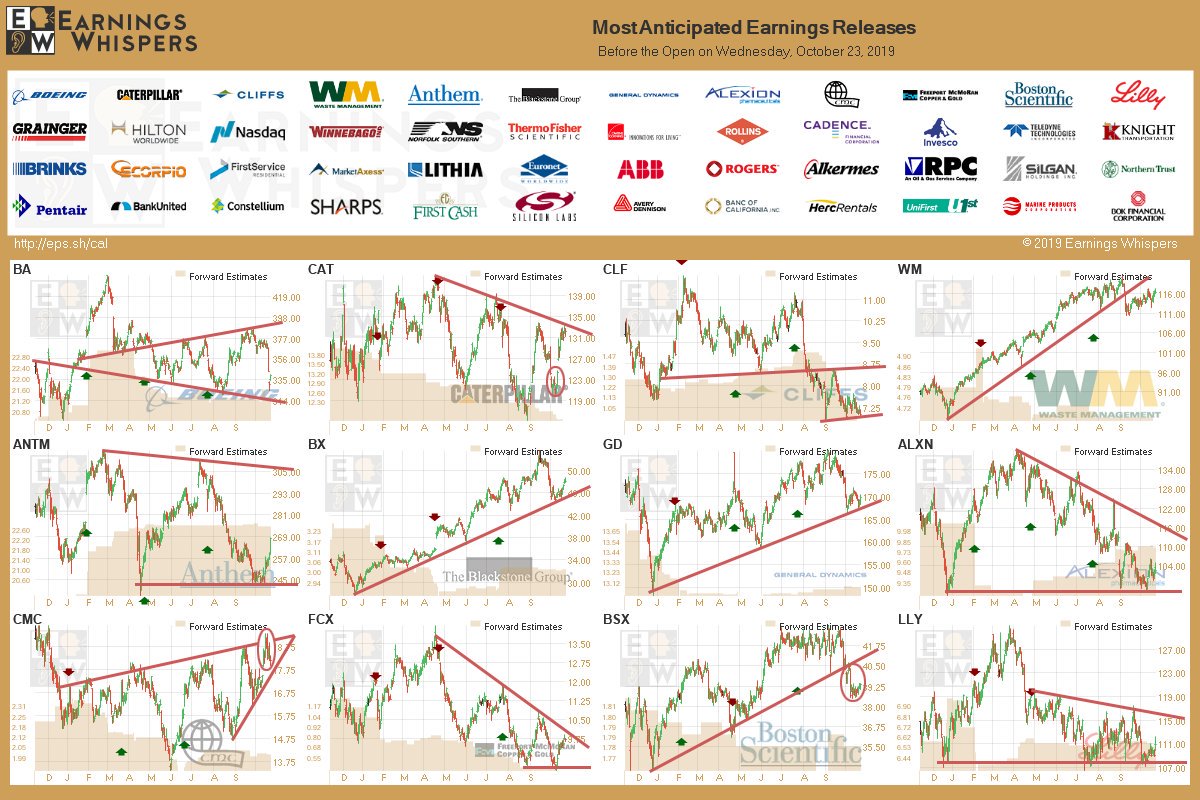

Caterpillar (CAT) is often regarded as a good proxy for the Global Economy and they just reported earnings that are down 8% from last year on 6% lower revenues AND they lowered their guidance to the $10.90-11.40 range, which is not bad for their $133 shares, which are already 20% down from last year's highs.

We like CAT but we'd like them a lot more around $110.Yesterday, we initiated a new, $100,000 Earnings Portfolio to give us something to do while we wait for a proper correction.As noted in yesterday's Morning Report, we went with Boing (BA) as our first official play and we added IRobot (IRBT) and Cliffs (CLF) as the day progressed:

Though BA didn't have much encouraging to say this morning, the lack of additional negatives has pushed the stock back to $350 so we're on our way to goal on that one already, which could net us a nice $13,250 (122%) profit at that level.CLF beat by a mile at 0.33 vs 0.24 expected and, keep in mind, that's just one quarter on a $7 stock – so silly!Our main premise there is a China deal will really get them going.

