Trading Weekly Iron Condors For Income

Today, we will be looking at trading weekly iron condors for income. Iron condors are one of the best structures for investors to generate income while still serving as a risk-defined strategy.

This article will explore trading weekly iron condors for income. We will then contrast the benefits and costs of trading more frequent weekly iron condors vs. monthly iron condors.

The Basics

The goal of an iron condor is to take advantage of the variance risk premia while not having an opinion on the direction of the underlying. This structure can be placed with options in various ways, such as a straddle or strangle. The issue with both trades is that they have an unlimited risk if the position moves against you. In contrast, an iron condor caps risk, thus making it more suitable for conservative investors.

As we will find out, this capped risk is even more important with shorter-term trades. Now let’s talk about whether choosing weekly iron condors is a good strategy or not.

The Benefits

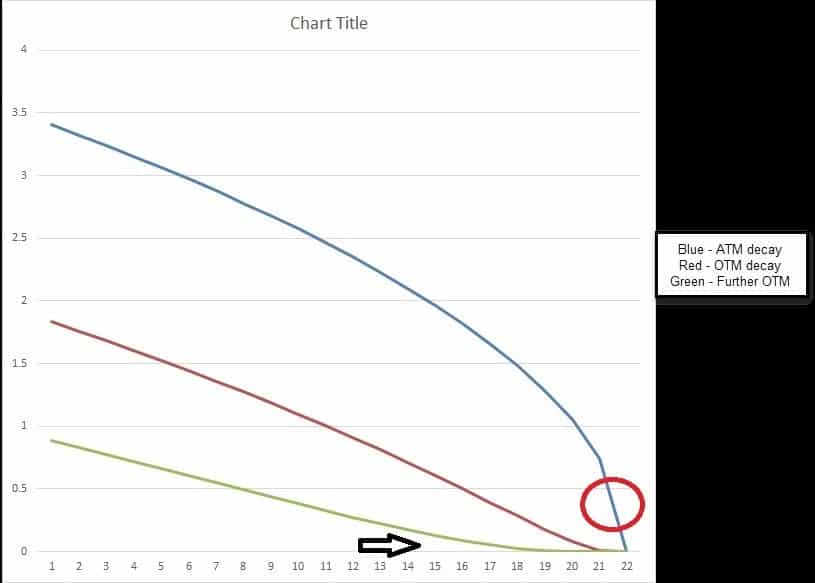

If iron condors take advantage of the variance risk premia, it only makes sense to place trades where this variance risk premia is most pronounced. From the graph below we can see that theta decay is highest for at-the-money (ATM) options nearing expiry.

Now an important point is that theta decay and variance risk premia are not the same. Theta is the decay of an option if the underlying security does not change in price.

Variance risk premia is the long-term overpricing of implied volatility relative to realized volatility. These two are not the same thing. While they are not the same, research suggests that the variance risk premia is highest with shorter dated options when theta is also the highest. This has to do with gamma and jump risk. By selling shorter dated options, we sell options with the highest gamma.

However, this can be dangerous for naked short positions. Why? Because a sharp realized move can leave an investor with immense losses for only a small premium collected.

While some investors say they will hedge, if you are trading individual securities, you cannot hedge overnight or intraday jumps. Thankfully with iron condors, we have a risk-defined trade so that we can take this gamma risk and still cap our losses. This allows us to avoid over-hedging and sleep easy at night.

The Downsides

The single biggest downside in trading weekly iron condors is the transaction costs. An iron condor has 4 legs. Placing weekly trades involves opening over a thousand legs over the course of a year. That is a lot of commission. Not to mention that the position will need closing. While the whole position can be closed and rolled, this is another thousand legs that need to be closed.

Letting a position run to expiry can make sense, but this can lead to assignment risk if the security is trading near a strike. This happens frequently when trading shorter dated options. As the expected range is a lot lower, traders expect that the security will often be near one of the strikes.

Not only are commissions costly, but slippage, or the additional price paid between the middle of the bid ask spread, may come into play. This can be an issue, especially with the long condor wings which can sometimes have wide spreads.

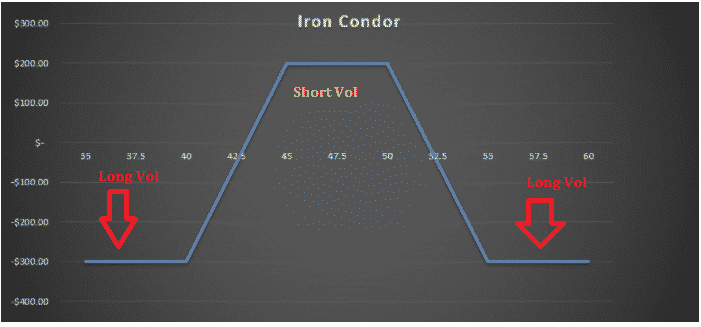

Another issue can come about from the structure of the iron condor itself. If a large realized move occurs and the security ends up outside of its wings, the exposure shifts from short volatility to long volatility, as per the diagram below.

Initially, we placed a trade wanting to be short volatility, and now we are long volatility at the red arrows. At this point, we can close out the trade early. Yet again, that adds transaction costs.

Lastly, we must address the time spent executing these trades. With someone who trades longer dated monthly options, they can afford to let their portfolio do its thing. In contrast, someone trading weekly iron condors is almost always trading.

Tips For Trading Weekly Iron Condors

For most retail investors, trading iron condors with at least a month to expiry will be a better fit and involve less stress than trading weekly options. Though if you want to trade weekly iron condors, here are some essential rules:

- Never systematically trade weekly iron condors on single stocks. Not only is variance risk premia less on single stocks than on indexes, transaction costs and slippage are both higher.

- Consider trading cash settled indexes. By trading indices like the SPX where options are cash settled, there is no assignment risk if the security is near the underlying strike.

- Consider selling over the prior weekend. Instead of placing your weekly trades on Monday, place them before the close on Friday. This takes advantage of the variance risk premia over the weekend, which has been historically higher than during the week.

- Don’t over-hedge. Hedging is especially important when placing trades. Despite this, due to the extreme gamma of short-dated options, over-hedging can kill profitability, especially as trades are already frequent enough. You bought the wings for a reason, consider this your maximum loss.

Concluding Remarks

Trading weekly iron condors can help take advantage of variance risk premia at its highest. While doing so, it also provides a defined risk structure, preventing serious losses and mitigating some gamma risk from shorter dated options.

Despite this, transaction costs due to multiple legs can often be higher than the variance risk premia itself. This makes trading indexes the most viable for a systematic weekly iron condor strategy. Alternatively, trading longer dated monthly options may provide comparable returns after factoring in increased transaction costs.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who ...

more