Everything You Need To Know About Options Bid Ask Spread

Today, we’re going to take a deep dive into options bid ask spreads. By the end, you understand what they are, how to analyze them, and learn what to look for to give you a higher probability of success with your trades.

We’ll also scrutinize different stocks to see which have wide bid ask spreads and why that can have a negative impact on your trading.

We’ll also look at the difference is spreads for at-the-money and out-of-the-money calls and puts and finally, we’ll look at what happens to spreads during volatility events.

Option Bid Ask Spread Explained

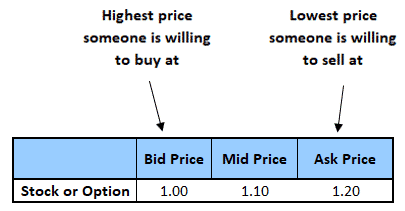

For any financial instrument, be it a stock or an option, there is a bid price and an ask price.

The bid price is the best (highest) price someone is willing to buy the instrument for.

The ask price is the best (lowest) price someone is willing to sell the instrument for.

Makes sense if you think about it.

Bid = buy. Therefore, the buyer wants the lowest possible price.

Ask = sell. Therefore, the seller wants the highest possible price.

The mid prices is therefore right in between where the buyers and sellers are.

Let’s look at a simple example:

(Click on image to enlarge)

Why Is It Important

When looking at a particular instrument for trading, it is important to check the bid-ask spread. Wide spreads can increase the costs of trading in that instrument via something referred to as “slippage”.

Slippage just means not getting filled at a good price. When a stock or option has a wide bid-ask spread, sometimes you can get filled at the mid-point, but sometimes you have to give up $0.05 or $0.10 to get into the trade.

This can result in negative P&L right from the outset and put you behind the 8-ball.

Remember that slippage can occur on trade entry, adjustment, and exit so that can mean a lot of slippage if you are trading an instrument with a widespread.

Some Tips on Order Entry

When buying an option or a stock, we click on the ask price, but we don’t want to pay the ask price, we want to be somewhere near the mid-price.

With an instrument like SPY, that’s not really a concern because the spread is so tight, but with other instruments with a widespread it’s crucial to get a good fill price.

Let’s say we have an option that has a bid of $2.00 and an ask of $2.60 and we want to buy it.

We click on the $2.60 but then we change the price to the mid-point of $2.30.

Actually, what I do is I start my order below the mid-point, say $2.20 in this case. It usually won’t get filled, so I then gradually increase my price until I’m at the mid-point where it sits and hopefully gets filled.

Other times,to ensure a good fill, I’ll leave the buy order at $2.20 and hope that market comes back to my price and I get filled.

Sometimes the market moves the other way and I miss out on getting into the trade. That doesn’t bother me because there will always be other trade opportunities and getting good fills is important. I don’t want to force trades.

Bid Ask Spreads on Different Instruments

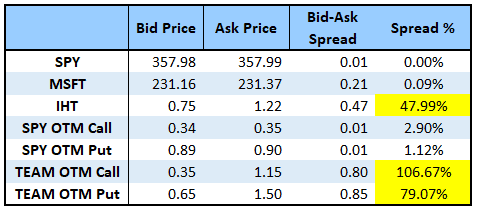

Let’s put theory into practice and look at the bid-ask spreads for various different underlying instruments.

SPY is the most highly liquid stock or ETF in the market. The bid price at the time of writing is 357.98 and the ask price is 357.99.

That’s a $0.01 spread or basically no spread at all, especially when taken in percentage terms.

MSFT is another highly liquid stock and the spreads there are very good also at only $0.21 or about 0.09%.

The next example is a penny stock called IHT. The spread is huge at $0.47 on a stock that’s only trading at around $1.00. That’s basically a 50% spread!!

Next, we’ll compare some options on a highly liquid ETF (SPY) and a less liquid stock (TEAM).

Here again, SPY wins by a long way with spreads of only 1-3% whereas TEAM has spreads of 79% and 106%.

It’s going to be MUCH HARDER to filled at the mid-point on TEAM options than it is on SPY options. Not impossible, but definitely harder.

And remember that slippage occurs on entry, adjustment, and exit.

For this reason, it is essential that beginner traders stick with highly liquid stocks and options with tight bid-ask spreads.

(Click on image to enlarge)

Bid Ask Spreads on Different Option Strikes

Clearly not all options are created equal and some stocks will have better option spreads than others.

But what about different options within the option chain? Do at-the-money options have tighter spreads than out-of-the-money options?