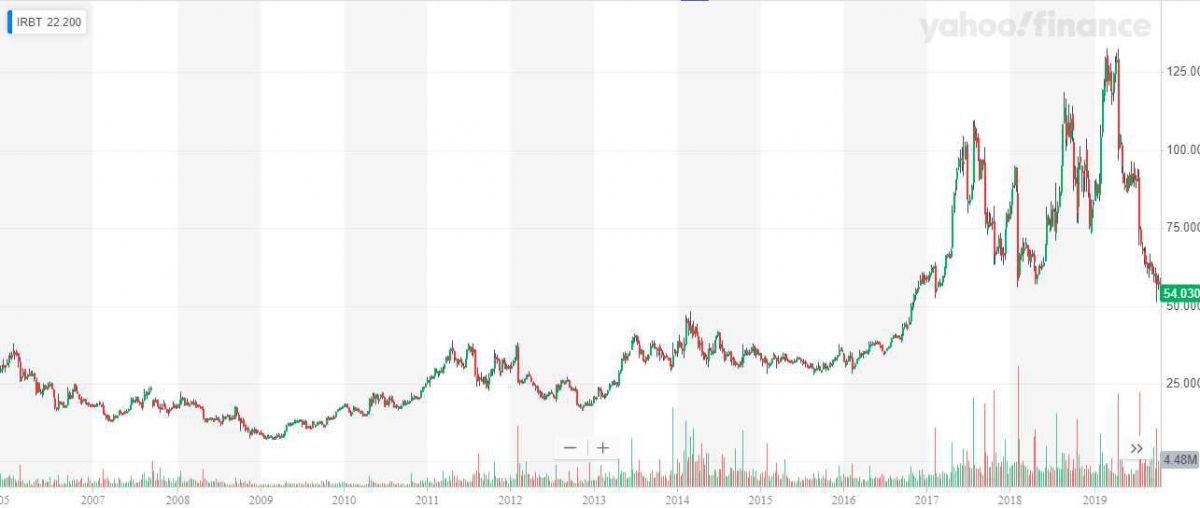

Unfortunately, we didn't win them all and IRBT was a big disappointment as tariffs are hurting them badly. We did think that was a possibility, which is why we did not sell puts initially but now we will sell 5 of the 2022 $35 puts for $10 ($5,000) and then spend $5 ($5,000) or less to roll the 2022 $45 calls down to the 2022 $35 calls which will widen our spread to a potential $25,000 on the same $5,750 net cash investment.

IRBT lowered their guidance to a $2.60-2.80 range from $2.40-$3.15, so about 5% lower so a 20% drop is a bit of an over-reaction – especially since there is no indication of product issues – simply Trump's tariffs taking a bite out of profits – certainly not a reason to dump the stock for the long haul. IRBT was our Stock of the Century at $10 back in 2009 but we took $100 and ran earlier this year as we were not happy that they sold off their military division .Now that it's back below $50, we're happy to get back on board!

Our Stock of this Decade, by the way, was Taser (TASR), now (AAXN) and they went from $5 to $50, which was our 10-bagger goal, so we moved on from them as well and we haven't officially announced it yet but Lockheed Martin (LMT) is our Stock of the 2020s, though we are hoping for a pullback to give us a chance to get on closer to $300.

Not in our Earnings Portfolio is a Top Trade we made on September 26th on Texas Instruments (TXN), which just announced disappointing earnings – just as we expected. Our trade idea was:

September 26th, 2019 at 3:50 pm | (Unlocked) | Permalink

P/E for TXN is 23.5 at $120Bn at $128.50 – that's historically high for them.They are pegged to make less money than they did last year but they are up 40% and earnings expectations for Q3 ($1.42) haven't come down since last Q even though chip prices have crashed. Of course TI sold most of their DRAM biz to MU ages ago and 75% of their business is analog semiconductors now but revenues were down 9% last Q and will be down 9% (from last year) again this Q with no end in sight so $130 is silly for them.

As a short on TXN, I'd go for:

- Sell 3 TXN Jan $130 calls for $6.25 ($1,875)

- Buy 5 TXN Jan $140 puts for $14.50 ($7,250)

- Sell 5 TXN Jan $125 puts for $6 ($3,000)

That's net $2,375 on the $7,500 spread so $5,125 (215%) upside potential if TXN is below $125 into Jan. Ordinary margin is $7,179 but hopefully short-term and a nice return either way.

As you can see on the chart, we got a bigger dip than we expected and TXN is already below $120 and that means our bearish spread should come in in the money for the full $7,500 while the short $130 calls will expire worthless.That's a fantastic 215% profit in just 90 days!

Earnings plays are a fun thing to do when we have a lot of cash on the sidelines. Usually we don't like to be short-term gamblers – but it's very boring waiting for a nice correction so we can re-deploy our CASH!!! May as well make a little more while we wait…

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more