This Chart Could Ignite A Santa Rally

As I write this note, the Dow is falling several hundred points for the day…

The stock market has moved sharply lower over the last few trading days…

And we’re wrapping up one of the most challenging bear markets in years (if not decades)!

Investors are understandably on edge.

But as we approach the long holiday weekend, an important chart is indicating a Santa rally may be just around the corner.

Now we’re still in a bear market. And I’m not expecting this rally to change the overall situation.

But if you’re an active trader, this rally may give you an opportunity to book some last-minute profits heading into year-end.

The “Put / Call” Index Goes Parabolic

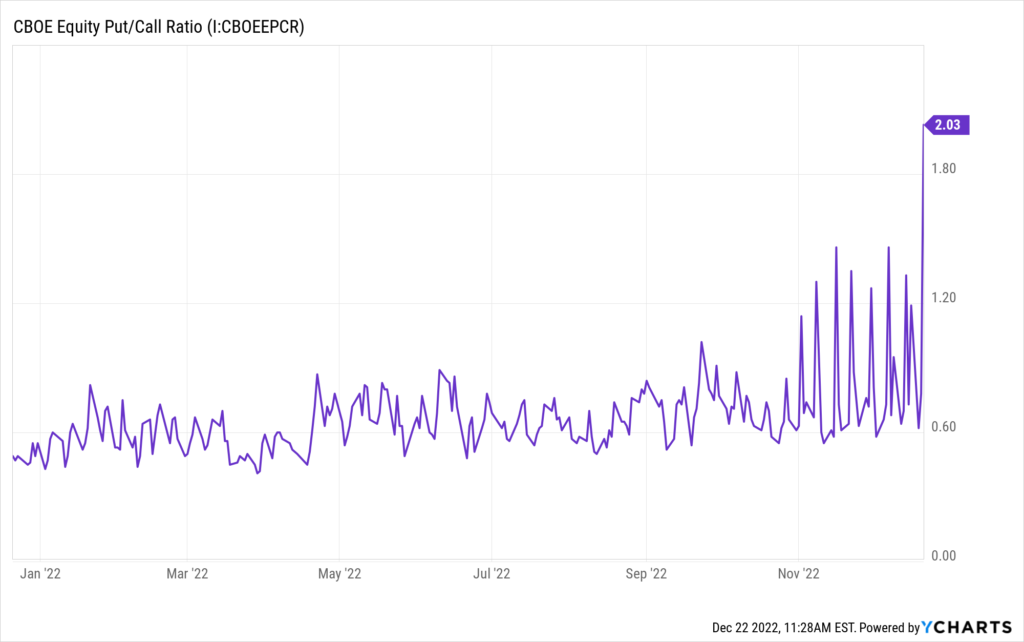

The chart below measures the number of bearish put contracts held by investors, compared to the number of bullish call contracts in play.

As you can see, the number of puts in play has surged as investors worry that stocks will continue lower.

Many investors buy put contracts to protect their wealth in a bear market. That’s because when stocks fall, prices for these put contracts rise.

So investors who own these puts can make a profit on these contracts — and that profit can help to offset losses from more traditional investments.

According to the chart above, investors are now well protected with these puts. And ironically, that’s a good sign for the market (at least in the short-term).

With so many put contracts in play, it’s unlikely we’ll see a widespread panic in the market. Because even if stocks trade lower, investors are already insured against a drop.

Meanwhile, investors who have bought this protection can now buy stocks more confidently. And after a few days of heavy selling, these investors have a lot of good bargains to choose from.

Preparing for a Santa Rally

There’s still a lot of risk for long-term investors… The Fed is raising interest rates, the economy may enter a recession next year, and key areas of the market like semiconductor stocks are breaking down.

But on a short-term basis, a Santa Claus rally is looking more and more likely.

Historically, the trading days between Christmas and New Years have been very bullish. And with stocks now relatively oversold — and now that investors have near record amounts of protection — I expect at least a moderate rebound for the overall market.

With that said, this rebound may be a great opportunity to set up bearish positions once stocks have a few positive trading days.

After all, speculative tech stocks still trade with rich valuations, many areas of the economy are showing signs of cracking, and the old phrase “don’t fight the Fed” still applies.

Overall, there’s still risk in the market. It’s still a time to play defense with your investments and protect your capital.

But heading into the end of the year, we may see some relief — even if it’s just temporary.

More By This Author:

No Time to Be A Hero

Don’t Look Now, But Housing Stocks Are Up

For Crude Oil, It’s 1986 All Over Again