What about options across different time periods?

Let’s take a look and see what we find.

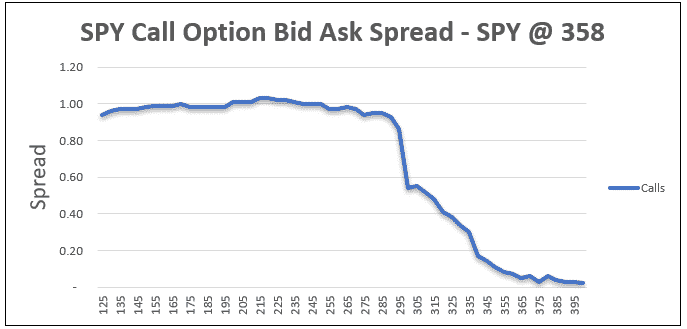

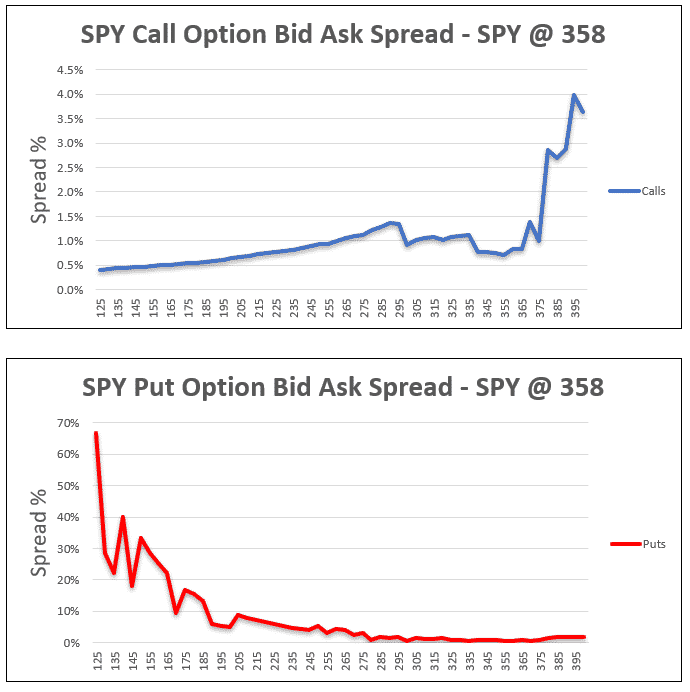

Taking a look first at SPY we can see that the at-the-money and out-of-the-money calls have a very low spread but that spread gets a lot wider for the in-the-money calls.

Looking at the chart below we can see that 355 and above calls have spreads of around $0.05 or less but the spread gradually gets larger the further in-the-money the strikes move, up to a maximum of about $1.00.

This data is using 45-day to expiration SPY options from September 2, 2020.

(Click on image to enlarge)

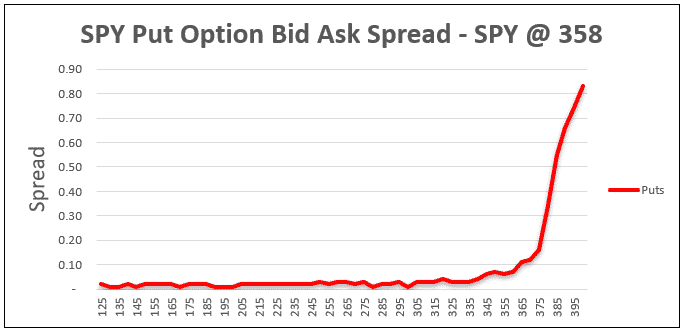

It’s a similar story with the puts where the at-the-money and out-of-the-money puts have a tight spread, but the in-the-money spreads start to blow out.

One point worth noting here is that the very far out-of-the-money options will naturally have a tighter spread. For example, options that are trading for only $0.05 or $0.10 shouldn’t have a $1.00 spread.

(Click on image to enlarge)

When we analyze the spreads in terms of a percentage of the option price, we get a slightly different story.

In terms of percentage, the spreads are widest for the out-of-the-money options in both cases.

(Click on image to enlarge)

What About Different Months?

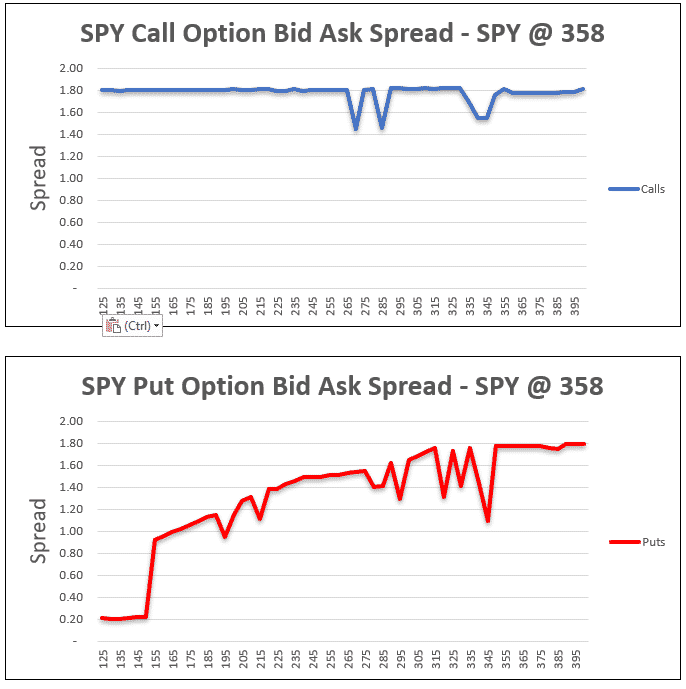

So far we’ve looked at SPY spreads for calls and puts across the one expiration period, what if we look at different expiry months.

Do you think long-term options will have wider spreads?

Let’s take a look and see.

We’ll take the furthest expiration we can find which in September 2020 was the December 16, 2022 expiry.

Here we can see the bid-ask spreads are generally much higher but that’s not unexpected because these long-term options will have much lower liquidity.

The calls are pretty consistent with a spread of around $1.80 and the puts also trade with spreads as high as $1.80.

(Click on image to enlarge)

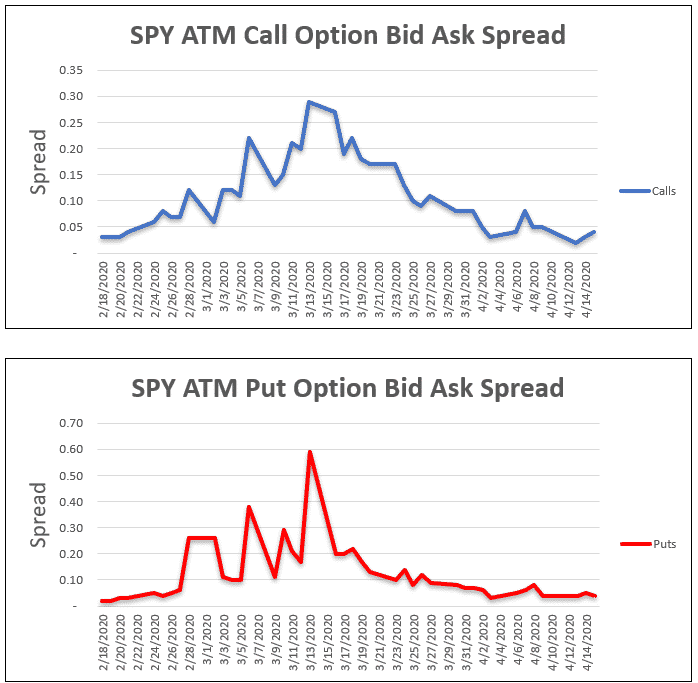

What Happens To Bid Ask Spreads During Volatility Events?

Bid-ask spreads will widen when volatility picks up and the market starts moving quickly.

From mid-February 2020 to late March 2020 volatility experienced a huge spike amid the coronavirus pandemic.

The VIX index jumped from around 14 to 85 in the space of a few weeks.

Let’s take a look at what happened to the bid-ask spreads for at-the-money SPY options during that period.

We’ll use the April expiration and look at a spreads before, during and after the spike.

(Click on image to enlarge)

Here we can see a clear widening of the bid-ask spreads during volatility spikes. Remember this is for SPY, the most liquid underlying that there is.

Spikes would have occurred across all underlying stocks and ETF’s, perhaps to a larger extent.

Summary

Some key things to take away from today’s article:

- Slippage can add up, so it’s best to focus on high liquidity stocks and options with tight bid-ask spreads.

- SPY is the best underlying instrument for option traders in terms of bid-ask spreads.

- Less liquid stocks can have wide spreads which can result in significant slippage.

- In-the-money options have wider spreads than at-the-money and out-of-the-money options (but not necessarily in percentage terms)

- Longer-dated options have wider spreads than short-term options.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more